The year 2025 will be remembered as the moment the “AI Summer” transitioned from speculative hype into a massive, tangible wealth-generation engine. While 2023 was about discovery and 2024 was about integration, 2025 became the year of the AI Billionaire.

Record-breaking activity across the artificial intelligence sector has propelled more than 50 founders and executives into the three-comma club this year. The phenomenon isn’t just limited to the “Big Tech” elite; it spans the entire stack, from the silicon and “picks and shovels” of infrastructure to the specialized application layers and the critical human-in-the-loop data labeling services.

The Economic Engine: 2025 AI Startup Valuations and Funding

The sheer scale of capital flowing into the sector is unprecedented. According to data from Crunchbase, global venture funding reached a fever pitch in 2025, with investors pouring more than $200 billion into AI-centric companies. Remarkably, AI startups captured 50% of all global funding this year—a 16% jump from 2024.

This concentration of capital has led to “valuation inflation” that would be terrifying in any other sector. However, with AI usage in the workplace jumping from 11% in 2023 to 23% in 2025 (per Gallup), the revenue growth for these startups is, in many cases, actually keeping pace with the hype.

The Infrastructure Boom: Building the Stargate to Wealth

Before an AI can “think,” it needs a home. 2025 saw a massive shift toward physical infrastructure, turning hardware and cloud providers into some of the wealthiest individuals on the planet.

The $500 Billion “Stargate” Project

In January, a landmark announcement by the U.S. administration revealed that OpenAI, SoftBank, and Oracle would collaborate on “Stargate”—a $500 billion data center initiative designed to secure U.S. AI supremacy. This announcement acted as a starter pistol for other tech giants. Meta, Alphabet, and Microsoft each committed upwards of $65 billion to proprietary infrastructure this year.

The Hardware Winners

This voracious appetite for compute power minted a new class of “Building Block Billionaires”:

- Astera Labs: Connectivity remains a bottleneck, making its founders new mainstays on the rich list.

- CoreWeave: The specialized cloud provider became the go-to for GPU access.

- ISU Petasys & Sanil Electric: Korean manufacturers of specialized chips and electrical transformers saw their valuations skyrocket as the global supply chain struggled to keep up with data center demands.

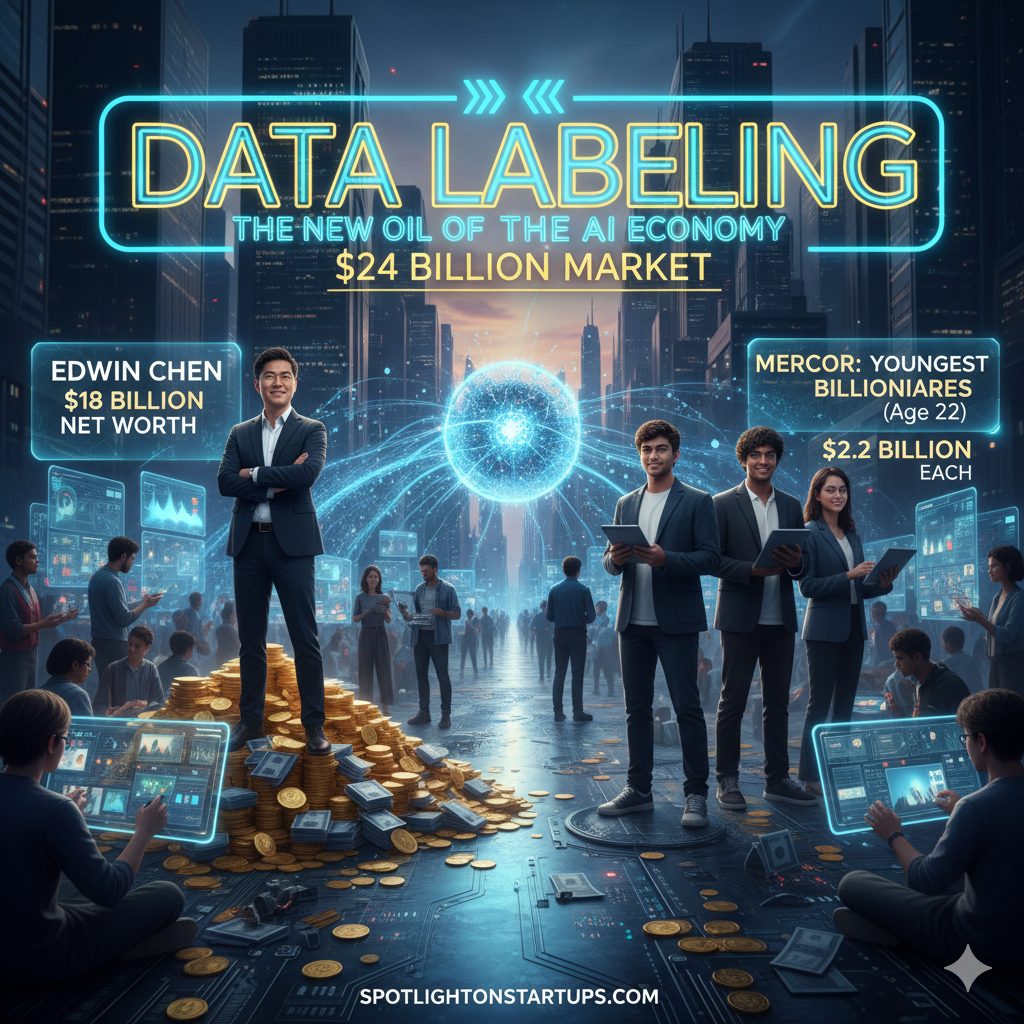

Data Labeling: The New Oil of the AI Economy

If compute is the engine, data is the fuel. However, raw data is useless without high-quality labeling. The 2025 market proved that the most valuable “AI” companies are often those that manage the human intelligence required to train the machines.

The Rise of Surge AI and Edwin Chen

Edwin Chen, the 37-year-old CEO of Surge AI, became the wealthiest newcomer on the Forbes 400 this year with an estimated net worth of $18 billion. Operating without reported venture capital backing, Surge AI generated $1.2 billion in revenue in 2024 by providing high-quality data to Google, Meta, and Anthropic. Chen’s 75% stake in the $24 billion company highlights a shift: profitability and ownership density are the new benchmarks for AI founders.

The Youngest Billionaires in History: Mercor

In October 2025, the record for the youngest self-made billionaire—previously held by Mark Zuckerberg—was shattered. The three cofounders of Mercor (Brendan Foody, Adarsh Hiremath, and Surya Midha), all aged 22, reached a net worth of $2.2 billion each following a $250 million funding round that valued their talent-vetting AI platform at $10 billion.

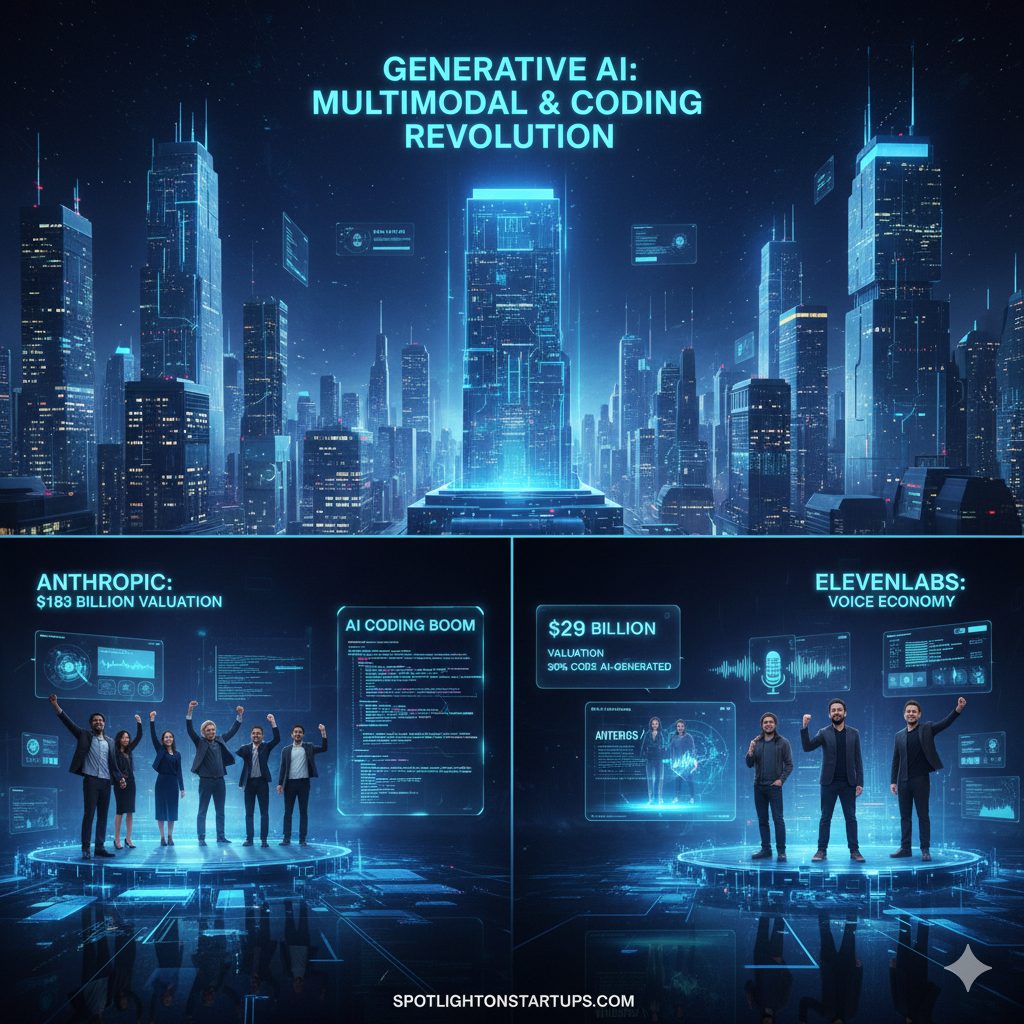

Generative Giants: Multimodal and Coding Revolution

The “Model Wars” continued to escalate in 2025, particularly in the realms of audio, video, and software development.

Anthropic’s Ascent

Anthropic, the creator of the Claude models, became a titan of industry. After raising $16.5 billion in 2025 alone, the company’s valuation hit $183 billion in September. This massive liquidity event vaulted all seven of its cofounders into the billionaire ranks simultaneously.

The Coding “Vibe”

AI is now writing a significant portion of the world’s software. Microsoft CEO Satya Nadella—now a billionaire himself—noted that 30% of Microsoft’s code is now AI-generated. This trend minted billionaires at:

- Anysphere (Cursor): Their AI coding tool is used by half of the Fortune 500, leading to a $29 billion valuation.

- Lovable: Swedish cofounders Anton Osika and Fabian Hedin reached billionaire status in just eight months, proving the “fastest-growing software company” title is now a moving target.

ElevenLabs and the Voice Economy

Multimodal AI (audio and video) saw its breakout year. ElevenLabs, the leader in human-sounding AI voices, raised funding at a $6.6 billion valuation. Founders Mati Staniszewski and Piotr Dabkowski joined the billionaire ranks as their technology became the standard for everything from YouTube narration to corporate customer service.

Notable AI Startup Billionaires of 2025

The following table summarizes the elite group of founders who defined the 2025 wealth surge:

| Name | Company | Net Worth | Key Innovation |

| Edwin Chen | Surge AI | $18 Billion | High-fidelity data labeling |

| Liang Wenfeng | DeepSeek | $11.5 Billion | Efficient, open-source LLMs |

| Bret Taylor | Sierra | $2.5 Billion | Enterprise AI Agents |

| Brendan Foody | Mercor | $2.2 Billion | AI-driven expert recruitment |

| Anton Osika | Lovable | $1.6 Billion | “Vibe coding” (Prompt-to-App) |

| Lucy Guo | Scale AI / Passes | $1.4 Billion | Data labeling & Creator tech |

| Michael Truell | Cursor | $1.3 Billion | AI Integrated Development Environments |

The Social Media Impact and Public Perception

As these billionaires emerge, the public’s interaction with AI has shifted. The launch of OpenAI’s Sora 2 in September 2025 flooded social media with indistinguishable-from-reality video content, further driving retail interest in AI stocks and startups.

A Permanent Shift in the Wealth Landscape

The 2025 AI boom is more than a bubble; it is a fundamental reordering of the global billionaire class. We are seeing the “Old Guard” of software-as-a-service (SaaS) being replaced by “AI-Native” founders who can scale companies to billion-dollar valuations with a fraction of the traditional headcount.

As we look toward 2026, the question is no longer who will build the next great AI, but who will own the infrastructure and data that keeps it running