Conducting market research is the process of gathering critical intelligence on your target customers, market size, and competitive landscape. The goal for any founder is to validate if a startup idea has a genuine opportunity to succeed in the real world. It’s a disciplined mix of analyzing existing data and generating new insights to confirm your assumptions—or, just as importantly, disprove them before you invest significant capital and resources.

Think of it as the foundational de-risking strategy for your entire venture. It’s the critical step that ensures you’re building a solution that customers will actually pay for.

Why Market Research Is Your Startup's Bedrock

Before spending a single dollar on development, every founder must answer a fundamental question: does a real market need exist for your solution? A staggering number of startups fail not because of a poorly built product, but because they engineered a brilliant solution to a problem that wasn't a priority for their target audience. Market research is the disciplined process of separating a founder’s vision from market reality.

This isn’t an academic box-ticking exercise; it’s a core function of an effective startup growth strategy. Founders who operate on assumptions are gambling with their venture's future. In contrast, those who build on a foundation of data operate with intention, strategic clarity, and a significantly higher probability of achieving product-market fit.

From Costly Assumptions to Data-Driven Decisions

Robust market insights inform your entire go-to-market strategy and directly shape your most critical early-stage decisions. This process transforms gut feelings into calculated moves that optimize for success.

- Refine Your Value Proposition: Research helps you move beyond generic benefits to craft a sharp, compelling message that resonates with a specific customer pain point. For example, a fintech startup might discover through interviews that their target small business owners care less about "AI-powered analytics" and more about "getting invoices paid 10 days faster."

- Validate Your Pricing Model: It reveals what customers are willing to pay, preventing you from undervaluing your offering or pricing yourself out of the market. This is a crucial element of financial management for any new venture.

- Prioritize Product Development: Insights clearly separate "must-have" features from "nice-to-haves," focusing your limited engineering resources on what will drive adoption and deliver immediate value.

The consequences of skipping this step can be catastrophic. According to CB Insights, 35% of failed startups cited a lack of market need as a primary reason for their shutdown—a problem entirely preventable with rigorous research.

"Your opinion, while interesting, is irrelevant. The only opinions that matter are your customers'. Market research is how you capture them."

Ultimately, learning how to conduct market research is a non-negotiable skill for any founder. It’s a foundational pillar that provides the clarity needed to navigate the treacherous path from a raw idea to true product-market fit. This entire process is central to the best practices for validating and scaling your company.

Setting Clear and Actionable Research Goals

Vague goals yield worthless data. It’s that simple.

Before exploring the mechanics of how to conduct market research, your first task is to define precisely what you need to learn. Launching surveys or interviews without clear objectives is like setting sail without a destination—you’ll collect plenty of information, but none of it will guide you toward your strategic goals.

Every research activity should be directly tied to a critical business decision. Are you trying to validate your pricing tiers? Define your Ideal Customer Profile (ICP)? Or map the competitive landscape to identify a unique positioning opportunity? Your goals must be specific, measurable, and linked to a concrete action you'll take based on the findings.

This discipline ensures every hour and dollar spent on research delivers a high-value insight that moves your startup forward. It’s the framework that prevents you from drowning in a sea of irrelevant facts.

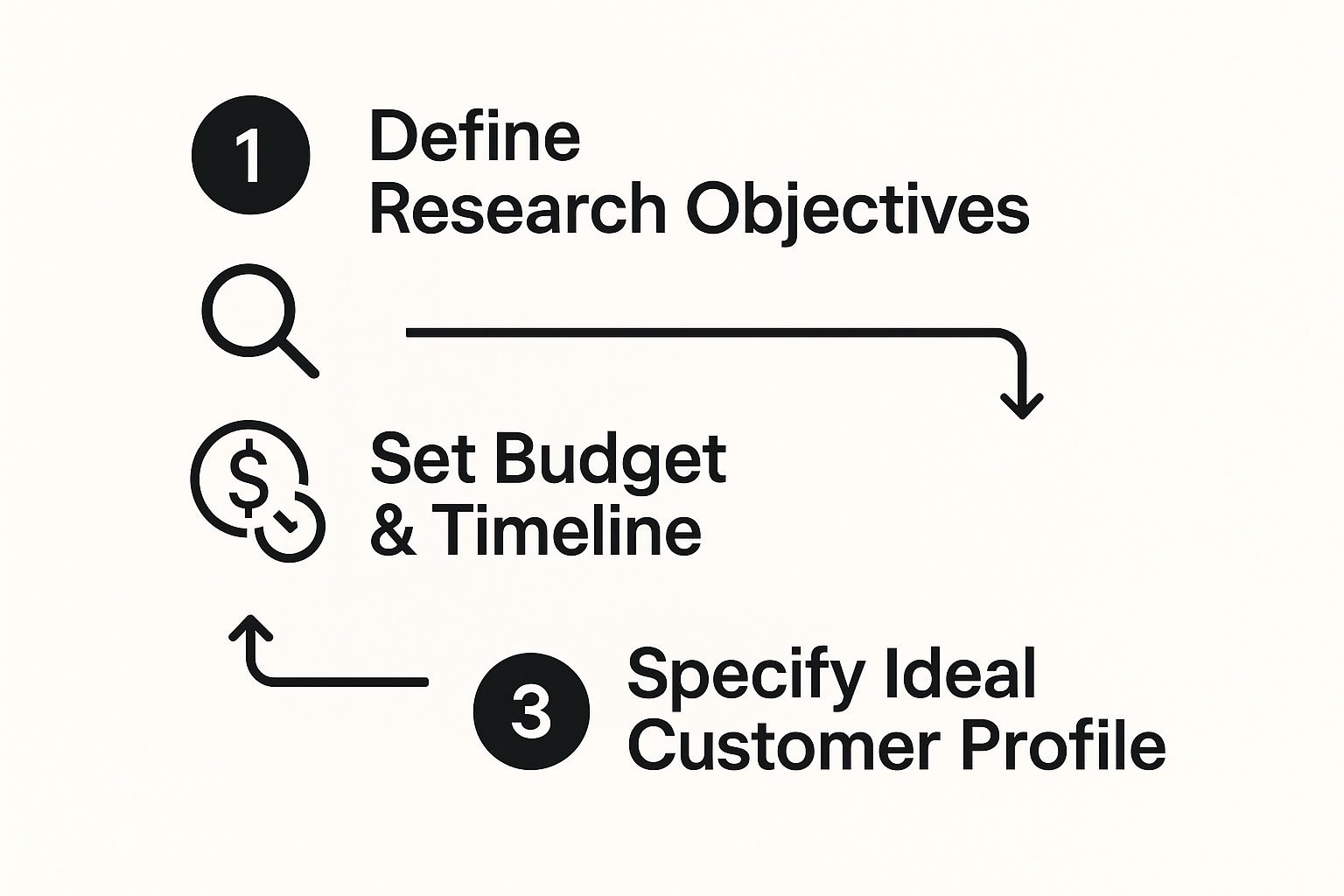

The infographic below outlines the foundational flow for structuring your research, beginning with clear objectives and culminating in a well-defined customer profile.

As you can see, practical constraints like your budget and timeline will directly shape the scope of your research and who you can realistically engage.

From Broad Questions to Sharp Objectives

Start by identifying your biggest unknowns—the core assumptions that, if proven wrong, could derail your entire venture. Then, transform those uncertainties into focused research questions. This is what distinguishes aimless information gathering from strategic intelligence.

Instead of asking a broad question like, "What do customers want?" get specific:

- To Define an ICP: "What are the shared professional titles, daily challenges, and software toolsets of our ten most engaged trial users?"

- To Validate Pricing: "At what price point does our target segment perceive our SaaS tool as a 'great value' versus 'too expensive'?"

- To Assess Competition: "Which features from our top three competitors are most frequently cited as 'essential' by potential customers in our niche?"

A well-defined research goal is a question that, once answered, makes your next business decision obvious. If the answer doesn’t point to a clear action, the question isn’t sharp enough.

Scope Your Research Realistically

Your startup’s stage, budget, and timeline are your guardrails. An early-stage, bootstrapped company can't afford a massive quantitative study, but it can absolutely conduct a dozen high-impact customer interviews that yield game-changing insights.

Be realistic about what you can accomplish. The goal isn’t to eliminate all uncertainty—that's impossible. It’s about reducing the most critical risks with the resources you have right now. This pragmatic approach ensures your research is both sustainable and impactful, giving you the clarity needed to make the next right move.

Choosing The Right Research Methods

With your research goals locked in, the next step is determining how you will get the answers you need. For a startup founder, this is a critical fork in the road where you'll decide between two fundamental paths: primary and secondary research.

Each path serves a distinct purpose. The most effective founders don't just pick one; they learn to blend them to gain maximum insight without exceeding their budget.

Think of it this way: secondary research is about learning from what’s already known, while primary research is about discovering something entirely new.

Start With Secondary Research To Build a Strong Foundation

Your first move should almost always be secondary research—analyzing existing data. Why start here? Because it’s fast, incredibly cost-effective, and provides a solid lay of the land before you spend a dime on proprietary studies.

You're essentially standing on the shoulders of giants, using credible sources to get your bearings.

A few goldmines for secondary data include:

- Industry Reports: Publications from firms like Gartner or Forrester are excellent for high-level trends and market sizing.

- Competitor Analysis: Deep-dive into your competitors' websites, pricing models, customer reviews (on G2 or Capterra), and media coverage. You'll quickly map out their strengths and, more importantly, their weaknesses.

- Government Data: Don't overlook free resources like the U.S. Census Bureau or the Bureau of Labor Statistics. They offer priceless demographic and economic data for market sizing.

This initial sweep prevents you from wasting time and money asking questions that have already been answered. It helps you understand the market size and spot the obvious gaps your startup could fill.

Deploy Primary Research For Bespoke Insights

While secondary data provides the big picture, primary research delivers specific, proprietary insights about your idea and your target customers. This is where you engage directly with your market to gather fresh, firsthand information. It requires more effort but yields data that no competitor has.

Primary methods like surveys and interviews are the backbone of modern market research. According to a recent report from marketresearchassociation.org, nearly 70% of researchers consider surveys their most valuable tool for gathering quantitative data, while in-depth interviews remain the gold standard for qualitative insights.

Smart founders don’t choose between primary and secondary research; they sequence them. Use secondary data to form your hypotheses, then use primary research to test them.

Creating A Blended Research Strategy

The most powerful approach is to weave both methods together. For example, after reading an industry report on a growing SaaS trend (secondary), you might conduct one-on-one interviews with five potential customers (primary) to validate their specific pain points related to that trend.

Here are a few go-to primary research methods perfect for startups:

- Customer Interviews: These are deep, qualitative conversations to understand the "why" behind your customers' behaviors and needs.

- Surveys: A fantastic quantitative tool for gathering data at scale, perfect for validating pricing hypotheses or prioritizing feature development.

- Focus Groups & Advisory Boards: Assembling a small, curated group can provide rich feedback on a new concept or marketing campaign. For ongoing, high-level feedback, you might even consider creating formal customer advisory boards for strategic guidance.

By starting broad with what's known and then going deep with targeted questions, you create an efficient, data-driven feedback loop that should inform every strategic decision.

Primary vs Secondary Research Methods for Startups

| Method | Type | Best For | Typical Cost | Key Benefit |

|---|---|---|---|---|

| Surveys | Primary | Validating hypotheses & collecting quantitative data at scale. | Low to Medium | Scalable and provides statistically relevant data. |

| Customer Interviews | Primary | Gaining deep, qualitative insights into user pain points and motivations. | Low to Medium | Uncovers the "why" behind customer behavior. |

| Focus Groups | Primary | Testing new concepts and observing group dynamics. | Medium to High | Generates rich, interactive feedback. |

| Industry Reports | Secondary | Understanding market size, trends, and competitive landscape. | Low to High | Provides a broad, foundational market overview. |

| Competitor Analysis | Secondary | Identifying market gaps, pricing strategies, and feature sets. | Low | Offers actionable insights from existing players. |

| Government Data | Secondary | Sizing markets and understanding demographic or economic trends. | Free | Highly credible and comprehensive data source. |

Ultimately, the goal is to mix and match these methods based on your stage, budget, and the specific questions you need answered. Start with what's free and accessible (secondary), then strategically invest in direct conversations (primary) to fill in the gaps.

Gathering and Analyzing Your Market Data

Collecting data is one thing; making sense of it is where the real value is created. Once your research methods are defined, your focus must shift to execution and analysis. This is the stage where you transform raw information—survey responses, interview transcripts, industry reports—into a coherent narrative. This story should reveal patterns, challenge your assumptions, and illuminate the path forward for your startup.

For a founder, this isn't about becoming a data scientist overnight. It’s about adopting the mindset of a detective. You are searching for clues buried in the data to understand what your customers really need and desire. The objective is to dig deeper than surface-level answers to find the actionable insights your competitors may be missing.

Mastering Primary Data Collection

When gathering primary data, the quality of your insights is directly tied to the quality of your collection process. The priority is to eliminate bias and create an environment where participants feel comfortable providing honest, detailed feedback.

- Writing Unbiased Survey Questions: Avoid leading questions that steer participants toward a desired answer. Instead of asking, "Wouldn't a feature that saves time be great?" use a more neutral framing: "Describe the biggest challenges in your current workflow."

- Conducting Deeper Customer Interviews: The most valuable insights in an interview come from follow-up questions. When a customer mentions a problem, don’t just move on. Dig deeper. Ask, "Why is that a problem for you?" or "Can you walk me through the last time that happened?" These prompts uncover the emotional drivers behind purchasing decisions.

The most valuable insights often come from the stories and frustrations shared in unscripted moments. Your job is to create the space for those moments to happen by asking open-ended questions and listening more than you talk.

Turning Raw Data Into Actionable Insights

With data in hand, the analysis begins. You don't need complex software or a PhD in statistics to find meaningful patterns, especially in the early stages. The goal is to distill everything you've learned into a few clear, actionable themes.

For qualitative data from interviews, thematic analysis is a powerful starting point. Group similar quotes and observations under common headings. You might identify themes like "frustration with existing tools," "desire for better collaboration," or "budget constraints." This simple framework transforms hours of conversation into a handful of core insights you can use to inform strategy.

For quantitative data from surveys, focus on the fundamentals. Calculate percentages, averages, and frequencies to identify significant trends. For instance, if 70% of respondents rate a specific pain point as "very significant," that is a clear signal for where to focus your product roadmap.

AI and machine learning tools can significantly accelerate this process. Startups using AI-powered platforms for survey analysis can identify customer sentiment and key themes up to 75% faster than with manual methods. The impact is not just on speed. A McKinsey study found that companies that extensively use customer analytics report significantly higher ROI and profits than their peers. This demonstrates the immense value of moving beyond data collection to deep analysis. You can discover more about how top companies use customer engagement to drive growth.

Turning Insights Into an Actionable Strategy

Market research that remains in a report is a colossal waste of a startup’s most precious resources: time and money. The entire purpose of learning how to conduct market research is to translate findings into tangible business actions. This is where you transform data into a growth strategy that drives results.

Your mission is to synthesize your findings into a clear, concise narrative. This story must energize your team, build investor confidence, and de-risk your own journey as a founder. Every insight you uncovered must lead directly to a specific, recommended action.

Synthesizing Data Into a Compelling Narrative

Avoid presenting a mountain of raw data to your stakeholders. Your role is to be the storyteller. Structure your findings around the core questions you initially set out to answer. For instance, if you discovered that your Ideal Customer Profile is deeply frustrated with inefficient workflows, that becomes a central theme of your strategic narrative.

This narrative must be both powerful and easy to understand, acting as the bridge between market signals and your startup’s next moves. It becomes the foundation for refining every aspect of your business.

Your research should directly inform these key strategic areas:

- Product Roadmap: Use customer feedback to ruthlessly prioritize features. If 80% of your interviewees consistently mentioned a specific pain point, that feature should immediately move to the top of your development backlog.

- Marketing Message: Sharpen your value proposition. Replace generic jargon with the exact words and phrases your customers used to describe their problems and ideal solutions. This is key to effective brand positioning.

- Business Model: This is your opportunity to validate or pivot your pricing. If your research indicates a strong preference for a subscription model over a one-time fee, that’s a clear signal for a strategic shift.

"An insight without a corresponding action is just trivia. The purpose of research is not to know more, but to do better. Link every 'we learned this' to a 'so we will do this.'"

From Findings to Framework

To ensure your research drives action, create a simple summary framework. A two-column table is highly effective: one column for the "Key Insight" and the next for the "Recommended Action." This creates undeniable clarity and establishes accountability.

A mixed-methods approach provides the strongest foundation for this framework. As cited by Investopedia, companies that blend qualitative insights with quantitative data tend to make more robust decisions. This balance is critical because it ensures you understand both the "what" and the "why" behind market dynamics. For further reading, see The Power of Qualitative Research from Harvard Business Review.

Ultimately, your market research findings should flow directly into your operational plans. This is how you transform research from an academic exercise into your startup’s strategic compass, guiding every decision toward sustainable growth and increasing your odds of securing funding.

Common Market Research Questions for Founders

Every founder, regardless of their confidence level, confronts similar questions when they begin market research. Understanding these common hurdles ahead of time helps turn uncertainty into a structured plan of attack. The goal isn’t to find a single magic answer, but to apply core principles that lead to smart, data-informed decisions.

Think of these questions as crucial checkpoints. Answering them keeps your research grounded, efficient, and ultimately, valuable for building a resilient startup.

How Much Should a Startup Budget for Market Research?

While there's no magic number, a practical rule of thumb for early-stage startups is to allocate 5-10% of your initial seed funding or operating budget. The most important principle is to be scrappy and resourceful, especially when capital is tight.

A large budget isn't a prerequisite for powerful insights. The key is to focus on activities that deliver the highest return on investment.

- Start with low-cost secondary research. This includes deep dives into competitor websites, industry publications, and government data. Much of this foundational work is free or low-cost.

- Focus on high-impact primary research. Targeted, one-on-one customer interviews are invaluable. The primary cost here is your time, supplemented by small incentives like gift cards to thank participants for their feedback.

As your startup grows and prepares to scale, the budget can and should expand to support more comprehensive studies. But in the early days, a lean, focused approach is the smartest path.

How Do I Find People to Interview for Primary Research?

Sourcing the right people for interviews is often the biggest challenge for founders. Generic feedback is not only unhelpful but can be misleading. You need insights from individuals who genuinely fit your Ideal Customer Profile (ICP).

Your first stop should always be your existing network.

The goal is always quality over quantity. Five deeply insightful conversations with your perfect target customer are infinitely more valuable than fifty shallow interviews with the wrong audience.

Here are a few proven channels to find interviewees:

- Your Personal and Professional Networks: Leverage your LinkedIn connections, university alumni groups, and former colleagues. A warm introduction is the most effective way to secure a "yes."

- Industry Communities: Engage where your target audience congregates. Participate in relevant Slack channels, online forums, or professional meetups.

- Targeted Recruiting Platforms: For highly specific criteria, services like UserInterviews.com or Respondent.io are excellent tools. They enable you to find participants based on precise demographic and professional attributes.

When Do I Know I Have Done Enough Research?

Market research is not a one-time task to be checked off a list. It’s a continuous feedback loop that should evolve with your business. However, for the initial validation phase, there is a clear signal that it's time to shift from research to action.

You've reached what is known as "thematic saturation." This is the point where new interviews and surveys no longer yield new insights. You begin hearing the same pain points, challenges, and desires repeated by different people, often in very similar language.

When you can confidently predict what your next interviewee will say about their core problems, you have built a solid enough foundation. You now have sufficient directional evidence to stop researching and start building, testing, and iterating on your assumptions in the real market.

At Spotlight on Startups, we provide the clarity and authority you need to move forward with confidence. Explore our platform for more actionable knowledge on building a successful venture. Learn more at https://spotlightonstartups.com/.