An Orange County tech startup business model is your company’s blueprint for success. It’s far more than just a plan to make money; it’s the fundamental logic that explains how you create, deliver, and capture value for your customers. For founders navigating the competitive Orange County ecosystem, a well-defined business model is the strategic foundation for building something that can actually last.

What Is an Orange County Tech Startup Business Model?

Imagine your startup is a high-performance car. The car itself—its sleek design and innovative features—is your product. Your team is the chassis holding it all together. But the business model? That’s the engine. It’s the integrated system that takes fuel (your resources) and turns it into forward motion (revenue and growth). Without a powerful, well-designed engine, the most beautiful car in the world is just a statue.

This is a lesson many founders learn the hard way. An amazing product with a broken business model is a fast track to failure. In fact, a CB Insights analysis found that 17% of startups fail simply because they lack a viable business model. For any entrepreneur trying to build a company, getting this right from day one is non-negotiable. It forces you to answer the gut-check questions that every investor, from Newport Beach to Irvine, will eventually throw at you.

The Core Components of an Orange County Startup Business Model

A solid business model isn’t just one big idea. It’s a set of interconnected parts that work together to make the whole machine run. When you break it down, you can see how everything from marketing to operations fits into a single, cohesive strategy.

Here are the essential pieces you need to figure out:

- Value Proposition: What specific problem are you solving? More importantly, why is your solution the one people should choose over all the other options out there? This is the core promise you make to your customers.

- Customer Segments: Who, exactly, are you building this for? You can’t be everything to everyone. Nailing down your ideal customer profile sharpens your marketing, sales, and product development.

- Channels: How do you actually get your product or service into your customers’ hands? This covers everything from your website and social media presence to your sales team and partner networks.

- Revenue Streams: How does the money come in? Is it a one-time sale, a monthly subscription, a usage-based fee, or something else entirely?

- Cost Structure: What does it cost to keep the lights on and deliver your value proposition? This includes everything from salaries and software licenses to marketing spend and office rent.

A business model is the story of how an organization creates, delivers, and captures value. It serves as a blueprint for strategy to be implemented through organizational structures, processes, and systems. – Alexander Osterwalder, Co-Creator of the Business Model Canvas

In the end, your business model isn’t a static document you write once and file away. It’s a living framework that connects your grand vision to the realities of the market. It guides your decisions on pricing, partnerships, hiring, and fundraising—turning a great idea into a great business.

Exploring Today’s Most Successful Orange County Tech Startup Business Models

Once you’ve got the basic idea of what a business model does, it’s time to pick the right design for your company. The startup world is full of proven models, and each one has its own quirks, ideal customer types, and ways of making money. Getting to know them is the first step toward building a business that can actually last and grow.

Think of it this way: every business model has to do three things well. It has to create value (solve a real problem), deliver that value to the customer, and then capture some of that value back as revenue.

If any one of those three pieces is weak, the whole structure falls apart. Let’s dive into the most popular models today and see how they nail this cycle.

The Subscription and SaaS Revolution

It’s hard to talk about modern startups without mentioning Software as a Service (SaaS). This model has taken over because it’s built on subscriptions. Instead of a big, one-time payment, customers pay a smaller recurring fee—usually monthly or yearly—for ongoing access to software. For founders and investors, this creates a predictable, compounding revenue stream that’s incredibly attractive.

The lifeblood of any SaaS business is Monthly Recurring Revenue (MRR). Success comes down to a simple formula: keep your customers happy so they stick around, and minimize churn (the rate at which they cancel). A great local example is Irvine-based Kajabi, which gives creators an all-in-one platform to run their business on a classic tiered SaaS plan.

This whole subscription economy is booming, projected to hit a market value of $1.5 trillion by 2025. It’s a massive shift in how we buy things, and it highlights why so many founders are chasing models that build long-term relationships instead of one-off sales. You can dig into more startup statistics and trends to get the full picture.

The Power of the Marketplace Model

Marketplace businesses don’t actually sell their own stuff. Instead, they build a digital venue that connects buyers with sellers and takes a small cut of each transaction. Think of giants like Airbnb or Uber. Their biggest hurdle is always the “chicken-and-egg” problem: you can’t get sellers without buyers, but you can’t get buyers without sellers.

The single most important metric for a marketplace is Gross Merchandise Value (GMV), which is just the total dollar value of everything sold on the platform. If you can get it right, you unlock powerful network effects—the platform becomes more valuable to everyone as more people join.

Freemium: A Strategy for Mass Adoption

The Freemium model is less of a revenue model and more of a customer acquisition machine. You give away a basic version of your product for free to as many people as possible, with the goal of converting a small fraction of them into paying customers for premium features. It’s a game that only works if your product has a massive potential audience and very low costs to serve each new free user.

Companies like Spotify and Dropbox used this playbook to become household names. To know if it’s working, you have to obsess over your conversion rate (from free to paid) and the Lifetime Value (LTV) of those paying customers. The math has to work out: the money from your few paid users needs to more than cover the cost of supporting all your free ones.

The best freemium products are like an escalator. They let you get on for free and then gently move you up to a premium offering as your needs grow. It’s a journey, not a hard sell.

This model is a long game. It demands patience and a deep understanding of what features are just “nice-to-have” versus what people will actually pay for.

Direct-to-Consumer (D2C): Cutting Out the Middleman

The Direct-to-Consumer (D2C) model has completely shaken up retail. D2C brands sell their products directly to customers online, skipping the traditional wholesalers and retailers entirely. This gives them total control over their brand story, the customer experience, and—critically—all their customer data.

D2C startups, like Orange County’s own Dr. Squatch, often build passionate communities using social media and great content. Their success lives and dies by two metrics: Customer Acquisition Cost (CAC) and LTV. A healthy D2C business makes sure that what a customer spends over their lifetime is way more than what it cost to get them in the door.

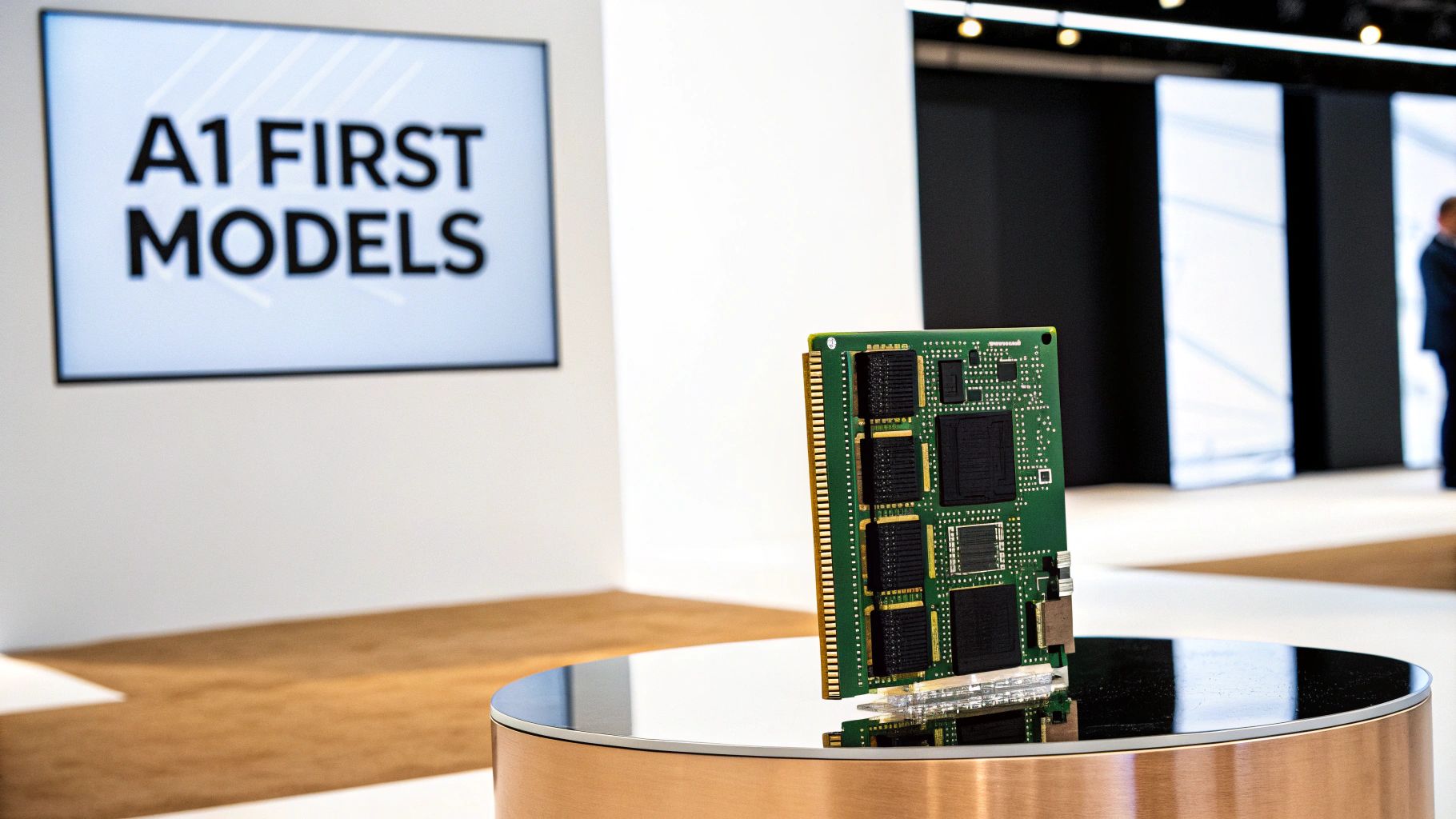

The Emerging AI-First Model

A newer, but increasingly critical, model is the AI-First business. In these companies, artificial intelligence isn’t just a cool add-on; it’s the core engine that makes the product work. They use AI to automate difficult tasks, create incredibly personalized experiences, or offer predictive insights that were never possible before.

Most AI-first companies run on a SaaS or usage-based pricing model. Their real competitive advantage—their “moat”—comes from their unique data and their algorithms, which get smarter with every new user. As AI gets easier to build with, this model is set to redefine entire industries, which is a trend explored in recent industry analyses of how AI reshapes business.

Comparing Popular Startup Business Models

To make it easier to see the differences at a glance, this table breaks down the models we’ve just discussed. It’s a quick cheat sheet for understanding how they work, where the money comes from, and what metrics matter most.

| Business Model | How It Works | Primary KPI |

|---|---|---|

| SaaS/Subscription | Customers pay a recurring fee (monthly/annually) for access to a product or service. | Monthly Recurring Revenue (MRR) |

| Marketplace | A platform connects buyers and sellers, taking a commission or fee from each transaction. | Gross Merchandise Value (GMV) |

| Freemium | A basic version is offered for free to attract a large user base; a small percentage pays for premium features. | Free-to-Paid Conversion Rate |

| Direct-to-Consumer (D2C) | The company sells its own physical products directly to customers online, bypassing retailers. | Customer Lifetime Value (LTV) to CAC Ratio |

| AI-First | The core value of the product is delivered by an AI engine, often sold via subscription or usage-based pricing. | User Engagement / Model Accuracy |

Choosing the right model from this list is one of the most important decisions a founder can make. Each one comes with its own playbook for growth, fundraising, and operations.

How to Choose the Right Business Model for Your Startup

Picking a business model isn’t just a box you check on a business plan. It’s the engine of your entire venture. Get it right, and it amplifies everything you do. Get it wrong, and even the most brilliant idea can suffocate before it ever has a chance to breathe. This isn’t about gut feelings; it’s a strategic choice that needs a clear-headed approach.

At its core, this decision is about finding the perfect marriage between the value you create for your customers and how you capture some of that value for your company. It means looking past what’s trendy and getting brutally honest about what actually works for your product, your market, and where you want to go.

A Framework for Making the Call

To avoid just throwing spaghetti at the wall, you need a framework. I advise founders to think of it as a matrix built on four critical pillars: your customer, your product, your market, and your financial endgame. The right business model isn’t just good on paper; it has to live at the intersection of all four.

This simple exercise forces you to ground your decision in reality. It’s the difference between building your startup on a solid foundation versus building it on sand.

The Four Pillars of Your Decision Matrix:

- Customer Profile & Behavior: Seriously, who are you selling to? A Freemium model that relies on massive volume might work for a consumer app where you don’t need to hand-hold every user. But if you’re selling complex B2B software to enterprise clients, you’ll need a high-touch subscription or direct sales model that accounts for long sales cycles and deep relationships.

- Product Nature & Value Delivery: What does your product actually do? If it has strong network effects—where every new user makes it better for everyone else (think marketplaces or social platforms)—then your model needs to prioritize user growth above all else. A transaction-based or Freemium model is a natural fit. On the other hand, if your product delivers deep, ongoing value through sophisticated software, a tiered SaaS model makes a lot more sense.

- Market & Competitive Landscape: What’s happening around you? If you’re entering a crowded market where everyone is giving away a basic version for free, launching with a strict paywall is probably a death sentence. You might have to use a Freemium or ad-supported model as a wedge to just get your foot in the door.

- Scalability & Financial Goals: What’s the long-term vision? If you’re chasing venture capital and aiming for explosive growth, investors will want to see predictable, recurring revenue. That means SaaS is king. But if you’re building a D2C brand, the conversation will be all about unit economics—specifically, the magic ratio of Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC).

Aligning Your Model with Your Value Proposition

Let’s get practical. Imagine you’re building a sophisticated cybersecurity platform for big banks. Your customer is risk-averse, needs a ton of support, and the value you provide is 24/7 protection. A Freemium model would be an absolute disaster here. It completely devalues the product and clashes with the high-touch sales process needed to land a bank. The obvious choice? A multi-year enterprise subscription.

Now, picture a different startup in Orange County creating a mobile app for surfers to find the best waves using crowd-sourced data. The app gets better as more surfers join. In this case, Freemium is perfect. A free tier gets thousands of users on the platform, creating that critical network effect. A premium subscription can then be layered on top, offering advanced wave forecasting or an ad-free experience.

Your business model isn’t just part of your strategy—it is the strategy. It dictates how you market, who you hire for sales, what your operational priorities are, and ultimately, how you’ll make money.

Choosing the right structure is a foundational decision that will echo through every other choice you make. It needs to be front and center in your early planning. Once you’ve landed on a model that feels right, you’ll find it’s much easier to write a winning startup business plan investors actually read. That document is where you’ll articulate not just what your startup does, but how it will function as a scalable, sustainable business.

Validating Your Model and Knowing When to Pivot

Let’s be honest. Your first business model is really just a hypothesis—your best guess about how your startup is going to work in the real world. Until you put it in front of actual customers, it’s all theory. This is where validation comes in, the process that separates a brilliant idea on a whiteboard from a viable, money-making business.

This isn’t about looking for pats on the back. It’s about stress-testing every assumption you’ve made. Too many founders fall in love with their initial concept and hunt for data that confirms their bias. You have to do the opposite: look for the hard truths, even the ones you don’t want to hear. According to CB Insights, the #1 reason startups fail is simply “no market need.” Proper validation is your best defense against that fate.

Actionable Methods for Business Model Validation

Validation isn’t a one-and-done event; it’s a continuous loop of learning and tweaking. It means getting out of your office and into the world where your customers live. The goal is simple: test your riskiest assumptions before you burn through your cash and energy.

Here are a few proven ways to do it:

- Customer Discovery Interviews: Forget online surveys for a minute. Sit down one-on-one with people in your target market and just listen. Ask open-ended questions about their problems and workflows—not about how great your solution is.

- Build a Minimum Viable Product (MVP): This isn’t about shipping a buggy, half-baked product. An MVP is the smallest, simplest version of your solution that provides real value to a small group of early adopters, allowing you to learn from their actual behavior.

- Analyze Early User Data: Once you have an MVP in the wild, the numbers tell the story. Pay close attention to engagement, retention, and conversion rates. This data gives you an unbiased look at whether your value proposition is actually hitting the mark.

The harsh reality is that a business model is just a series of untested hypotheses. Your job as a founder is to systematically de-risk those hypotheses as quickly and cheaply as possible.

Of all the assumptions you need to test, the most important is willingness to pay. The only way to truly know if someone will pay for your product is to ask them for money. Don’t ask if they would pay; ask them to actually pay through pre-orders, a paid pilot, or even a simple landing page with a “Buy Now” button.

The Art of the Strategic Pivot

Sometimes, the market gives you an answer you weren’t hoping for: your initial idea was off. This isn’t failure—it’s incredibly valuable feedback. A successful pivot is a structured course correction, not a desperate Hail Mary. It’s about taking what you’ve learned and channeling it into a new hypothesis about your product, your market, or your entire business model.

The story of Slack is a classic example. The company didn’t start as a collaboration tool; it began as a video game called Glitch. When the game flopped, the founders noticed that the internal chat tool they’d built for themselves was far more compelling. That was the pivot—turning an internal tool into the core product that became a giant in the industry.

So, how do you know when it’s time to pivot? Look for the signs:

- Stagnant User Growth: You’re putting in the work, but you just can’t seem to attract or keep users.

- Negative Customer Feedback: People are consistently confused by your product or just don’t like it.

- Intense Competition: A competitor is solving the problem so effectively that you can’t carve out a space.

- Unfavorable Unit Economics: Your Customer Acquisition Cost (CAC) is consistently higher than your customer’s Lifetime Value (LTV).

Pivoting takes guts. It means admitting your first strategy didn’t work but having the conviction that you and your team can find a better way forward. To dig deeper into these critical decisions, check out our guide on startup founder best practices to validate, fund, and scale. Knowing when to hold ’em and when to fold ’em is what separates resilient founders from those who go down with a sinking ship.

The Future of Orange Count Tech Startup Business Models

The startup world never sits still. It’s always in motion, with new technology constantly rewriting the rules of the game. While proven models like SaaS and marketplaces are still titans, the next wave of iconic companies is being built on frameworks that put emerging tech right at the center.

For any founder who wants to build a company that doesn’t just compete but actually defines a new category, understanding these future-facing models isn’t just nice to know—it’s essential.

The biggest driver of this change? Artificial intelligence. In fact, one of the most powerful trends shaping startups right now is the deep integration of AI. The Global Startup Ecosystem Report 2025 shows a massive surge in AI-first business models. These aren’t just startups using AI; they are companies where AI is woven into every part of the operation—from automating workflows to delivering hyper-personalized customer experiences.

This represents a complete shift in how startups create and deliver value.

The Rise of the AI-First Model

For an AI-First company, artificial intelligence isn’t just a feature—it’s the engine. These startups don’t just bolt on a chatbot and call it a day. Instead, they construct their entire value proposition around proprietary algorithms and hard-to-get data sets. We’re talking about companies using AI for drug discovery, running autonomous logistics, or building predictive financial models.

This approach completely changes the unit economics. Sure, the upfront investment in R&D and data infrastructure can be steep, but AI-First companies are designed for incredible scale. Their competitive advantage isn’t just a piece of software; it’s a self-improving system that gets smarter with every bit of data it crunches.

Here’s what an AI-First model looks like up close:

- Data as a Core Asset: The business is built around collecting, cleaning, and using unique data that competitors can’t easily get their hands on.

- Automation at Scale: The model automates complex, cognitive tasks that once demanded human experts.

- Predictive Power: The real value delivered to customers isn’t just a tool, but an insight or prediction that helps them make better decisions.

While revenue might come from familiar sources like subscriptions or usage-based fees, the underlying moat is far deeper and more defensible.

Platform and Ecosystem Models

Another massive trend is the evolution of platform business models. A linear business makes a product and sells it. A platform, on the other hand, creates a space where two or more groups can connect and exchange value. Think of a simple marketplace connecting buyers and sellers, but the modern version is far more ambitious.

Today’s platforms are focused on building entire ecosystems. They provide the foundational infrastructure—like an operating system or a set of APIs—and then invite third-party developers, creators, or other businesses to build on top of it. This creates a powerful flywheel, as the platform becomes exponentially more valuable with every new participant who joins.

Look at Shopify. It’s not just an e-commerce tool. It’s a platform that supports a thriving ecosystem of app developers, theme designers, and marketing agencies, all of whom build their own businesses by serving Shopify merchants. The platform’s success is directly tied to the success of its community.

The Creator Economy and Hyper-Personalization

The creator economy signals a huge shift toward individual-led businesses. Platforms like Substack, Patreon, and Kajabi have given millions of writers, artists, and experts the tools to connect directly with their audiences and monetize their expertise through subscriptions, courses, and digital products.

This isn’t just a consumer phenomenon; it’s a powerful business model. Startups are building the “picks and shovels” for this new economy—the tools for creation, audience management, and monetization. The core promise is empowerment, giving individuals the leverage to operate like a modern media company. This model thrives on authenticity and a deep sense of community.

Sustainability-Focused Ventures

Finally, a growing wave of founders is building business models around sustainability and social impact. These aren’t non-profits. They are for-profit companies where the mission and the revenue model are one and the same. It’s often called the “double bottom line” (profit and purpose) or the “triple bottom line” (profit, people, and planet).

You see this in renewable energy, circular fashion (rentals or resale), and sustainable ag-tech. Their value proposition speaks directly to a growing base of consumers and investors who care about ethical and environmental responsibility. For these startups, sustainability isn’t a marketing slogan—it’s a core competitive edge.

As these models become more mainstream, they will heavily influence investor trends driving startup valuations, as VCs look for companies built for long-term resilience.

Common Questions About Startup Business Models

Even after you’ve got a handle on the different models, the real-world questions start popping up. Founders are constantly wrestling with the practical side of building a company that actually lasts. Here, we’ll tackle some of the most frequent questions I hear, giving you a peek into how investors think, the pitfalls of juggling revenue streams, and the real difference between a few core concepts.

Think of this as a quick guide to help you make smarter, more confident decisions as you build.

How Do Investors Actually Evaluate a Business Model?

Investors, especially those in competitive hubs like Orange County, are looking for much more than just a clever way to make money. They need to see a convincing story of how your startup will not only grow but also defend its turf and deliver a serious return. Their analysis usually boils down to a few critical areas.

First up is scalability. They’re trying to picture how your business gets ten, fifty, or even a hundred times bigger without your costs ballooning right alongside it. This is exactly why models built on recurring revenue, like SaaS, get so much attention.

Next, they’ll get granular on your unit economics. The relationship between what it costs you to land a customer (Customer Acquisition Cost, or CAC) and how much that customer is worth over time (Lifetime Value, or LTV) is the fundamental math of a healthy business. A strong LTV/CAC ratio, often cited as 3:1 or better, is proof that you’ve built an engine that can acquire customers profitably.

Investors are betting on the engine, not just the car. They need to see a business model that is not only functional today but is built to accelerate and dominate a large, growing market tomorrow. Evidence of validation is the ultimate proof.

Finally, they’ll hunt for defensibility. What stops a bigger, better-funded competitor from swooping in and copying you? This “moat” can come from a few places:

- Network Effects: The product gets more valuable as more people use it (think marketplaces or social platforms).

- Proprietary Technology: You have unique IP or an algorithm that’s tough to replicate.

- High Switching Costs: It’s a pain—financially or logistically—for customers to leave you for someone else.

An idea on a slide deck is one thing. But showing them real traction with your first customers, even a small group, provides the validation they desperately want to see.

Can a Startup Juggle Multiple Business Models?

It’s possible, but this is almost always a move for a more mature company. When you’re just starting out, focus is your single most valuable asset. Trying to run two different models at once is a recipe for diluting your efforts, confusing your customers, and burning through your cash.

The smart play is to master one model first. Prove that your primary engine works—that it can bring in consistent, predictable revenue. Once that core is stable and scaling, then you can start exploring other complementary streams.

For example, a SaaS company with a solid user base might add a marketplace to connect those users with third-party experts. A direct-to-consumer brand that has built a loyal community could introduce a subscription box to lock in recurring revenue. The key is that the new model has to build on what you’ve already established, not distract from it.

What’s the Difference Between a Business Model and a Revenue Model?

This one trips people up all the time, but the distinction is crucial for thinking strategically. Your revenue model is just one piece of the puzzle—it answers the simple question, “How do we make money?” Think subscription fees, ad sales, or transaction cuts.

A business model, on the other hand, is the entire blueprint for how your company creates, delivers, and captures value. It answers a much wider set of questions:

- Who is our customer?

- What problem are we solving for them?

- How do we find and win them over?

- What key things do we need to do (and have) to deliver that solution?

- What does it cost us to operate?

Tools like the Business Model Canvas are great for mapping this all out. In short, the revenue model is just a single gear in the much larger machine that is your business model. Focusing on the whole machine forces you to think like a strategist, not just a seller.

At Spotlight on Startups, we provide the clarity, inspiration, and authority you need to move forward with confidence. From case studies of high-growth companies to deep dives into funding pathways, our platform delivers actionable knowledge for founders, investors, and ecosystem partners. Explore our insights at https://spotlightonstartups.com/.