Did you know Orange County tech startups saw a 42% increase inearly-stage funding dealsin 2023—outpacing both LA and Silicon Valley growth rates over the same period? If you’re looking to raise capital in Orange County, you’re not just joining a booming local ecosystem, you’re setting yourself up for some unique home-court advantages—and challenges. Whether you’re seeking your first seed round or planning a Series A, this is the guide Orange County founders, investors, and startup supporters turn to for real-world, region-specific startup funding wisdom.

Orange County Tech Startup Funding: Surprising Growth in 2024

In 2024, Orange County Tech Startup Funding is surging at a pace that surprises many experienced founders and investors. Unlike Los Angeles or the Bay Area—which often dominate headlines—Orange County’s tech ecosystem is quietly but steadily growing, with record-high deal flow in sectors ranging from life sciences and healthtech to SaaS and fintech. According to PitchBook, seed rounds in Orange County now average $1.2M–$2M, while Series A funding often lands between $4M–$9M, reflecting both the area’s maturing startups and increasing investor appetite.

What’s fueling this trend? A unique blend of lower operating costs, world-class universities like UCI and Chapman, and a hands-on investor network with a distinctly regional focus. This guide delivers practical, stage-by-stage advice on securing orange county tech startup funding, with actionable checklists, local pitch examples, and tips for avoiding common pitfalls specific to this market. Whether you’re a founder, early team member, investor, or advisor, Orange County’s vibrant startup momentum in 2024 offers a window of opportunity not found anywhere else in Southern California.

What You’ll Learn about Orange County Tech Startup Funding

-

Seed and Series A funding basics for the Orange County tech startup founder

-

Actionable checklists and real-world examples from the Orange County startup ecosystem

-

Common mistakes OC founders make (and how to sidestep them)

-

Data-driven tips for preparing and closing your funding round

Seed Funding in Orange County Tech Startup Scene: The Fundamentals

Seed funding is often the lifeblood of Orange County startups—providing the initial capital to turn bold ideas into tangible products. In Orange County, seed rounds typically range from $500,000–$2 million, and are used to build a minimum viable product (MVP), validate early user demand, and start developing product-market fit. What sets OC’s seed stage apart is the ecosystem’s expectation that founders tap into local talent, possibly join regional programs like LaunchPad SBDC or EvoNexus, and demonstrate a strong grasp of both regional and sector-specific opportunities.

Securing orange county tech startup funding at the seed stage means more than pitching a great idea—it’s about showing you have the right team, a working prototype, and some evidence that your solution resonates with Southern California’s unique market needs. Founders are often expected to be deeply connected with local startup accelerators, angel investor groups, and service providers, increasing visibility and credibility within a close-knit, collaborative ecosystem. This section covers what OC investors want to see, checklists every founder needs, and pitfalls that can derail promising teams before they ever hit “launch”.

For founders looking to further refine their approach, understanding the nuances of investor expectations and pitch strategies can make a significant difference. You might find it helpful to explore additional insights on how Orange County startups can stand out to local investors and optimize their funding journey—these practical tips can help you avoid common missteps and strengthen your pitch.

What Do Orange County Investors Look for at Seed Stage?

Orange County seed investors—ranging from local angel investor groups to micro-VCs—evaluate startups on a mixture of universal and hyper-local criteria. First, they want to see a founding team with clear roles, solid experience, and commitment to the local ecosystem. Technical talent from UCI or Chapman, or advisors with prior exits, are powerful credibility boosters. Next, OC investors want a working MVP that’s already gathering early user feedback—even if it’s just from pilot customers or a limited launch.

Equally crucial is some sign of product-market fit (PMF). While you don’t need to prove massive traction yet, savvy Orange County investors are looking for authentic demand, partnership conversations, or even small but growing revenue streams in the region. Since Orange County’s market profile differs from LA or Silicon Valley, investors love seeing startups plugged into incubators like LaunchPad SBDC or EvoNexus, leveraging regional networks for mentorship and validation. The list below details the essentials that local seed funders demand.

-

Team composition and experience—local OC talent or specialists

-

Working prototype or MVP with early user feedback

-

Initial indicators of product-market fit (even if just a pilot market)

-

Market opportunity size relevant for Southern California

-

Connection to local incubators or accelerators (LaunchPad SBDC, etc.)

Checklist: How to Prepare for Seed Funding as an Orange County Startup

Preparation is everything when seeking seed funding in Orange County. Below is the foundational checklist to maximize your chances of impressing local investors:

-

Cap table and legal structure review—ensure clear equity splits and founder alignment

-

Concise pitch deck with references to Orange County trends and opportunities

-

Early traction and metrics—show user growth, monthly recurring revenue (MRR), or signs of market demand

-

Financial model tailored to OC’s unique cost structure and salary benchmarks

-

Up-to-date list of local angel investors (like Tech Coast Angels), accelerators, and trusted OC service providers

This checklist not only boosts your credibility but also demonstrates you’ve “done your homework” on the unique requirements of orange county tech startup funding. Angel investor groups and startup incubator programs want to see founders organized and ready to scale within the OC context.

Common Pitfalls for OC Startups Raising Seed Funding

Many promising Orange County startups stumble at the seed stage due to easily avoidable mistakes. One major misstep is underestimating the required runway—the number of months your business can survive before needing additional capital. With the region’s higher cost base compared to other parts of California, failing to plan for a long enough runway can doom your startup’s progress just as you reach critical milestones.

Another pitfall is skipping early validation with local test users or ignoring Orange County’s powerful accelerator and mentor programs, like LaunchPad SBDC or the OC Startup Council. Some teams overlook key regional compliance and legal requirements, exposing the venture to unnecessary risk down the line. By avoiding these pitfalls, OC founders position themselves as trustworthy and investment-ready, standing out in an increasingly competitive landscape.

-

Not validating demand with local test users

-

Ignoring Orange County accelerator or mentor programs

-

Overlooking regional compliance and legal needs

“Orange County’s rapidly growing tech sector means local expertise—and connections—are more important than ever.” — OC Startup Council

| Seed Stage Criteria | OC Startup Expectations |

|---|---|

| Typical Raise Amount | $500K–$2M |

| Investor Type | Angel Investors, OC-based Early VCs |

| Key Documents | Pitch Deck, Cap Table, Financial Projections |

| Proof Required | Prototype, Early Users, Market Validation |

Transitioning from Seed to Series A: Orange County Tech Startup Funding Milestones

Once your startup has early traction and is ready to scale, it’s time to consider Series A funding. In Orange County, this stage is where startups demonstrate true product-market fit, generate repeatable revenue, and develop a scalable go-to-market strategy. A Series A round typically ranges from $2 million to $10 million, opening the door to institutional VC funds—both regional and national. OC founders ready to seek Series A need to “level up” in terms of metrics, team sophistication, and network depth.

So, what signals to regional and national investors that your Orange County startup is ready? Typically, indicators include hitting $1M+ in annual recurring revenue (ARR), showcasing a repeatable customer acquisition process, and presenting experienced leadership (sometimes with new hires from the Southern California region). Founders must also provide a polished cap table, clear legal structure, and defined expansion plans—often focused not just on OC, but on national or international growth. The differences between seed and Series A funding in Orange County are significant, so a direct checklist approach helps keep founders on track as they prepare for this leap.

Series A Checklist for Orange County Startups

Major investors now want to see a fine-tuned operation and a robust growth engine. Make sure your Orange County tech startup funding pitch contains:

-

$1M+ annual recurring revenue or sector-relevant signs of fast, sustainable user/customer growth

-

Clear and repeatable go-to-market engine with key traction metrics

-

Seasoned leadership, including Southern California or OC-based hires where possible

-

An expanded network—bring in active board members and advisory network (think OC Startup Council or LaunchPad SBDC)

-

Detailed and clean cap table, legal structure ready for institutional diligence

-

Ambitious but credible expansion plans (national scale, or international if justified by sector)

Having these elements shows investors that you’re not just ready to grow but prepared to do so—backed by realistic plans, strong relationships, and hard proof of momentum from the heart of Southern California.

Key Metrics at Series A for OC Startups

At Series A, numbers speak louder than vision. Investors seek evidence your Orange County startup is evolving into a business that can scale rapidly. Benchmark metrics they’ll scrutinize include:

-

ARR (Annual Recurring Revenue)—$1M+ is typical, though some SaaS and fintech may get traction with less if growth is explosive

-

Customer/user growth rate and churn rate (the percent of customers lost each month)—a high user retention rate is a major plus

-

CAC (Customer Acquisition Cost) vs. LTV (Lifetime Value)—showing a healthy gap between what you spend to win a customer and what you earn over their lifetime

-

OC market penetration—demonstrate that you’re winning locally but with numbers competitive on a national stage

Having detailed answers for these metrics signals to regional venture capital firms and national funds that your company is scalable, efficient, and ready for the bigger leagues of tech startup funding.

Mistakes to Avoid During Series A in Orange County

At Series A, even small missteps can matter. First, avoid the temptation to raise capital before your core metrics are proven—it’s better to delay than to close a weak round or dilute early. Also, make sure you communicate a clear “why us?” story that differentiates your OC startup from similar companies in Los Angeles, the Bay Area, or even among other Southern California hotspots.

Clean up your cap table and resolve founder equity splits before pitching institutional investors. Many strong teams have lost deals over cap table confusion or unresolved internal disputes. Lastly, don’t leave regional investors and networks out of the loop—relationships within the OC ecosystem are key to warm VC introductions, referrals, and positive investor dynamics.

-

Raising too early before key metrics are proven

-

Poor differentiation from LA or Bay Area competitors

-

Messy cap table or unresolved founder equity splits

-

Neglecting to build investor relationships within the OC ecosystem

“At Series A, investors want to see proof—traction, scalability, and a path to significant growth. OC startups with a strong network have the edge.” — Local Angel Investor

| Series A Criteria | OC Startup Standards |

|---|---|

| Typical Raise | $2M–$10M |

| Proof Points | Product-Market Fit, $1M+ ARR, Repeatable Sales |

| Investor Type | Institutional VC, Orange County VCs, National Funds |

| Team | Operational Scalability, Key Hires, Advisor Network |

Inside the Orange County Tech Startup Ecosystem: Who, Where, and Why It Matters

What makes Orange County’s startup ecosystem tick? Unlike the mega-hubs of LA or Silicon Valley, Orange County features close collaboration, active support organizations, and a specialty in sectors like life sciences and healthtech. Local investors, startup incubators, and service providers play a vital funding and mentorship role at every stage—especially during the “critical mass” years between prototype and scaling.

Understanding this landscape is essential for maximizing your orange county tech startup funding opportunities. When you know who’s funding, where deals happen, and the specific advantages of operating in OC, it’s easier to build momentum, join the right programs, and get your startup on the radar of active local and national investors.

Who Funds Orange County Tech Startups?

If you’re raising capital in OC, your primary players are local angel groups (like Tech Coast Angels and OC Angel Investors), regional venture capital funds (Okapi Ventures, Cove Fund, Sunstone Management), and a growing set of corporate innovation arms tied to big industry (Edwards Lifesciences, Allergan). Don’t underestimate the impact of startup incubators and accelerators—not only do outfits like LaunchPad SBDC or EvoNexus open doors to mentors and pitch events, but their investor introductions can make or break your round.

-

Angel groups (Tech Coast Angels, OC Angel Investors)

-

VCs with OC presence (Okapi Ventures, Cove Fund, Sunstone Management, etc.)

-

Startup incubators/accelerators (EvoNexus, LaunchPad SBDC)

-

Corporate innovation arms (Edwards Lifesciences, Allergan, etc.)

Recent Data: Orange County Startup Funding Trends

According to 2023–2024 reports, Orange County tech startups closed more deals and larger round sizes than many peer regions in Southern California. The number of pre-seed and seed deals has grown rapidly, with average round sizes outpacing even parts of LA and San Diego. Hot sectors in OC include life sciences, healthtech, SaaS, fintech, cleantech, medtech, and artificial intelligence (AI). Pitch competition opportunities are also surging, with the OC Startup Council and local partners hosting dozens of high-profile events that connect founders and investors more directly than ever before.

-

Number of deals/year, average round size (OC vs. other Southern California hubs)

-

Leading sectors: life sciences, SaaS, fintech, cleantech, healthtech, medtech, AI

-

Increase in pitch competition opportunities (e.g., OC Startup Council events)

Unique OC Advantages—and Challenges

Orange County’s talent pool—sourced from UCI, Chapman University, and nearby colleges—offers startups technical strength at a lower cost than Silicon Valley. Operating costs, including real estate and salaries, tend to be lower than LA or Bay Area equivalents. Importantly, OC’s investor network is intensely regional: local connections matter. Angel groups, VCs, and even accelerators often look for founders who are actively engaged in the “ecosystem,” participating in local events, accelerators, and pitch competitions.

The flip side? OC’s ecosystem can feel less dense; there are fewer mega-VC funds chasing the next unicorn, so founders need to be visible, persistent, and creative in building their startup’s reputation. Addressing regional compliance, leveraging OC networks, and establishing strong service provider relationships (legal, accounting, PR) are the keys to standing out and landing the funding your startup needs.

-

Talent pool from UCI, Chapman University, and local colleges

-

Lower operating cost than LA or Bay Area

-

Regional investor focus: often more hands-on, local connections matter

-

Challenges: fewer mega-VC funds, less density, must build visibility

“In OC, the network is everything. Founders need to become active in local investor and accelerator circles.” — Tech Startup Service Provider

| OC Ecosystem Player | Role in Funding |

|---|---|

| Tech Coast Angels | Seed/Angel |

| Okapi Ventures | Seed/Series A |

| Cove Fund | Seed |

| LaunchPad SBDC | Mentorship/Incubator/Investor Intros |

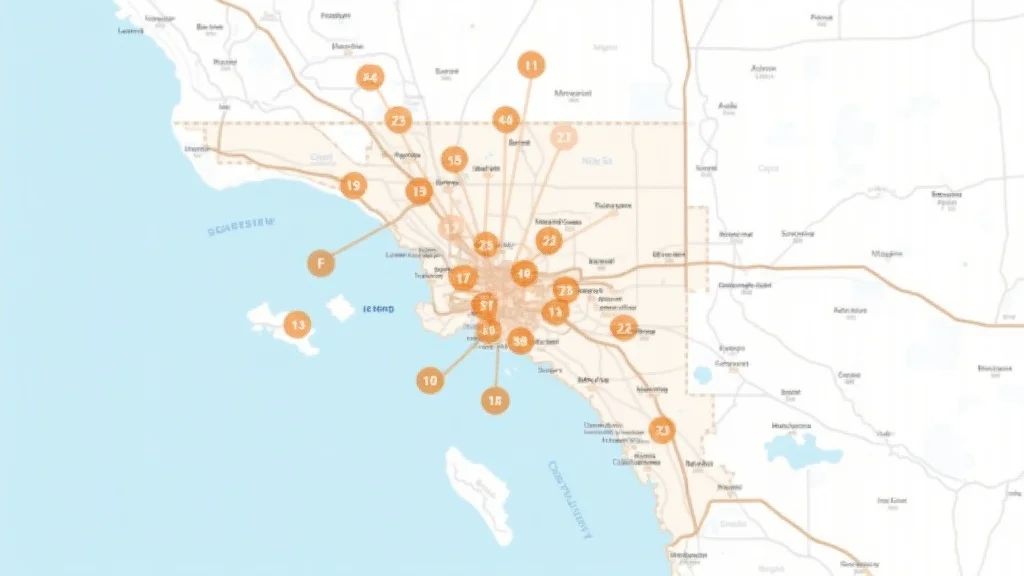

Map: The Orange County Startup Funding Landscape

Practical Action Plan for Orange County Tech Startup Funding Success

-

Solidify your team, roles, and division of equity (clean cap table)

-

Validate market need, build—and test—your MVP in the OC region

-

Start generating traction and tracking early metrics

-

Prepare key documents (pitch deck, financials, competitive map)

-

Engage with regional accelerators (LaunchPad SBDC, EvoNexus) and service providers

-

Build relationships with OC Startup Council and local investors early

-

Negotiate term-sheets and valuations with regional insights in mind

-

Plan communications and investor updates specific to OC priorities

Executing each step improves not just your odds of closing a round, but also your long-term credibility and relationships within Orange County’s startup ecosystem. Early communication with service providers, continuous networking opportunities, and regular updates to prospective investors often turn out to be as critical as your metrics when the decision to invest gets made.

Top Orange County Tech Startup Funding Mistakes (and How to Avoid Them)

-

Trying to raise national-level amounts before proving OC traction

-

Neglecting OC-based advisors, accelerators, or council networks

-

Focusing too much on the product, too little on go-to-market

-

Not tracking runway—underestimating local hiring or compliance costs

-

Poor investor communications, especially with early-stage backers

| Mistake | How to Avoid |

|---|---|

| Raising Too Early | Wait until major traction visible |

| Weak Cap Table | Simplify equity; clean up structure pre-raise |

| Ignoring Regional Players | Attend OC Startup Council events, local pitch competitions |

| Running out of Runway | Model costs/raise appropriately |

Cheat Sheet: Orange County Seed vs Series A Funding Comparison

| Round | Typical Amount | Key Metrics | Best Practice |

|---|---|---|---|

| Seed | $500K–$2M | Prototype, Market Validation | Focus on local angels, incubators |

| Series A | $2M–$10M | ARR, Scalable Growth | Engage institutional VCs, show OC differentiation |

“The difference between a successful raise and a failed one? Local knowledge and persistence.” — Orange County Startup Founder

Looking Ahead: The Future of Orange County Tech Startup Funding

Orange County’s startup ecosystem is evolving quickly, with new opportunities and expectations for ambitious founders. Emerging sectors like healthtech, medtech, cleantech, freight/logistics tech, and advanced AI are attracting both investor dollars and talent. Corporate innovation partnerships—from hospitals to global logistics leaders—are also helping Orange County startups scale and gain credibility faster than ever before.

Looking forward, Orange County’s venture groups and angel networks are doubling down in their priority areas, especially life sciences and SaaS. Corporate innovation labs are more active in competitive rounds, and local universities are spinning out more big data, medical device, and software company startups each year. If you want to succeed in OC, now is the time to plan your next move, prepare for follow-on rounds, and show that you can win in Southern California and beyond.

Emerging Sectors for OC Tech Startup Funding

-

Healthtech and medtech (driven by local universities and hospital partnerships)

-

Freight/logistics tech (proximity to ports and distribution centers)

-

Cleantech and sustainability

-

AI/ML applications across industries

Investor Outlook: Orange County’s Priority Areas

-

Venture groups doubling down in life sciences and biotech

-

Angel networks favoring SaaS, B2B, and CleanTech

-

Increased corporate innovation partnerships

How OC Tech Startup Founders Should Prepare Now

-

Start scaling—beyond just the OC market

-

Prepare your next round as soon as you close the current one

-

Show you can win in Southern California, then nationally

“The Orange County tech startup funding market is evolving. Founders who align with investor focus areas are primed for success.” — OC Investor

People Also Ask: Funding Your Orange County Tech Startup

How to get funding for your tech startup?

To get funding for your Orange County tech startup, start by building a capable team, developing a working prototype, and validating market demand locally. Engage with OC’s angel investors, accelerators like LaunchPad SBDC, and pitch at startup council events. Prepare a clear cap table and compelling pitch deck. Establish early traction—either revenue or rapid user growth—and leverage the mentor and service provider networks unique to the Orange County region. Regular investor updates and referrals from active ecosystem players greatly improve your funding odds.

What is the 50 100 500 rule startup?

The “50 100 500 rule” describes key growth metrics for tech startups aiming to raise funding: 50 qualified leads, 100 paying customers, and $500k in annual revenue. In Orange County, hitting these numbers—especially $500K+ in revenue—shows local investors your startup is executing well and ready for institutional scrutiny. While not a strict requirement, achieving performance in this range makes your company stand out during angel or seed rounds, improving your credibility and negotiating position in the OC startup ecosystem.

Where can I get funding for my startup?

In Orange County, top funding sources include angel investor groups (such as Tech Coast Angels), local VCs (like Okapi Ventures, Cove Fund), startup incubators and accelerators (LaunchPad SBDC, EvoNexus), and corporate innovation arms tied to health, real estate, and big data industries. Pitch competitions hosted by OC Startup Council offer visibility and valuable connections to investors. National funds increasingly scan OC deals, especially for startups showing strong local traction and sector leadership.

What tech companies are in Orange County?

Orange County is home to a diverse suite of tech companies, from established giants (Edwards Lifesciences, Blizzard Entertainment, Vizio) to growth-stage and early startups in SaaS, medical device, fintech, cleantech, and AI. Major employers leverage talent from UCI and Chapman, while the startup ecosystem regularly produces fast-growing companies in life science and innovative software solutions. New ventures are continually emerging through incubators and university spin-outs.

FAQs: Orange County Tech Startup Funding Details

-

What documents do I need for seed funding in OC?

-

How do I approach angel investors versus VCs in Orange County?

-

Is OC startup funding accessible to teams outside Irvine or Newport Beach?

-

What are average deal sizes for OC startups at each stage?

What documents do I need for seed funding in OC?

You should have a pitch deck tailored to Orange County, an up-to-date cap table, financial projections for 18 months or more, and evidence of early traction—such as user metrics or revenue. A solid legal structure and clear founder agreements are essential. If you’ve participated in programs like LaunchPad SBDC or EvoNexus, include endorsements and feedback from mentors or advisors. Being thorough and organized increases your credibility with local angel investor groups and funds.

How do I approach angel investors versus VCs in Orange County?

Approach angel investors through pitch competitions, incubator demo days, and platforms like Tech Coast Angels. Build a relationship through local events, and personalize your communication—regional ties matter. When targeting VCs, especially as you approach Series A, focus on demonstrating traction, operational scalability, and a clear “why OC?” angle. Institutional VCs will scrutinize your cap table, legal structure, and growth metrics in more detail, so preparation and local referrals are key.

Is OC startup funding accessible to teams outsideIrvineorNewport Beach?

Absolutely—while Irvine and Newport Beach host many hubs, OC startup funding is increasingly available across the region, including Costa Mesa, Santa Ana, Fullerton, and surrounding areas. What matters most is your connection to regional networks (angel groups, accelerators, service provider circles) and your ability to show traction that resonates with local investors’ priorities. Remote and hybrid teams are common, but visibility at OC-centric events boosts your odds.

What are average deal sizes for OC startups at each stage?

In 2024, average seed funding in Orange County ranges from $500K–$2M. Series A deals typically close between $2M–$10M, although standout SaaS, life sciences, or medtech teams may raise higher. The OC average is competitive with Los Angeles and outpaces many peer regions, but investors are selective—metrics, product-market fit, and engagement with local networks strongly influence valuation.

Key Takeaways from Orange County Tech Startup Funding Guide

-

Start early, network locally—leverage the OC startup ecosystem

-

Focus on traction, clean documents, and OC-specific strategies for seed and Series A

-

Capitalize on OC’s lower cost base and strong talent pool, but don’t ignore the need for visibility

-

Top mistakes: weak cap tables, unproven demand, and failing to tap regional players

-

The OC tech funding landscape is growing—position your startup now for future growth rounds

Next Steps: Connect with OC Tech Startup Funding Experts

Ready to raise capital and tell your OC tech startup story? Call Gregg at (949) 354-6605 for a free Founder Spotlight Interview and Tech Startup Business Spotlight. This is your opportunity to attract investors, connect with the OC Startup Council, and get noticed in Orange County’s fast-growing tech ecosystem.

If you’re eager to deepen your understanding of the Orange County startup landscape and discover more strategies for long-term growth, there’s a wealth of expert perspectives and founder stories available. Exploring broader resources on Orange County’s innovation ecosystem and startup success journeys can help you anticipate market shifts, build stronger networks, and position your company for future funding rounds. By learning from those who have navigated similar challenges, you’ll gain actionable insights to accelerate your own path. Take the next step and immerse yourself in the region’s most valuable startup knowledge—your future investors and partners are already paying attention.

Sources

For entrepreneurs seeking to secure seed and Series A funding in Orange County, several local resources and organizations can provide valuable support:

-

Tech Coast Angels Orange County (TCA OC): TCA OC is a prominent angel investment group that offers early-stage funding to innovative startups. They have established annual funds, such as the TCA OC Fund 22, designed to streamline the funding process for entrepreneurs and provide investors with diverse opportunities. (prweb.com)

-

UCI Beall Applied Innovation’s Startup Launch Program: This program offers grants of up to $5,000 to early-stage startups affiliated with the University of California, Irvine. The grants can be used for prototyping, patent fees, and other startup-related expenses, with funding distributed based on milestone achievements. (innovation.uci.edu)

-

Orange County Startup Council: This community service association connects tech startups with partners, customers, and investors. They offer directories of local startups, investors, and service providers, as well as events and resources to support the growth of early-stage companies. (ocstartupcouncil.org)

Engaging with these organizations can provide access to funding opportunities, mentorship, and networking events tailored to the Orange County tech startup ecosystem.