Raising capital from venture capitalists is not a single event—it's a structured campaign demanding strategy, resilience, and meticulous preparation. For many founders, the venture capital funding process can feel like an opaque and overwhelming challenge. However, understanding it as a clear journey—from initial preparation and investor outreach to due diligence and closing the deal—transforms it into a series of manageable, strategic steps.

This guide provides a practical framework for navigating each phase, positioning your startup for success and helping you build the kind of founder-investor partnership that drives exponential growth.

Your Founder's Roadmap to VC Funding

Founders are often so focused on building a category-defining product that they are caught off guard by the distinct phases of fundraising. Each stage demands a different strategy, specific documentation, and a unique mindset. This process is not arbitrary; it's designed by investors to systematically de-risk their investment. They are not just buying a piece of your company; they are betting on a compelling vision, a massive market opportunity, and, most importantly, a leadership team that can execute flawlessly.

To secure funding, you must think like an investor. To help you do that, here is a high-level overview of the venture capital funding process.

The Venture Capital Funding Process at a Glance

| Stage | Primary Objective | Key Deliverables & Actionable Insights |

|---|---|---|

| Preparation | Build a compelling investment case. | Pitch deck, financial model, business plan. Focus on a narrative that shows market validation and a scalable growth strategy. |

| Outreach & Pitching | Secure meetings with aligned investors. | Curated investor list, warm introductions, and a pitch that showcases founder excellence and deep market knowledge. |

| Due Diligence | Validate all claims about the business. | A well-organized data room with financials, contracts, IP documentation, and customer references. Transparency is key. |

| Term Sheet | Agree on the high-level terms of the deal. | A signed term sheet from a lead investor that aligns economic and control terms with long-term partnership goals. |

| Closing | Finalize legal documents and receive funds. | Executed legal agreements and wired funds, marking the official start of your new partnership. |

As you can see, each phase builds directly on the one before it. Success depends on executing each step with precision.

Key Phases of the Journey

Think of the fundraising journey as a series of non-negotiable milestones. The process breaks down into four core stages:

- Preparation: This is where you build your fundraising toolkit. It includes a persuasive pitch deck, a solid financial model, and a clear business plan that demonstrates founder vision.

- Engagement: It's all about finding and connecting with the right investors—those who understand your industry, your stage, and your mission.

- Validation: This is the due diligence phase, where investors verify every claim you've made to ensure your startup is a sound investment.

- Negotiation & Closing: The final stretch. Here, you'll finalize the investment terms and secure the capital needed to scale your startup.

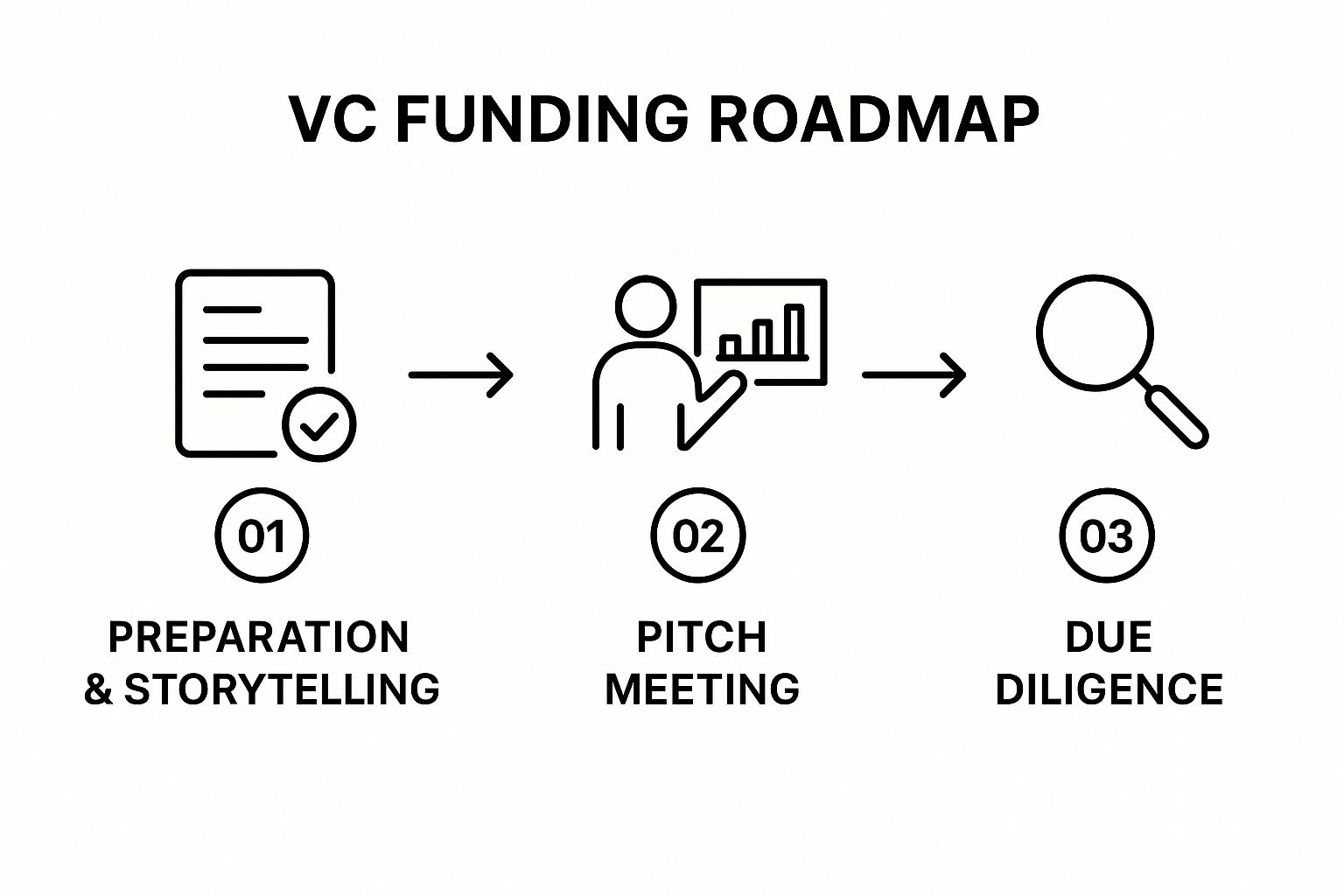

This visual captures how the main stages flow together, from telling your story to surviving the intense scrutiny of due diligence.

The infographic highlights a key point: a great pitch is the bridge between a well-prepared founder and an investor who is ready to conduct a deep dive.

Many founders view fundraising as a distraction from the core business. This is a critical error. Treat the funding process as a core business function. A well-run process signals a well-run company, which builds investor confidence at every touchpoint.

A core component of your preparation is a bulletproof business plan. For a complete walkthrough, check out our guide on how to write a winning startup business plan investors actually read. When you understand what investors are looking for from the very beginning, you can anticipate their questions, shape your narrative, and lead your startup through every stage with confidence.

Preparing Your Startup for Investor Scrutiny

Before you approach a single venture capitalist, you must build an ironclad investment case. This is where the real work begins—long before the first handshake. It’s about substantiating your brilliant idea with a compelling story and cold, hard data.

Think of it like building the foundation for a skyscraper. A weak foundation will crumble under the intense pressure of investor scrutiny.

Crafting a Narrative That Captivates

VCs review hundreds, if not thousands, of pitch decks annually. A deck full of metrics might get a nod, but a powerful story is what gets remembered. Your narrative is the glue that holds your entire fundraising case together, turning facts and figures into a mission investors want to join.

At its core, your story must answer three fundamental questions:

- The Problem: What massive, validated pain point are you solving?

- The Solution: How does your product uniquely and elegantly fix that problem?

- The Vision: How will you dominate a market and change an industry?

A great story gives your data context and makes investors believe in you as the one founder who can lead this charge. It’s what separates a forgettable slide deck from a compelling investment opportunity.

Building the Indispensable Pitch Deck

Your pitch deck is your startup’s highlight reel, business plan, and resume rolled into one. It is your foot in the door. While every deck is unique, the most effective ones follow a logical flow that investors expect.

Here’s a framework for a deck that secures the next meeting:

- Company Purpose: State what you do in one clear, powerful sentence.

- Problem & Opportunity: Define the pain and quantify the opportunity (Total Addressable Market, or TAM).

- Your Solution: Show, don’t just tell, how your product is the answer.

- Business Model: Explain precisely how you make money.

- Traction: This is your proof. Showcase user growth, revenue, key partnerships—any metric that validates your progress.

- Team: Introduce your team and explain why you are uniquely qualified to win.

- Competition: Acknowledge competitors and articulate your defensible advantage.

- Financial Projections: Present your data-backed roadmap to profitability.

- The Ask: State how much capital you need and what milestones it will help you achieve.

The deck's primary job is to generate enough interest to secure a meeting. That’s it.

Financial Modeling That Inspires Confidence

A superficial financial model is an immediate red flag for investors. This isn't just about projecting large numbers; it's about demonstrating a deep, nuanced understanding of your business drivers. You aren’t predicting the future—you are presenting a logical, defensible plan to build a massive company.

Your financial model is a test of your strategic assumptions. It forces you to translate your growth strategy into numbers, showing VCs you’ve mastered key metrics like customer acquisition cost, pricing, churn, and operational expenses. A sloppy model signals a sloppy founder.

Be prepared to defend every assumption. A powerful deck tells your story, but your financials prove you have the business acumen to turn that story into a reality.

Finding and Engaging the Right Investors

Once your fundraising materials are razor-sharp, you are ready to find the right investment partners. This is not a numbers game. Blasting a generic pitch deck to a long list of VCs is a surefire way to be ignored.

Think of it as strategic matchmaking. You are looking for investors who not only write checks but also bring deep industry expertise, a powerful network, and a genuine belief in your mission.

The first step is to build a highly curated list of potential investors by researching their investment thesis—their specific focus on industries, business models, and startup stages. A firm specializing in late-stage B2B SaaS will not consider your pre-seed consumer hardware idea. Platforms like Crunchbase and PitchBook are invaluable for identifying VCs with a track record of backing companies like yours.

Differentiating Between Investor Types

Not all venture capital is the same. Understanding the key players in the ecosystem helps you target your outreach effectively.

- Angel Investors: High-net-worth individuals investing their own capital, usually in very early-stage startups. They are often relationship-driven and can be incredible mentors.

- Seed-Stage VCs: Firms specializing in writing the first institutional checks (Pre-Seed to Series A). They are comfortable with high risk and bet heavily on the founding team and market potential.

- Multi-Stage VCs: Giants like Sequoia Capital or Andreessen Horowitz invest at any stage, from seed to pre-IPO. They offer immense resources but are notoriously difficult to access.

- Corporate VCs (CVCs): Investment arms of large corporations. Beyond financial returns, they often seek a strategic advantage that aligns with their parent company’s goals.

The Power of the Warm Introduction

Once you have your target list, how do you get their attention? In the insular world of venture capital, a warm introduction is invaluable. This is when a trusted mutual contact—another founder they’ve backed, a lawyer, or a Limited Partner in their fund—makes the connection.

A warm introduction acts as a powerful signal. It tells an investor that someone they respect has already vetted you and believes you are worth their time. This social proof can elevate your pitch from the slush pile directly to the top of their inbox.

If a direct connection is not possible, a brilliantly crafted, personalized cold email can occasionally break through. It must demonstrate that you have done your homework on the partner and their firm, convey your value proposition in a few sentences, and be exceptionally concise.

Staying informed on global investment trends provides a strategic edge. For instance, according to CB Insights, generative AI has been a major driver of venture activity. Understanding where capital is flowing helps you refine your strategy and target the right investors. You can dive deeper into these global venture capital trends to ensure you are fishing in the right ponds.

Delivering a Pitch That Resonates

The pitch meeting is where preparation meets opportunity. A great pitch is not a monologue; it is a strategic conversation designed to build rapport and establish unwavering credibility.

Investors are assessing much more than your slides. They are evaluating you, the founder. They are looking for resilience, deep market insight, and the leadership qualities required to navigate the inevitable challenges of scaling a startup. This is your stage to prove you possess those intangibles.

Structuring a Narrative for Maximum Impact

While your deck provides the logical flow, your verbal delivery must weave those points into a compelling story. A winning pitch feels less like a business report and more like an exclusive preview of an incredible opportunity. The goal is to create a sense of inevitability—that your solution is the future, and this is their chance to be part of it.

Your narrative should follow a simple but powerful arc:

- Hook them with the problem. Start with a relatable, vivid description of the pain point you are solving.

- Reveal your elegant solution. Clearly and concisely explain how your product or service is the perfect remedy.

- Show them the future. Paint a picture of the massive market you will capture and the industry you will transform.

This framework elevates a list of features into a mission, making your vision feel both urgent and achievable.

Mastering the Conversation Beyond the Slides

Seasoned investors will often steer the conversation off-script by interrupting with questions, challenging assumptions, and probing for weaknesses. Do not panic. This is their method for testing how you think on your feet.

The best pitches quickly evolve from a presentation into a collaborative discussion. When an investor starts brainstorming with you, challenging your ideas, or asking "what if" questions, you have captured their intellectual curiosity. That is a clear sign you are on the right track.

This is where your deep understanding of the market truly shines. When a VC questions your traction or competitive moat, do not become defensive. View it as an opportunity to showcase your strategic thinking and prove you have considered every angle. These are the moments that separate a good founder from a great one.

Handling Tough Questions with Poise

Objections are not rejections; they are requests for more information. Every founder is grilled on market size, customer acquisition costs, or defensibility. Your ability to answer with data-backed confidence is what matters.

Here’s a simple framework for turning tough questions into wins:

- Acknowledge and Validate: Begin with, "That's a great question." This shows you respect their perspective.

- Answer Directly and Succinctly: Provide a clear answer without rambling, using specific data points whenever possible.

- Bridge to a Strength: Pivot from your answer to a related strength. For instance, if asked about a competitor, acknowledge them and then immediately explain your unique, defensible advantage.

This approach demonstrates that you are not just a visionary but also a pragmatic operator. Ultimately, the pitch meeting is your chance to make investors believe in you. A strong performance makes it almost impossible for them to decline a second meeting, moving you one step closer in the venture capital funding process.

Getting Through the Due Diligence Gauntlet

Making it past the initial pitch is a huge win, but now you enter what is often the most grueling phase: due diligence. Think of it as a full-body scan of your company. VCs will put every claim you have made under a microscope to be certain about their investment.

This is not designed to make you sweat; it is about giving investors the confidence to write the check. A smooth, transparent diligence process signals professionalism. Disorganization or defensiveness, on the other hand, can kill a deal quickly.

The Four Pillars of Due Diligence

Investors will examine everything, but their investigation primarily focuses on four critical areas.

Financial Diligence: This goes far beyond your forecast. They will analyze historical financials, unit economics (like LTV:CAC ratios), burn rate, and every assumption in your model. They are looking for consistency and a realistic grasp of your company's financial health.

Technical Diligence: Investors need to confirm your product is built on a solid foundation. They may bring in technical experts to evaluate your architecture, code quality, and engineering team's capabilities. Be prepared to defend your tech stack's scalability and any intellectual property.

Legal Diligence: This is a corporate health check. Lawyers will review incorporation documents, your cap table, employment agreements, customer contracts, and IP filings. Any issues, like messy founder equity splits or potential IP disputes, will be uncovered here.

Customer & Market Diligence: Investors need to validate that customers love your product. They will want to speak with them directly to understand why they buy from you. They will also conduct their own research to confirm the market size you pitched is credible.

Set Up Your Data Room for a Smooth Ride

The command center for due diligence is your virtual data room (VDR)—a secure online folder containing all requested documents. A well-organized data room does more than accelerate the process; it reflects your operational competence.

Your data room is a silent test of your execution skills. A clean, logical VDR tells investors you are organized and professional. A messy one signals chaos and raises questions about your ability to run the company effectively.

Do not wait to be asked. Start building your data room now. Create a clear folder structure that mirrors the diligence pillars. Proactively populating it can shave weeks off the timeline and prevent "deal fatigue."

Understanding broader market dynamics is also helpful. For example, recent KPMG data shows that while overall deal volume may fluctuate, large investments continue to flow into high-conviction sectors like AI. This means investors are writing larger checks for fewer companies, making their diligence process more intense than ever. You can learn more about how these global VC investment trends influence investor expectations.

Decoding the Term Sheet and Securing the Deal

After months of pitching and due diligence, a term sheet lands in your inbox. This is a major milestone, but it marks the start of the final sprint, not the finish line. This non-binding agreement outlines the investment's core terms and is where your abstract partnership is defined on paper.

Your mission is twofold: secure a deal that reflects your company’s value and establish a partnership built for success, not conflict. Rushing this stage can lead to significant founder dilution, loss of control, and a misaligned relationship with your new partners.

Key Terms You Absolutely Must Understand

A term sheet can be intimidating, but a few key clauses carry most of the weight. Master these, and you can negotiate with confidence.

Valuation (Pre-money vs. Post-money):Pre-money valuation is what your company is worth before the investment. Post-money is the pre-money value plus the new capital. This number directly determines how much of your company you are selling. For a deeper look at how investors arrive at this figure, explore these 5 investor trends driving startup valuations in 2025.

Liquidation Preference: This determines who gets paid first—and how much—if the company is sold. A 1x non-participating preference is the founder-friendly standard, meaning investors get their initial investment back before others. Beware of more aggressive terms like participating preferred stock, which can significantly reduce the payout for you and your team.

Anti-Dilution Provisions: These protect investors if you raise a future round at a lower valuation (a "down round"). “Broad-based weighted average” protection is common and fair. Avoid "full ratchet" anti-dilution, a punishing term that can severely erode founder equity.

Board Seats and Protective Provisions: The term sheet specifies who joins your board of directors. It also lists company decisions requiring investor approval, such as selling the company or taking on major debt. These provisions define control, so be comfortable with where the lines are drawn.

The Art of a Collaborative Negotiation

Negotiation should not be adversarial. The best deals emerge from a collaborative spirit, where both sides seek a win-win outcome. You are entering a partnership that will last for years; starting with a contentious fight is a poor foundation.

The term sheet negotiation is a test of your future working relationship. How you handle disagreements and find common ground here sets the tone for how you will navigate challenges together as partners.

An experienced startup lawyer is your most valuable ally at this stage. A great attorney who specializes in venture deals can translate the jargon, advise on "market" terms, and help you push back on unfavorable clauses without jeopardizing the deal. Their fee is an investment in protecting your company’s future.

Market context is also crucial. For example, a recent Q2 2025 VC benchmark report noted that while global venture funding remains robust, deal count has fallen, with AI startups attracting a disproportionate share of capital. This indicates that while terms for top startups can be competitive, investors are highly selective.

Common Questions on the VC Funding Process

The venture capital world can feel like a black box, and navigating it for the first time raises many questions. Clarity is the first step toward building the confidence needed to succeed.

Here are answers to some of the most common questions from entrepreneurs embarking on the VC funding process.

How Long Does the Entire Process Take?

The timeline often surprises first-time founders. A typical fundraising process takes six to nine months from initial preparation to cash in the bank.

Here is a breakdown of that journey:

- Preparation (1-2 months): Building your pitch deck, perfecting your financial model, and organizing your data room.

- Outreach (2-3 months): Identifying the right VCs, securing warm introductions, and conducting dozens of initial meetings.

- Due Diligence (1-2 months): Once a lead investor is serious, they will conduct a deep dive into every aspect of your business.

- Closing (1-2 months): Negotiating the term sheet, finalizing legal documents, and closing the round.

The key takeaway is to start fundraising long before your cash runway is low.

What Are the Most Common Reasons VCs Pass?

Venture capitalists say "no" far more often than they say "yes." Understanding why they pass can help you avoid common pitfalls.

A "no" from a VC is rarely a final judgment on your idea. Think of it as a signal of misalignment with their specific fund, thesis, or stage. It’s about fit, not failure.

Most rejections stem from a few core reasons. A market that is not large enough to generate venture-scale returns is a classic deal-breaker. Other common reasons include a founding team that lacks deep domain expertise, insufficient traction, or a product without a clear competitive moat.

What Is the Role of a Lead Investor?

In any funding round, the lead investor is your anchor. They are the partner who sets the tone for the deal.

The lead typically writes the largest check, giving them the conviction to conduct thorough due diligence. They also set the core investment terms in the term sheet and usually take a seat on your company's board of directors.

Their commitment sends a powerful signal to the market, making it significantly easier to attract other "follow-on" investors to complete the round. Securing your lead investor is the single most important milestone in your fundraise.

Should a Founder Use a Fundraising Advisor?

For early-stage companies (Pre-Seed, Seed, and Series A), the answer is almost always no.

At this stage, investors are betting on you. They need to see your passion, vision, and ability to sell that vision directly. Using an advisor or broker can be a major red flag, suggesting you are unable or unwilling to do the hard work of selling your own company.

The founder must lead the charge. While later-stage companies might hire an investment banker for a complex Series C or D round, the fundraising responsibility for an early-stage startup rests squarely on the founder's shoulders.

At Spotlight on Startups, we provide the clarity and authority you need to master every stage of the entrepreneurial journey. Whether you’re preparing for a critical funding round or refining your business model, our expert insights offer a blueprint for success. Explore our platform to move forward with confidence: https://spotlightonstartups.com/