Product market segmentation is the strategic process of dividing a broad market into smaller, well-defined groups of consumers who share similar needs, characteristics, or behaviors. For a startup, this isn't just a marketing exercise—it's a core survival strategy. It’s how founders stop trying to be everything to everyone and start focusing their precious resources on the customers most likely to buy and champion their product.

By zeroing in on specific groups, founders can carve out a strong, defensible market position, a critical step for scaling a startup and attracting investor interest.

Why Segmentation Is a Startup Superpower

Staring down a massive, undefined market is intimidating. The temptation to build a product for "everybody" is a classic startup trap, and it’s a fast track to burning cash and diluting your value proposition. This is where product market segmentation becomes your compass, distinguishing fast-growing startups from those that never achieve liftoff.

Forget the one-size-fits-all approach. Segmentation helps you find your true fans—the people who don't just need your product but will become its loudest champions. This laser focus brings clarity to every aspect of building a company, from feature development and marketing copy to hiring and fundraising.

The Strategic Advantages of a Focused Market

When you know exactly who you're building for, you unlock critical competitive advantages that go far beyond marketing:

- Optimized Resource Allocation: Early-stage startups operate with lean teams and tight budgets. Segmentation ensures every marketing dollar and engineering hour is aimed at the audience with the highest potential return on investment, a key metric for investors.

- Stronger Product-Market Fit: By concentrating on a niche, you can tailor product features to solve their specific problems with precision. This is the fast lane to achieving true product-market fit, the holy grail for any early-stage company.

- Increased Customer Loyalty: Customers feel seen and understood when a product speaks their language. This connection builds loyalty, boosts retention, reduces churn, and sparks the kind of word-of-mouth growth that money can't buy.

Getting this right is a game-changer. According to research cited by Investopedia, a staggering number of new product launches fail, often due to poor market segmentation. That statistic isn't meant to scare you; it's a reminder of how critical it is to find and target the right audience.

For a founder, segmentation isn't about excluding potential customers. It’s about winning over the right customers first. This creates a solid foundation—a beachhead—from which you can expand your market presence with confidence and credibility.

Ultimately, a sharp segmentation strategy turns a vague idea into a high-growth business plan. It gives you a roadmap for building a loyal customer base and carving out a durable position in the market. A great way to get deep inside your core segment's head is by creating a feedback loop, which we cover in our guide on building effective customer advisory boards. That direct insight is pure gold for your product and marketing teams.

From the Mass Market to the Power of the Niche

To understand why product market segmentation is so critical for modern startups, it helps to look at the evolution of market strategy. Not long ago, the playbook was simple: build one thing and sell it to everyone.

This was the golden age of the mass market. Henry Ford nailed the sentiment perfectly with his famous line about the Model T: "Any customer can have a car painted any color that he wants, so long as it is black." The goal wasn't choice; it was manufacturing efficiency.

Back then, a one-size-fits-all model made sense. Consumer options were limited, and the companies that won were those that could produce the most for the least. Marketing was about casting the widest net possible.

The Cracks in a One-Size-Fits-All World

But as markets matured and competition intensified, that old model began to show its age. A more diverse world of consumers emerged, filled with individuals who wanted products that fit their unique tastes, needs, and lifestyles.

Suddenly, the inefficiency of trying to be everything to everyone became painfully obvious. Companies were wasting enormous sums on marketing campaigns with messages so broad they resonated with almost no one.

This shift set the stage for a total rethink of business strategy. Smart leaders began to challenge the idea of a single, uniform market. The real turning point came in 1956, when marketing professor Wendell R. Smith published a game-changing article. He argued that treating the market as one big entity was a losing proposition. Instead, he proposed something new: dividing it into smaller, more distinct groups based on their specific wants. You can explore his foundational work on market segmentation strategies to see where it all started.

A Founder's Takeaway: The journey from mass market to segmentation is all about focus. The old giants scaled through sheer volume. Today's startups scale through precision—they find their niche, win it over completely, and then expand from that strong foundation.

How Technology Poured Rocket Fuel on Niche Marketing

Then came the digital revolution, supercharging the entire concept of segmentation. The internet, social media, and data analytics handed companies a powerful new toolkit for understanding their customers on a granular level.

Suddenly, businesses could collect and analyze vast amounts of data about user behaviors, preferences, and backgrounds.

This data-driven power turned segmentation from a high-level theory into a precise, actionable strategy. Founders no longer had to rely on gut feelings to define their audience. Now, they could pinpoint hyper-specific niches, understand their pain points in incredible detail, and craft messages so personal they felt bespoke. This tech leap leveled the playing field, making it possible for even a tiny startup with the right AI tools to outmaneuver industry giants by owning a well-defined slice of the market.

Choosing Your Segmentation Framework

You're sold on the why. Now for the how. The next step is picking the right frameworks for the job. Think of segmentation frameworks as different lenses, each giving you a unique perspective on your potential customers. Looking through just one gives you a flat image, but layering them brings your market into sharp, three-dimensional focus.

The four classic frameworks—Demographic, Geographic, Psychographic, and Behavioral—are the bedrock of any smart segmentation strategy. While each offers its own insight, the real magic for a startup happens when you combine them to build a rich, detailed picture of your ideal customer profile (ICP).

The Four Pillars of Market Segmentation

Let’s break down the big four. Each answers a fundamental question about your audience, and together, they form a complete profile that guides your product, marketing, and sales decisions.

To make it easier to see how they stack up, here’s a quick comparison of the primary frameworks.

Comparison of Product Market Segmentation Frameworks

| Framework | Focus (The 'What') | Key Data Points | Best For Startups When… |

|---|---|---|---|

| Demographic | The "Who" | Age, gender, income, education, occupation | Establishing a baseline understanding of the market and identifying broad potential user groups. |

| Geographic | The "Where" | Country, region, city, climate, population density | Launching location-based services, physical products, or testing a "beachhead" market strategy. |

| Psychographic | The "Why" | Lifestyles, values, interests, personality, beliefs | Building a strong brand identity and connecting with customers on an emotional, value-driven level. |

| Behavioral | The "How" | Purchase history, product usage, loyalty, feature adoption | Optimizing a SaaS product, reducing churn, and creating targeted customer acquisition and upselling opportunities. |

While this table gives you a high-level view, let's dig into what each of these frameworks looks like in action.

Demographic Segmentation: The Who

Demographic segmentation is almost always the starting point. It's the most straightforward approach, grouping people based on objective, statistical data. It’s all about the "who."

This is foundational because the data is relatively easy to obtain and provides a clean, high-level map of your audience.

- What It Is: Slicing the market by quantifiable traits like age, gender, income, education level, occupation, and family size.

- Data You Need: Census data, analytics platforms (like Google Analytics), customer surveys, and public records.

- Startup Example: A fintech startup building a budgeting app might target users aged 25-35 with an annual income over $60,000. This demographic often has disposable income but is also beginning to focus on long-term financial planning.

Geographic Segmentation: The Where

Geographic segmentation organizes your market based on physical location. This is the "where," and it’s non-negotiable for any business with products, services, or marketing that depends on location.

This framework is perfect for tailoring your offers to local cultures, climates, or regulations.

For founders, geographic segmentation isn't just about country or state. It can be as granular as a specific city, neighborhood, or even a college campus, allowing for highly targeted "beachhead" market entry strategies.

A sustainable delivery service, for example, would use geographic data to launch in dense urban areas where demand for eco-friendly options and convenience is sky-high. Likewise, a clothing brand isn't going to waste ad spend promoting winter coats in Miami.

Psychographic Segmentation: The Why

This is where things get interesting. Psychographic segmentation moves beyond the "who" and "where" to uncover the "why" behind customer decisions. It groups people based on their lifestyles, values, interests, and personality traits.

This is how you connect with customers on an emotional level. It's about what they truly care about, not just the box they check on a census form.

- What It Is: Dividing the market based on psychological attributes like attitudes, beliefs, personal values, and lifestyle choices.

- Data You Need: Customer interviews, social media listening, surveys asking about hobbies and values, and focus groups.

- Startup Example: A direct-to-consumer (D2C) brand selling ethically sourced coffee could build its entire brand identity around a psychographic segment of environmentally conscious consumers. These customers value sustainability and are willing to pay a premium for products that align with their beliefs.

Behavioral Segmentation: The How

For tech and SaaS startups, behavioral segmentation is often the most powerful tool. It groups customers based on their direct actions and interactions with your product or brand—the "how."

This framework gives you a direct line of sight into which features users actually value, how loyal they are, and where they are in their customer journey.

- What It Is: Segmenting based on purchasing habits, product usage rates, brand loyalty, and benefits sought.

- Data You Need: Website analytics, CRM data, in-app user activity, purchase history, and customer feedback.

- Startup Example: A project management SaaS company could segment users into "power users" who utilize advanced features daily and "casual users" who only log in for basic task tracking. This allows them to send targeted tutorials to casual users to boost engagement while offering exclusive beta access to power users to build loyalty and get high-quality feedback.

Getting a handle on these frameworks is a massive step toward building a winning go-to-market plan. To see how segmentation fits into the bigger picture, check out our other guides on product strategy. By thoughtfully layering these approaches, you'll stop shouting into the void and start having meaningful conversations with a well-defined audience ready to become your biggest fans.

Executing Your Segmentation Strategy Step by Step

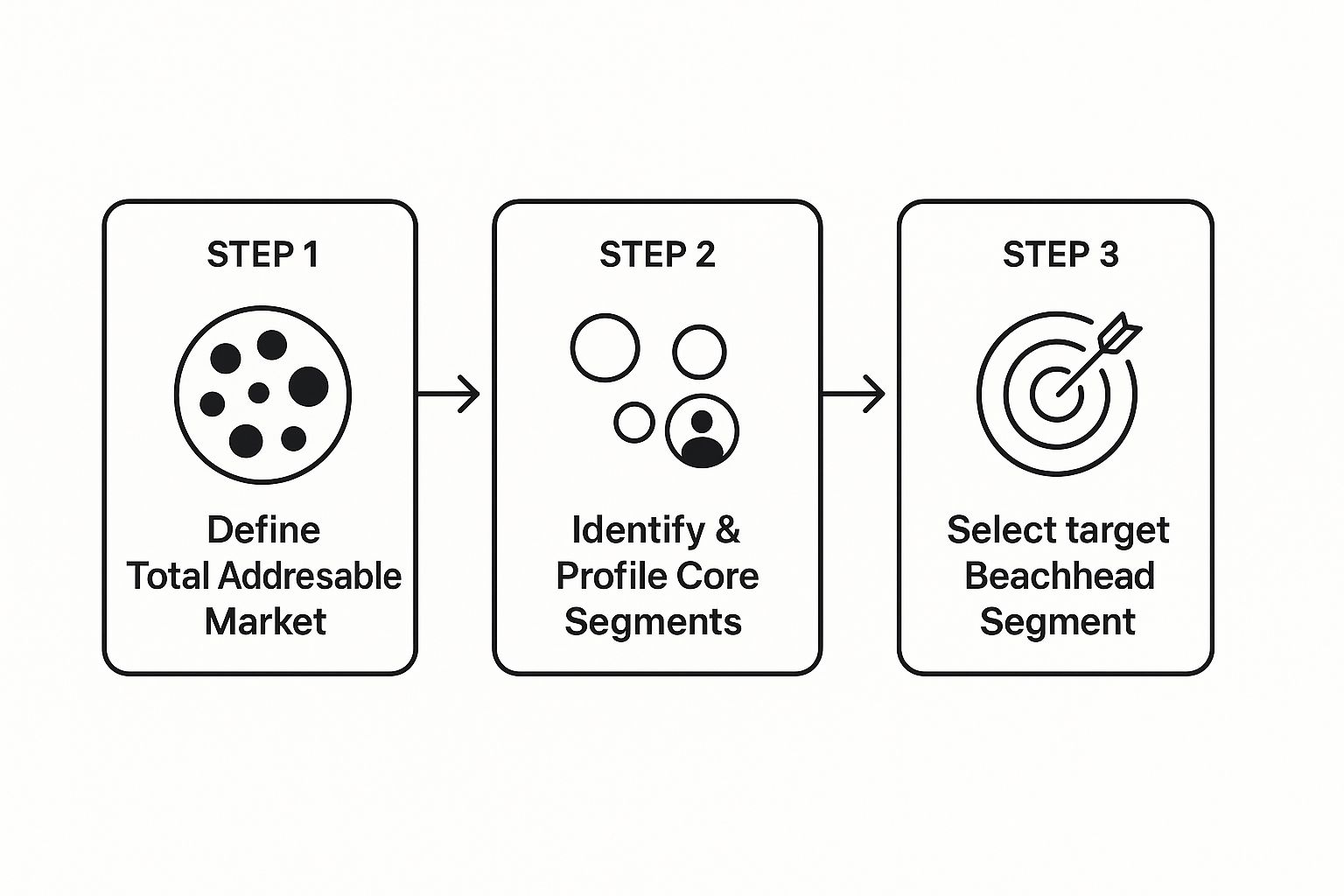

Knowing the frameworks is one thing; putting them to work is where the real value is created. This is the moment theory becomes action.

For founders, segmentation isn't a one-and-done task. It's a disciplined process that transforms a massive, overwhelming market map into a clear, focused plan for growth. Let's walk through this process step-by-step, turning a complex strategy into a manageable roadmap.

Define Your Total Addressable Market

Before you can slice up the pie, you need to know its total size. The first step is to define your Total Addressable Market (TAM). This represents the total revenue opportunity available for your product or service if you were to achieve 100% market share.

For an early-stage startup, claiming you'll conquer the entire TAM is a rookie mistake that investors will see right through. The real value is in providing context. It sets the boundaries for your entire strategy and answers the fundamental question: "How big is the opportunity we're pursuing?"

This high-level view keeps your strategy grounded and ensures your segmentation efforts are based on a realistic market potential.

Conduct Meaningful Customer Research

With your market boundaries sketched out, it's time to become a detective. Assumptions are the enemy of good segmentation; real data is your most trusted ally. This isn't about confirming what you think you know. It's about uncovering what your potential customers actually think, need, and do.

The best research blends two types of data to paint a complete picture:

- Quantitative Data: This is the "what." Use tools like Google Analytics, run surveys with Typeform or SurveyMonkey, and analyze industry reports. This provides the hard numbers and statistical trends.

- Qualitative Data: This is the "why." Conduct customer interviews, run a small focus group, or listen to conversations on social media. This is where you'll find the nuance—the stories and motivations behind the numbers.

If you're a founder on a shoestring budget, you don't need a massive research firm. Simply talking to a handful of potential users can yield game-changing insights that will prevent you from making expensive mistakes later. For a deeper dive, explore our guides on market research for startups.

Identify and Profile Your Core Segments

With data in hand, it's time to connect the dots. Sift through your research, looking for patterns and clusters based on the frameworks we've covered—demographics, behaviors, and psychographics. Your goal is to identify 3-5 core segments that are clearly distinct from one another.

Once you’ve identified them, bring each one to life by building out a detailed profile or persona. Go beyond age and location:

- Pain Points: What keeps them up at night? What are their biggest frustrations related to your solution?

- Goals & Motivations: What are they trying to accomplish? What drives their decisions?

- Watering Holes: Where do they spend their time, both online (e.g., LinkedIn, specific forums) and off?

- Behavioral Traits: How do they discover new products? What influences their buying decisions?

A well-crafted profile turns an abstract group into a relatable "person," making it infinitely easier for your entire team—from engineering to marketing—to understand who they're building for.

This process acts as a funnel, moving from a massive market view down to a single, focused target.

As the visual shows, great segmentation is about narrowing your focus until you land on an actionable target you can actually win.

Evaluate Each Segment's Potential

A hard truth for founders: not all segments are created equal. With your new profiles ready, you must critically evaluate each one to decide where to place your bets. The temptation to chase the largest segment is strong, but it's often a trap.

Score each segment against a consistent set of criteria to keep the decision strategic and objective.

A Founder's Takeaway: Your perfect first segment isn't just the biggest one. It's the one that's reachable, aligns with your company's core mission, and is being overlooked by competitors. It's your path of least resistance to finding your first true fans.

Here are the key factors to evaluate:

- Size and Growth Potential: Is the segment large enough to support your business goals, and is it growing?

- Profitability: Can they afford your solution, and is the potential return worth the investment?

- Accessibility: Do you have a realistic and cost-effective way to reach this group through your marketing and sales channels?

- Competitive Landscape: Is this a hyper-competitive "red ocean" or an underserved "blue ocean"? Can you become a dominant player here?

Select Your Target Beachhead Segment

You’ve done the research and evaluated the options. Now, it's time to make a decision and choose your primary target. In the startup world, this is called your beachhead market. This is the specific segment you will pour all your energy into winning first.

The beachhead strategy is about focus. It’s about planting your flag in a small, defensible niche and completely dominating it before expanding. When you own this first segment, you build credibility, generate cash flow, and create a base of evangelists who will carry your message to the next market.

Once you’ve locked in on this group, your final step is to sharpen your messaging to speak directly to their pains and their goals. This laser-focused approach is what makes your value proposition resonate, setting you up for crucial early traction and long-term success.

Learning from Brands That Mastered Segmentation

Theory is valuable, but seeing segmentation in action is where the real lessons are learned. The most effective way to grasp this strategy's power is by studying brands that have nailed it. By analyzing how iconic companies built their empires, founders can extract practical, actionable insights.

The core principles used by these global giants can help any startup find its own defensible, profitable corner of the market. Let's break down how two very different companies used segmentation to dominate their industries.

Coca-Cola: Geographic and Psychographic Mastery

Coca-Cola is a masterclass in blending geographic and psychographic segmentation. While it appears to be a single, monolithic brand, its global success is built on an almost invisible ability to adapt its product and message to local cultures and tastes.

The company doesn't just ship one version of Coke worldwide. It meticulously adjusts sweetness levels, changes packaging, and even tweaks brand names to fit regional expectations. This geographic precision is why the product feels familiar yet tailored everywhere from Tokyo to Toronto.

Simultaneously, Coca-Cola’s marketing is a masterwork of psychographics. Their campaigns are consistently built around universal human values—happiness, friendship, celebration—but the execution is localized to reflect cultural nuances. This dual approach is how the brand manages to feel both globally massive and personally relevant.

Founder Takeaway: Your core product might have universal appeal, but its presentation and messaging should never be one-size-fits-all. Tap into geographic and psychographic insights to connect with local customer values, making your brand feel like it belongs in their world.

Victoria's Secret: Demographic and Lifestyle Segmentation

Victoria's Secret provides a textbook case of using demographic segmentation to conquer new markets without diluting its core brand identity. For decades, the company’s focus was squarely on adult women, carefully crafting a brand image built on sophistication and allure.

However, they identified a large, underserved market: younger women. The company’s launch of its sub-brand, PINK, was a brilliant segmentation play.

- Target Audience: PINK was created specifically for teenage girls and young women—a demographic with completely different values, style preferences, and media consumption habits.

- Product Design: The products are more casual, vibrant, and comfort-focused, standing in stark contrast to the main brand’s aesthetic.

- Brand Voice: PINK’s marketing is energetic and fun, leaning heavily on social media platforms and brand ambassadors that resonate with a younger audience.

Global mega-brands offer powerful proof of segmentation's impact. Coca-Cola manages over 500 brands across the globe, fine-tuning sweetness and packaging for local tastes. In a similar vein, Victoria’s Secret split its market by creating distinct brands for different age groups: the main line targets adult women, while its sub-brand, PINK, is all about teenage girls and young women. This crystal-clear segmentation maximizes engagement and sales by speaking directly to what different customers want. You can find more examples of how top brands do this in this analysis of market segmentation.

By launching a distinct sub-brand, Victoria's Secret successfully captured a new, fast-growing demographic without alienating its established customer base. It was a strategic masterstroke that allowed them to own two different segments simultaneously. These stories make it clear: whether you're tailoring a global product or launching a new brand for a specific age group, sharp segmentation is the key to building a loyal, engaged audience.

Common Segmentation Pitfalls to Avoid

Getting your product market segmentation right can feel like a superpower. Suddenly, your marketing clicks and your product resonates. But even the best-laid plans can be derailed by common mistakes.

For founders, sidestepping these traps is just as crucial as choosing the right framework. A misstep here doesn't just slow you down—it can burn through cash, waste precious time, and stall your growth engine completely. The key is to remain disciplined and let data, not just gut feelings, drive your strategy.

The Over-Segmentation Trap

One of the easiest mistakes is slicing the market too thinly. In the hunt for a perfect, untapped niche, it's tempting to keep adding qualifiers until you've defined a segment so specific it’s no longer commercially viable. Precision is valuable; over-segmentation leads to a tiny audience that cannot support a scalable business.

Imagine a SaaS startup targeting "left-handed freelance graphic designers in Austin, Texas, who use a specific outdated software." While highly specific, is this group large enough to build a company around? Probably not. A viable segment must be substantial enough to generate meaningful revenue and justify the cost of acquisition.

A Founder's Reminder: The goal isn't to find the smallest possible niche; it's to find a profitable one. Your ideal segment is both clearly defined and large enough to fuel your growth ambitions. You're looking for that "Goldilocks" zone—not too broad, not too narrow, but just right.

Targeting Unreachable or Unprofitable Segments

You've identified a segment. That's only half the battle. The next critical question is: can you actually reach them effectively? It's a classic pitfall to define a perfect customer profile that you have no practical or cost-effective way to engage. This is the strategic equivalent of having a fantastic product with no distribution channels.

For instance, a startup might identify "recently retired executives planning to travel the world" as a valuable psychographic segment. But if this group doesn't use specific social platforms, read particular publications, or attend certain events, how will you get your message in front of them? Attempting to do so could drain your marketing budget for minimal return.

The same logic applies to profitability. A segment might seem large and accessible, but if its members lack the budget or don't perceive enough value to pay for your solution, it's a dead end. Before going all-in, always validate a segment's ability and willingness to pay.

Relying on Assumptions Instead of Data

Founder intuition is an incredible asset; it helps you spot opportunities and make quick decisions. But when it comes to segmentation, it can be a terrible guide. Building your strategy on what you think you know about your customers—without backing it up with hard data—is a recipe for disaster. This is how you end up building features nobody wants and crafting marketing messages that fall flat.

Ground every decision in both quantitative and qualitative insights.

- Quantitative Validation: Dig into analytics, run surveys, and analyze market reports. This confirms the size of your potential segments and helps you understand their behaviors at scale.

- Qualitative Validation: Get on the phone. Conduct customer interviews, listen to conversations on social media, and read reviews. This uncovers the "why" behind the numbers—their real pain points, motivations, and goals.

When you blend both data types, your segments stop being theoretical exercises and start reflecting actual market realities. Solid data removes the guesswork and helps you build a resilient strategy capable of weathering market shifts.

Frequently Asked Questions About Segmentation

Executing a smart product market segmentation strategy always brings up practical questions for founders. Getting the day-to-day execution right is just as critical as the high-level planning. Here are some straight answers to the questions we hear most often from entrepreneurs.

How Often Should a Startup Revisit Its Segments?

Product market segmentation isn’t a one-and-done task. Think of it as a living strategy that needs regular check-ins to ensure it remains effective, because markets shift, customer needs evolve, and your own product changes.

As a general rule, plan for a formal review of your segments at least annually. However, certain events should trigger an immediate reassessment:

- A major product pivot: If you change your core offering, your target audience will likely change with it.

- A significant market shift: New competitors, disruptive technology, or economic changes can render your old segments irrelevant.

- A new funding round: Fresh capital usually comes with aggressive growth expectations, which may require targeting different or larger segments.

- Stalling growth: If your customer acquisition or retention numbers flatline, it's a huge red flag that your current segmentation is no longer effective.

What Are the Best Low-Budget Tools for Research?

You don't need a massive budget to gather powerful segmentation data. In fact, some of the best insights come from free or affordable tools. The real magic happens when you blend quantitative data (the "what") with qualitative insights (the "why").

Here are a few tools every lean startup should have in its arsenal:

- Google Analytics: A free powerhouse for understanding the demographic and geographic data of your website visitors.

- Social Media Insights: Platforms like Meta Business Suite, LinkedIn Analytics, and X (formerly Twitter) Analytics offer surprisingly detailed audience breakdowns at no cost.

- Survey Platforms: Tools like Typeform or SurveyMonkey have free versions that are perfect for getting direct feedback on customer pain points, values, and behaviors.

Don't forget, the most valuable research tool you have is a simple conversation. Just scheduling five interviews with potential customers can uncover more actionable insights than a mountain of passive data ever could.

Can a Startup Target More Than One Segment?

It’s incredibly tempting to chase multiple opportunities at once, but for an early-stage startup, this is a common trap. The most successful founders employ a "beachhead" strategy—a concept borrowed from military tactics. It involves focusing every ounce of your resources (engineering, marketing, sales) on dominating one single, well-defined segment first.

Once you win that initial market, you establish a strong foothold. You build credibility, generate crucial early revenue, and create a base of loyal fans who will help you expand into adjacent segments later. Trying to fight on multiple fronts spreads limited resources too thin, diluting your impact. Focus first, then expand.

At Spotlight on Startups, we provide the clarity and frameworks you need to build a resilient, high-growth company. Explore our expert insights to navigate the challenges of scaling with confidence. Learn more at https://spotlightonstartups.com/.