To understand how to pitch to investors, you must embrace a critical mindset shift: your startup isn't asking for a handout; it's an unmissable investment opportunity with the potential for a massive return. You are not just a founder seeking capital; you are a visionary offering a lucrative partnership. Mastering this perspective starts with getting inside the investor’s head long before you build a single slide.

Decoding the Investor Mindset

Before you write a single word of your pitch, you must understand your audience. Pitching isn't just a presentation of your features or a recitation of your business plan. It's about directly answering the unspoken questions every venture capitalist is asking. VCs see dozens of pitches a week, and their process is optimized to filter out noise and identify signals of genuine, high-growth potential.

Their evaluation is more than a cold analysis of your numbers. It’s a sophisticated assessment of risk, opportunity, and, most importantly, the founding team's potential. To secure funding for early-stage companies, you must learn to speak their language and frame your story around their core motivations.

The Three Core Questions in Every Pitch

Every element of your presentation—every data point, story, and projection—should be engineered to answer three fundamental questions. Address these with clarity and conviction, and you're well on your way.

-

Is the Market Big Enough? Investors are not looking for stable lifestyle businesses; they are hunting for unicorns—ventures capable of capturing a significant share of a large and expanding market. This is where you must demonstrate your grasp of the Total Addressable Market (TAM). A $10 billion market is exponentially more compelling than a $100 million one. Your pitch must sell the vision of this massive opportunity.

-

Is This the Right Team to Win? An idea is worthless without exceptional execution. Investors are betting on you and your co-founders as much as the business itself. They look for evidence of grit, deep domain expertise, and a unique "unfair advantage"—be it proprietary technology, a novel insight, or a key strategic partnership. They are fundamentally asking: can this team navigate adversity, pivot when necessary, and attract A-player talent to scale the startup?

-

Can This Deliver a 10x Return? Venture capital is a high-risk, high-reward asset class. VCs operate on the knowledge that most of their portfolio companies will fail. They rely on one or two massive successes to generate returns for their own investors (Limited Partners). Your financial model and go-to-market strategy must present a credible path to growing their investment by 10x or more within a five-to-seven-year timeframe. The vision must be ambitious yet grounded in a viable plan.

Key Takeaway: An investor’s primary objective is to identify startups with exponential growth potential. Your entire pitch must serve as a well-reasoned argument for why your company represents one of those rare opportunities, clearly articulating market size, team strength, and financial upside.

Looking Beyond the Obvious Metrics

While the pitch deck provides the quantitative data, savvy investors are reading between the lines. They are assessing the founder's mindset, looking for subtle cues that are often better predictors of success than any spreadsheet.

In fact, many investors are more focused on what venture capitalists look for beyond the pitch deck.

They are evaluating your coachability. Are you receptive to critical feedback, or do you become defensive when your assumptions are challenged? They are gauging your resilience. Have you overcome significant obstacles to get to this point? Stories of founder grit are powerful because they demonstrate that you won’t falter when the inevitable challenges of scaling a startup arise. Remember, from your initial email to the final handshake, you are always being evaluated.

Crafting a Narrative That Wins Funding

Facts and figures are essential, but investors don’t write checks based on spreadsheets alone. They invest in compelling stories. After hearing hundreds of pitches, the ones that resonate are built around a powerful, memorable narrative. Your task is to transform your data into a story that makes your opportunity feel urgent, inevitable, and inspiring.

This isn't about fiction; it's about strategic framing. A great pitch narrative weaves the core elements of your business—the market gap, your innovative solution, your team’s expertise—into a classic story structure. The market problem is the villain, your startup is the hero, and the investor is the mentor providing the critical resource (capital) needed for the hero to succeed.

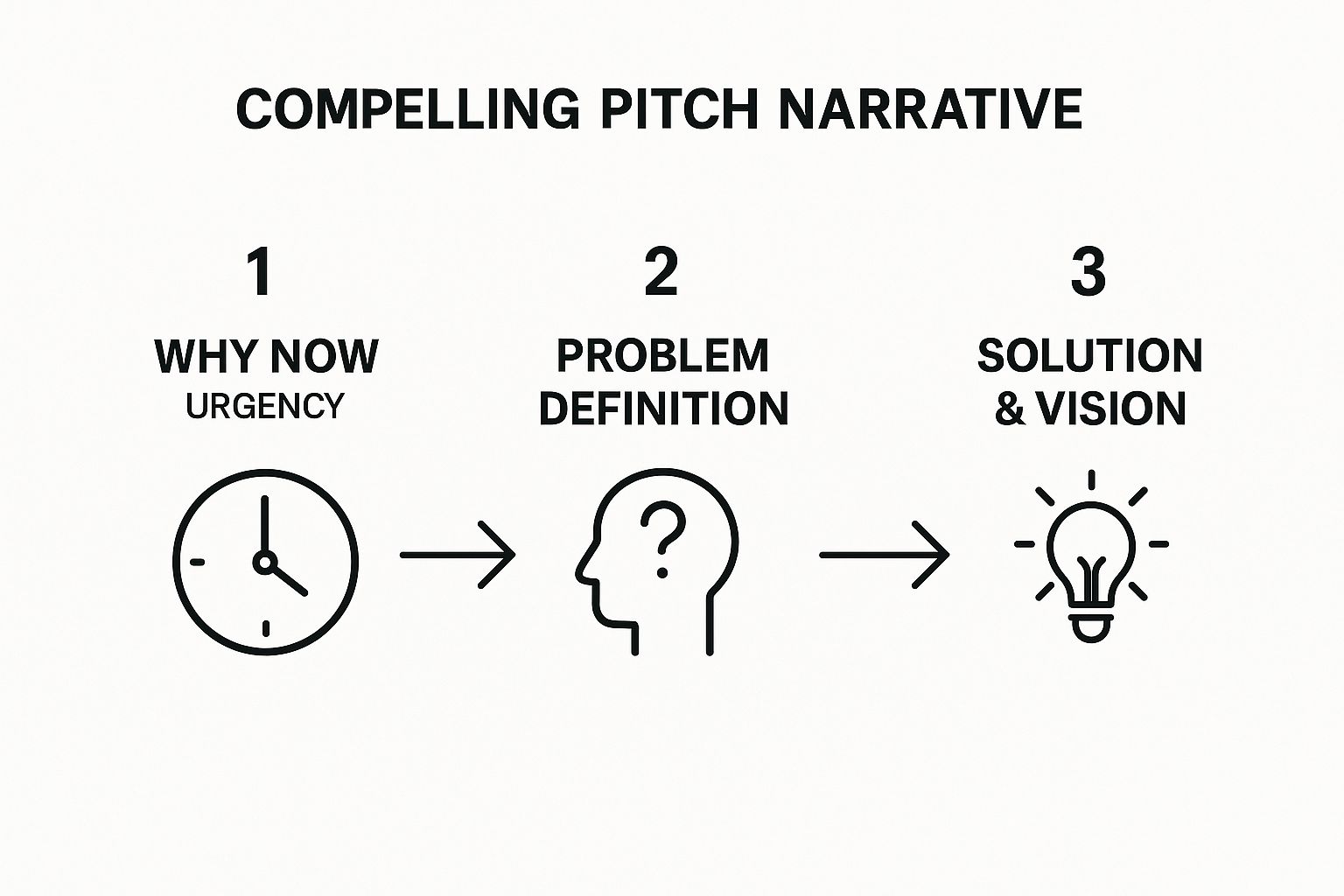

This infographic breaks down the core flow of a powerful pitch story.

This logical sequence—from establishing urgency to defining the problem and unveiling your solution—creates an emotional and intellectual arc. It guides the investor from understanding the market's pain to believing in your company's potential.

Establish the “Why Now” Urgency

The most powerful pitches start by answering one question: why is this the perfect moment for this company to exist? An idea pitched five years too early is as non-viable as one pitched five years too late. You must create a sense of inevitability and urgency.

Connect your startup to a broader technological, regulatory, or behavioral shift. For instance, the rise of remote work created a "why now" moment for collaboration software, just as growing climate awareness did for sustainable tech. According to McKinsey, technological acceleration is a key trend shaping the next decade, creating fertile ground for innovation. Your pitch needs to convince investors that the window of opportunity is open right now.

Define a Clear and Relatable Problem

Before introducing your solution, you must establish a villain everyone understands. Investors need to feel the pain of the problem you're solving. The more visceral and relatable you make the problem, the more powerful your solution will appear.

Avoid abstract jargon. Use specific, human-centric examples.

- Weak Problem: "The current process for B2B procurement is inefficient."

- Strong Problem: "Finance managers at mid-sized companies waste an average of 30 hours per month manually reconciling invoices across disparate software systems, leading to costly errors and delayed payments."

The second example is powerful because it's specific, quantifiable, and creates empathy. By painting a vivid picture of the problem, you make the need for your solution self-evident.

Present Your Elegant Solution and Visionary Future

With the problem clearly established, introduce your solution as the focused, elegant answer. This is not the time for a feature list. Describe the core value proposition that directly addresses the pain point. How does your product or service make the customer’s life dramatically better, cheaper, or faster?

But a solution is not enough; you must sell the visionary future it enables.

Key Takeaway: Don't just sell a product; sell a new reality. If your solution is wildly successful, what does the world look like in five years? How has the industry been transformed? Painting this picture helps investors see the scale of the opportunity far beyond your initial product.

Your story should also reflect an awareness of the current investment climate. As reported by TechCrunch, a narrative that combines growth potential with capital efficiency is essential in today's market. Highlighting how your startup aligns with a surging sector, like AI in enterprise SaaS, or demonstrating a clear path to profitability can make your narrative incredibly persuasive.

Weave in Your Founder Story

Finally, never forget that investors back people. Your team's origin story is a critical piece of the narrative. Why are you uniquely qualified to solve this problem? What personal experience or deep-seated passion fuels your determination?

Sharing a genuine story about your journey builds an authentic connection and establishes trust. It demonstrates the resilience and conviction required to navigate the founder's journey. For more guidance, explore our guide on how startup founders can craft a compelling origin story investors remember. A strong personal narrative transforms your pitch from a business proposal into a mission an investor wants to join.

Building Your Pitch Deck Slide by Slide

If your story is the soul of your pitch, the deck is its skeleton. It is the visual framework that guides the conversation, providing structure and evidence for your narrative. A great deck does more than present facts; it makes your entire business opportunity digestible, compelling, and memorable in under 20 minutes.

Clarity and brevity are paramount. Investors have a ruthlessly efficient filter for fluff. Every slide must have a singular, clear purpose. It is not a business plan; it is a highlight reel designed to secure the next meeting.

The Anatomy of a Winning Deck

While every business is unique, a winning pitch deck follows a logical, compelling flow. It walks the investor from the macro-level problem down to the specific investment opportunity. Think of it as a funnel, starting broad and becoming more focused with each slide.

The goal is to proactively answer key questions, building momentum until you've painted an irresistible picture of your startup's potential.

Key Takeaway: An effective pitch deck is a masterclass in communication. It proves you can distill a complex business into its most essential, exciting components—a critical skill for any founder seeking to lead a high-growth company.

The Essential Slides and Their Strategic Goals

Each slide must do a specific job. What idea are you trying to implant in the investor’s mind? Let's break down the core components.

The Opening Salvo: Problem and Solution

Your first two slides can make or break the entire pitch.

- The Problem: Create immediate empathy and urgency. Use a powerful statistic or a relatable anecdote that makes the pain point tangible. You want investors nodding in agreement.

- The Solution: Introduce your company as the hero. In the simplest terms possible, explain what you do. A clean sentence like, "We are a SaaS platform that automates invoice reconciliation for finance teams," is far more effective than a paragraph of technical jargon.

Sizing Up the Opportunity: Market and Competition

Once you've hooked them, demonstrate that this is a massive opportunity, not a niche product.

- The Market Opportunity: This slide is about scale. Use metrics like Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) to illustrate a credible path to capturing a significant share of a multi-billion dollar industry.

- The Competition: You have competition—even if it's just the status quo. Acknowledge your rivals and use a simple matrix or a "magic quadrant" to show how you're fundamentally different and better positioned to win. This demonstrates strategic awareness.

Proving You Can Pull It Off

The second half of your deck is about proving that your team can execute this vision and turn it into a concrete, investable plan.

Your Go-to-Market Strategy slide is pivotal. Demonstrate a scalable, repeatable plan for customer acquisition. Is it through content marketing, a direct sales force, or channel partnerships? Be specific and show you understand the underlying unit economics, such as customer acquisition cost (CAC).

Finally, the Team slide builds trust. This isn't just a list of names. Highlight the specific, relevant experience that makes your founding team uniquely qualified. Investors bet on the jockey, not just the horse. This is your moment to prove you're the right jockey.

This table outlines the critical slides that form the backbone of a successful pitch deck—a checklist for crafting a story that gets you to the next meeting.

The Essential Investor Pitch Deck Structure

| Slide Number | Slide Title | Core Purpose & Key Question to Answer |

|---|---|---|

| 1 | Company Purpose / Vision | What is the one-sentence summary of your company? (e.g., "We are the Airbnb for office space.") |

| 2 | The Problem | What painful, urgent, and expensive problem are you solving? Why does the status quo fail? |

| 3 | The Solution | How does your product or service elegantly solve that problem? Show, don't just tell (use a simple visual or demo). |

| 4 | Market Size | How big is this opportunity? Use TAM, SAM, and SOM to prove there's potential for venture-scale returns. |

| 5 | The Product | How does it work? Highlight 2-3 key features that deliver the core value proposition. |

| 6 | Business Model | How do you make money? Clearly explain your pricing, revenue streams, and customer lifetime value. |

| 7 | Go-to-Market Strategy | How will you reach your customers in a scalable and repeatable way? What are your primary acquisition channels? |

| 8 | Competitive Landscape | Who are your direct and indirect competitors? How are you different and why will you win? |

| 9 | Traction | What progress have you made? Showcase key metrics like revenue, user growth, partnerships, or key hires. |

| 10 | The Team | Why is this the right team to execute this vision? Highlight relevant domain expertise and past successes. |

| 11 | Financial Projections | What is your believable 3-5 year financial forecast? Show key drivers like revenue, expenses, and profitability milestones. |

| 12 | The Ask | How much are you raising, and what key milestones will you achieve with the capital? Be specific about the use of funds. |

Stick to this structure, and you'll have a narrative that flows logically, hits all the key points investors need to hear, and puts you in the best possible position to get funded.

Mastering Your Financial Projections

A compelling story and a polished deck get you in the door, but your financial model is what keeps you there. If your numbers are flimsy, the conversation will end quickly.

Mastering your financials isn't about predicting the future with perfect accuracy. It’s about demonstrating a deep, operational understanding of your business's core mechanics and unit economics.

Investors need to see more than an ambitious hockey-stick graph. They want to believe you have a grounded understanding of your revenue model, customer acquisition costs, and lifetime value. This is where you prove you can be a responsible steward of their capital.

Build Your Projections from the Ground Up

A common mistake is top-down forecasting—e.g., "we'll capture 1% of a $50 billion market." To an investor, this sounds naive and disconnected from operational reality.

Instead, build a bottom-up model based on the tangible drivers of your business.

- Marketing Spend: What is the expected lead generation from $X in ad spend?

- Conversion Rates: What percentage of leads will convert to paying customers?

- Sales Team Capacity: How many deals can one salesperson realistically close per month?

- Pricing Tiers: What is the anticipated distribution of customers across your pricing plans?

Building projections from these operational assumptions creates a financial story that is both ambitious and credible. It proves you’ve thought through the how, not just the what if. This detailed thinking is a cornerstone of writing a winning startup business plan investors actually read.

The Key Metrics Investors Actually Care About

Early-stage investors focus on a handful of key metrics that reveal the health and scalability of your business. Be prepared to defend these numbers rigorously.

For Pre-Seed & Seed Stage Startups:

- Customer Acquisition Cost (CAC): The total sales and marketing cost to acquire one new customer.

- Lifetime Value (LTV): The total revenue generated from a single customer over their entire relationship with your company. Investors look for an LTV to CAC ratio of at least 3:1.

For Series A and Beyond:

- Monthly Recurring Revenue (MRR) & Annual Recurring Revenue (ARR): The lifeblood of a subscription business, indicating predictable income.

- Gross Margin: The percentage of revenue remaining after accounting for the cost of goods sold (COGS). High gross margins (75%+) signal strong scalability.

- Churn Rate: The percentage of customers who cancel their subscription each month or year. High churn is a silent killer for SaaS businesses.

Key Takeaway: Your financial model is a story told through numbers. It must clearly illustrate how an injection of capital will activate specific growth levers, leading to a scalable, profitable business over the next 3-5 years.

Frame Your Ask with Precision

The "ask" slide is the climax of your financial narrative. State exactly how much you are raising and, more importantly, what you will achieve with it. Vagueness is a deal-killer.

Connect every dollar to a clear, measurable milestone.

- The Ask: "$1.5M Seed Round"

- Use of Funds:

- 40% Product Development: Hire 3 senior engineers to build out X and Y features.

- 35% Sales & Marketing: Hire 2 account executives and launch paid acquisition campaigns.

- 25% Operations: Cover overhead for an 18-month runway.

This level of detail demonstrates financial discipline and strategic thinking, assuring investors that you will deploy their capital for maximum impact.

Navigating the Pitch Meeting and Follow Up

Your pitch deck gets you the meeting, but the meeting is where investors decide if they believe in you. This is your opportunity to bring the story to life, demonstrate command of your business, and forge a genuine connection. The process doesn't end with the presentation; a strategic follow-up is critical for maintaining momentum.

Think of the pitch meeting not as a presentation, but as a structured conversation. The goal is to engage investors in a dialogue about the future you are building. It is a performance rooted in authenticity and meticulous preparation.

Mastering the Art of the Q&A

The Q&A session is often the most critical part of the meeting. This is where investors will probe for weaknesses, test your assumptions, and observe how you perform under pressure. Welcome tough questions as an opportunity to demonstrate your expertise and strategic thinking.

Prepare for these common challenges:

- On Competition: "What if a major tech company enters this space?" Acknowledge the threat and articulate your defensible advantage—be it a network effect, superior technology, or speed of execution.

- On Scalability: "How does this scale beyond your initial beachhead market?" Present a clear, phased plan for expansion that demonstrates foresight into future operational hurdles.

- On Defensibility: "What is your 'moat'?" Your answer must go beyond features. Focus on proprietary data, a strong brand community, or exclusive partnerships that are difficult to replicate.

Key Takeaway: A confident, thoughtful answer to a difficult question builds more credibility than a flawless but superficial presentation. Investors are betting on founders who can navigate inevitable roadblocks.

Reading the Room and Managing Your Time

A great pitch requires acute situational awareness. Pay attention to body language and engagement levels. If an investor seems disengaged, you may be losing them. If they are leaning in and asking specific questions, you have struck a chord.

Be prepared to adapt. If they grasp your product quickly, spend less time on the demo and more on financials or go-to-market strategy. Your time is limited; allocate it to the areas generating the most interest.

The Professional Follow-Up Strategy

Your work is not done when the meeting ends. A prompt, professional, and persistent follow-up strategy is essential for keeping the conversation alive and making it easy for investors to take the next step.

Send your first follow-up email within 24 hours. Keep it concise.

- Thank them for their time and reiterate your enthusiasm.

- Briefly reference a key point from the discussion.

- Provide a link to a secure data room containing your pitch deck, financial model, and team bios.

- Clearly state the next step, such as, "Happy to schedule a follow-up call next week to dive deeper into the financial model."

Awareness of market trends can inform your follow-up. According to CB Insights, while overall global venture funding has seen fluctuations, investment in key sectors like AI remains robust. Knowing these recent global venture capital trends allows you to frame your opportunity within a strong ecosystem.

A brief, value-added email every week or two—sharing a product milestone or a relevant industry article—keeps you top-of-mind without being intrusive. This professional persistence often separates funded startups from those that fade away.

Common Questions Every Founder Asks About Pitching

Navigating the fundraising process can feel opaque. Every founder faces similar questions, and having clear answers is the first step toward walking into a pitch meeting with confidence.

Let's address some of the most common concerns.

How Long Should My Pitch Actually Be?

Keep your formal presentation to 15-20 minutes, maximum. This respects the investor's time and demonstrates your ability to distill complex information into its most critical components—a key founder trait.

Your goal is not to convey every detail but to spark enough interest to secure the next meeting. The remaining time should be dedicated to Q&A, where the real evaluation occurs.

What's the Single Biggest Mistake Founders Make?

The most common mistake is focusing on product features instead of the business opportunity. An investor is not buying technology; they are buying into the potential for a massive return on their capital.

Too many founders get lost in technical jargon and fail to emphasize the three things an investor truly cares about:

- The massive size of the market.

- A scalable and profitable business model.

- Why your team is uniquely positioned to win.

Pro Tip: Frame your entire pitch around the investment opportunity. Your product is the vehicle, not the destination. Lead with the business case.

Should I Slap a Valuation on My Pitch Deck?

For early-stage rounds (pre-seed and seed), the answer is almost always no. Do not include a specific valuation or valuation cap in your deck.

Stating a hard number prematurely can make you appear naive or rigid, boxing you in before a negotiation can begin. Your deck should focus on your "ask"—how much capital you are raising and the specific milestones you will achieve with it. The valuation is a key part of the negotiation that occurs much later in the process, after an investor has bought into your vision.

How Do I Pitch When I Have Zero Revenue?

Pitching a pre-revenue startup requires shifting the focus from financial traction to other powerful forms of validation.

You must excel in these areas:

- The Massive Market: If you lack revenue, you must paint an exceptionally vivid picture of the problem you are solving and the market opportunity.

- The All-Star Team: This is your greatest asset. Highlight the unique experience, industry credibility, and relentless drive of your founding team.

- Early Traction (Non-Revenue): Showcase progress through a working prototype, signed letters of intent from potential customers, a rapidly growing waitlist, or strong user feedback from beta tests.

At this stage, you are selling a vision, a story, and most importantly, the team that can make it a reality.

At Spotlight on Startups, we deliver the clarity, inspiration, and authority you need to move forward with confidence. Explore more expert insights at https://spotlightonstartups.com/.