Scaling a startup isn't just about growing bigger—it's about building smarter. This is the critical shift from adding resources to multiplying output. It’s the difference between hiring another salesperson to close ten more deals and architecting a sales process that enables one person to close one hundred. This guide provides a practical framework for building a business that runs on well-oiled systems, not just the sheer force of will of its founding team.

For founders, investors, and startup professionals, understanding how to scale a startup is fundamental. It's the journey from surviving to thriving, transforming an early-stage venture into a market leader.

The Critical Leap from Surviving to Scaling

Every founder knows the early days: the scrappy, all-hands-on-deck grind to find product-market fit and land those first precious customers. But the mindset that fuels survival mode is the very thing that can hinder scaling. The challenge is moving from "doing things that don't scale," as Paul Graham famously advised, to building an engine that does.

The odds are formidable. Research indicates that only about 0.5% (1 in 200) of startups achieve true scaleup status. It's a sobering statistic from the Startup Genome Project. While a decent number of companies survive past the five-year mark, most get stuck in a cycle of linear growth, never reaching the velocity needed to dominate their market. This journey is less about brute force and more about strategic design. You can explore more data on startup scaling challenges to see why so few make the cut.

Defining Your Scaling Blueprint

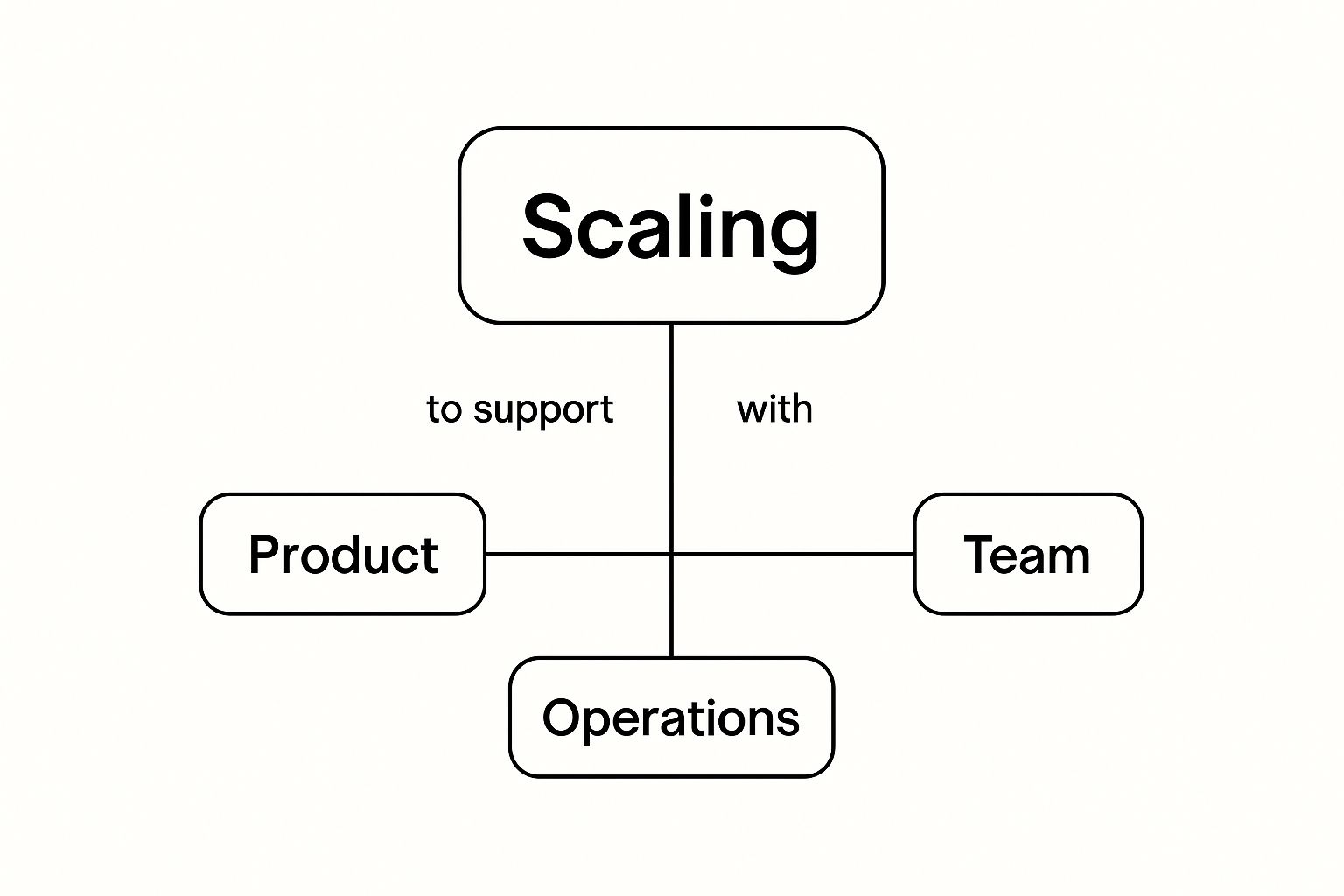

Successful scaling isn't a chaotic sprint; it's a structured expansion built on three core pillars: Product, Team, and Operations. These aren't separate silos. They are deeply interconnected, and a weakness in one will inevitably drag the others down, as illustrated in the following concept map.

This visual clarifies that scaling is a full-company evolution, not just a task for sales or marketing. Every part of the business must mature in sync. A killer product with a weak team will fail to execute. A great team with broken operations will burn out. Before pouring capital into your growth engine, it's essential to understand the fundamental difference between simply growing and strategically scaling.

Growth vs. Scaling: Key Differentiators

| Focus Area | Growth Mindset (Adding Resources) | Scaling Mindset (Multiplying Output) |

|---|---|---|

| Hiring | "We need more people to do more work." | "How can we enable our current team to be 10x more effective?" |

| Technology | Adopting tools to solve immediate problems. | Building an integrated tech stack that automates core processes. |

| Sales | Adding more reps to hit a higher quota. | Developing a repeatable sales playbook and self-serve funnels. |

| Marketing | Increasing ad spend to get more leads. | Building organic channels and viral loops that grow on their own. |

| Customer Support | Hiring more support agents for more tickets. | Creating a knowledge base and community to deflect tickets. |

| Finance | Focusing on revenue growth at all costs. | Obsessing over unit economics (LTV:CAC) and profitability. |

The contrast is clear: Growth is linear and often expensive. Scaling is about creating leverage to achieve exponential results without a corresponding explosion in costs.

"Scaling is not the same as growth. Growth means adding resources at the same rate you're adding revenue. Scaling means adding revenue at a much greater rate than you add resources." – Reid Hoffman, Co-founder of LinkedIn. This distinction is the core of a scalable business model.

This guide provides a practical framework for making that leap. We will walk through how to build a company that not only grows but has the foundation to endure and dominate.

Confirming Product-Market Fit Before You Hit the Gas

The single biggest mistake founders make is hitting the accelerator too soon. Pouring cash into sales and marketing before a product truly resonates with a core market—known as premature scaling—is a classic startup killer. Before attempting aggressive growth, you need undeniable proof of product-market fit (PMF).

This isn't just about positive feedback or an increasing user count. Real PMF is a powerful, almost gravitational pull from the market. It’s the moment your product shifts from a "nice-to-have" to a "must-have" for your customers.

Moving Beyond Vanity Metrics

Early traction can be misleading. Metrics like website traffic, social media followers, or even initial sign-ups can create a false sense of security. To confirm genuine PMF, you must dig deeper and focus on metrics that signal real user engagement and dependency.

Consider the case of a B2B SaaS company that celebrated hitting 10,000 users for its project management tool. The founders quickly realized their monthly churn was nearly 40%. People were signing up but not sticking around. The product was useful, but not indispensable—a textbook sign of weak PMF.

Strong PMF tells a different story through its metrics:

- High Retention Rates: Users don't just try your product; they integrate it into their daily workflows. A low churn rate is one of the clearest signals you've built something essential.

- Strong Net Promoter Score (NPS): When customers are asked how likely they are to recommend your product, a significant portion should be "Promoters" (scoring 9 or 10).

- Organic Growth: Happy customers become your best sales team. A steady stream of new users from word-of-mouth referrals is a powerful indicator of PMF.

A potent qualitative signal for product-market fit is when users say they would be "very disappointed" if your product vanished tomorrow. A simple survey asking this one question, popularized by Sean Ellis, can be more revealing than a dozen complex analytics reports.

Listening to the Right Signals

Validating PMF requires a systematic approach to gathering and analyzing customer feedback. The goal isn't just to ask for feature requests; it's to understand their problems so deeply that you can create the solution they didn't even know how to ask for.

This is where direct, structured communication is critical. Establish formal feedback loops to separate valuable signals from noise. A great way to start is by creating customer advisory boards, which provide invaluable, high-fidelity insights.

Think of confirming PMF as your final pre-flight check. It’s the moment you prove the engine works before attempting takeoff. Once those signals are strong and consistent, you've earned the right to scale.

Building a Team That Thrives Under Pressure

As you scale, the operational pressure intensifies. The scrappy, do-it-all crew that got you to product-market fit may not be the same team that gets you to $50 million in revenue. A flat structure that works for 10 people will buckle under the weight of 50.

The challenge isn't just adding headcount; it’s evolving your organization from a tight-knit band of generalists into a structured team of specialists—without losing the culture that made you successful. This requires a deliberate shift in how you hire, lead, and manage performance. For most founders, this is the hardest part of scaling. Your role must transform from chief "doer" to the primary architect of the team and its systems.

From Generalists to Specialists

In the early stages, you hire for versatility. You need people who can wear multiple hats—the engineer who moonlights in customer support, the marketer who contributes to product design. But as you grow, this approach becomes a bottleneck. To multiply output, you need focused experts who bring deep domain knowledge.

This evolution demands a structured, repeatable hiring process. It's time to define roles with clarity, outlining not just responsibilities but the specific outcomes expected in the first 90 days.

- Create scorecards for every role. Go beyond the standard job description. A scorecard defines the mission for the position, the concrete outcomes they need to achieve, and the core competencies required.

- Structure your interviews. Ditch unstructured chats. Implement a consistent process where different team members assess specific competencies, such as technical skills, culture fit, or leadership potential.

- Check references with purpose. Don't just ask, "Were they a good employee?" Ask pointed questions tied to your scorecard. For instance: "Can you give me an example of a time they drove a project from concept to completion with minimal supervision?"

A critical mindset shift for a founder is realizing you can no longer be the smartest person in every room. Your job is to hire people who are significantly smarter than you in their respective fields, then empower them to do their best work.

Empowering Leaders and Delegating Outcomes

As you bring in specialists, you must also cultivate new leaders and master the art of delegation. Micromanaging a growing team is a fast track to burnout—for you and your team.

Consider a fintech startup that grew from 15 to 75 employees in one year. The founder, initially involved in every product decision, had to step back. She hired a new Head of Product and gave them total ownership of the roadmap. Instead of dictating features, she delegated the outcome: "Increase user engagement by 25% in the next six months." This shift freed her to focus on fundraising and strategy, and it empowered her team to solve problems creatively. True delegation isn't about offloading tasks; it's about entrusting others with responsibility for results.

Engineering a Repeatable Growth Engine

Founder-led sales and sheer hustle have a ceiling. To truly scale, you must transition from "doing" everything to "designing" the machine that does the work for you. Sustainable growth isn't magic; it’s a feat of engineering. The goal is to build a system that predictably acquires customers and generates revenue without your constant, direct involvement.

Master Your Unit Economics (Before You Burn Your Cash)

Before fueling any engine, you must understand its efficiency. For a startup, that means mastering your unit economics. Two metrics, above all others, dictate whether you scale profitably or just scale your burn rate: Customer Acquisition Cost (CAC) and Lifetime Value (LTV).

Put simply, CAC is what you spend to acquire one new customer. LTV is the total revenue you expect from that customer over their relationship with you.

The LTV to CAC ratio is your North Star. A healthy business model, according to sources like Investopedia, typically shows a ratio of 3:1 or higher. This means for every dollar invested to acquire a customer, you generate at least three dollars in return.

A ratio below 3:1 is a red flag, suggesting you're likely paying too much for growth. Conversely, an exceptionally high ratio like 8:1 could indicate you're underinvesting in growth and ceding market share to competitors.

Monitoring these numbers allows you to make data-driven decisions. You can confidently invest more in channels with a low CAC and high LTV, and decisively cut those that are unprofitable. This financial discipline is non-negotiable for sustainable scaling.

For more on building self-sustaining systems, explore our articles on effective growth loops.

Build Your Go-to-Market Machine

With a firm handle on unit economics, it’s time to systematize your go-to-market strategy. This involves building playbooks and leveraging technology to make sales and marketing efforts predictable and efficient.

This process requires discipline:

- Map the Customer Journey: Document every touchpoint a customer has with your company, from the first ad they see to becoming a loyal advocate.

- Write the Sales Playbook: Codify the exact steps, scripts, email templates, and collateral your team uses. This ensures consistency and accelerates onboarding for new hires.

- Build Your Tech Stack: You cannot scale on spreadsheets. Adopt a CRM like HubSpot or Salesforce and integrate it with marketing automation tools to streamline your entire funnel.

This systems-first mindset separates startups that hit a growth ceiling from those that achieve exponential scale. While initial traction can feel explosive, maintaining that velocity requires a well-oiled machine. Global data shows startups forecasting an average revenue growth of 522% in their first year, which slows to 236% in the second. A repeatable engine is your best defense against this slowdown. To learn more, you can explore the full findings on startup growth rates.

Securing the Right Funding for Your Scaling Journey

Scaling a startup requires significant capital. However, the wrong investor can do more damage than no funding at all. Fundraising for a scale-up isn’t just about the size of the check; it's about finding a strategic partner aligned with your vision who can add value beyond capital.

Making the leap from seed funding to a Series A, B, or beyond demands a different playbook. Early-stage investors bet on a brilliant idea and a scrappy team. Later-stage VCs, however, need to see a proven, repeatable business model. They aren’t funding an experiment; they’re backing a predictable machine built for market dominance.

What VCs Really Look For

Your pitch deck is merely the ticket to the conversation. The real test comes when investors scrutinize your metrics and market position. They are looking for specific signals that prove your startup is ready to scale efficiently.

These signals go beyond a compelling story. Investors want hard evidence of a massive total addressable market (TAM), undeniable traction with strong unit economics, and a defensible competitive moat. For a deeper dive, read our breakdown of what venture capitalists look for beyond the pitch deck.

Choosing an investor is like picking a co-founder. You are entering a long-term relationship that will be tested under immense pressure. Prioritize partners who bring deep industry expertise and a powerful network, not just the highest valuation.

Matching Metrics to Funding Stages

Investor expectations evolve with each funding round. Arriving unprepared for these benchmarks is a common and fatal fundraising mistake. You must know the story your numbers need to tell at each stage to unlock the next level of capital.

Investor Expectations by Funding Stage

| Funding Stage | Typical ARR (Annual Recurring Revenue) | Key Metrics of Focus | Primary Use of Funds |

|---|---|---|---|

| Series A | $1M – $3M | Product-Market Fit, LTV:CAC > 3:1, Low Churn Rate | Building out sales and marketing teams, product development. |

| Series B | $5M – $20M | Predictable Revenue Growth, Market Share, Gross Margins | Aggressive market expansion, scaling operations, talent acquisition. |

| Series C+ | $20M+ | Profitability Path, Market Leadership, Operational Efficiency | Preparing for IPO, strategic acquisitions, global expansion. |

Think of this framework as your fundraising roadmap. By focusing on these core metrics, you not only attract the right investors but also build a fundamentally healthier and more sustainable business.

Think Beyond Borders for Faster Growth

In today's interconnected world, your startup is no longer confined by geography. Your next key hire, strategic partner, or major customer could be anywhere. The most successful founders understand that learning how to scale a startup requires a global-first mindset from the outset.

Tapping into different startup ecosystems can provide a significant competitive edge. Some regions offer deep talent pools at a lower cost, while others present untapped markets or unique access to capital. This isn't just about outsourcing; it's about strategically integrating international talent and opportunities into your company's DNA.

The global startup landscape is dynamic. According to recent findings from Startup Genome, Asia and Africa are surging in ecosystem development, while some parts of Europe are experiencing slower growth. These shifts are driven by investments in local infrastructure, founder-friendly policies, and talent cultivation. For founders, this creates new pockets of opportunity. To understand these trends, it is worth reviewing the latest report on the state of the global startup economy.

Actionable Steps for Global Integration

Building a global footprint doesn't require opening a dozen international offices overnight. Start with small, strategic moves to unlock global advantages without depleting your runway.

- Build a Distributed Team: Look to global talent hubs for specific skills. You could build your core engineering team in a region known for its technical universities, giving you access to world-class talent while managing your burn rate.

- Forge International Partnerships: Identify companies in other markets that serve a similar customer profile but are not direct competitors. A strategic partnership can accelerate entry into a new market and provide invaluable local intelligence.

- Test New Markets Systematically: Before committing to a full-scale international launch, test the waters. Use digital channels to gauge demand. A small, targeted ad campaign or a localized landing page can provide crucial data on market viability with minimal risk.

A global mindset forces you to build systems and processes that are inherently more scalable. When your team, customers, and partners are spread across time zones, you have no choice but to document everything, communicate with clarity, and empower local decision-making—all hallmarks of a well-run scale-up.

Thinking globally from day one hardwires your startup for a much larger future. It instills a level of operational discipline and cultural awareness that domestically-focused companies often learn too late.

Questions I Get All the Time About Scaling

When you're in the thick of scaling a startup, the questions come fast and furious. Even with a perfect plan on paper, the real world throws curveballs that need straight answers.

What’s the Biggest Mistake Founders Make When Scaling?

Hands down, the most common—and fatal—mistake is premature scaling. It’s an easy trap to fall into. You see a flicker of traction, get excited, and start pouring money into sales, marketing, and hiring before you’ve actually nailed product-market fit.

It's the leading killer of startups for a reason. You burn through your cash on a growth engine that isn't built on a sustainable, repeatable model. The focus, always, has to be on locking down that loyal user base first. They’re your foundation.

Another huge blunder I see is letting the company culture slip. When you're hiring quickly, that original vibe and set of values can get watered down in a hurry. As a founder, it’s your job to be the chief evangelist for your culture—define it, shout about it, and weave it into everything you do so it scales right alongside your headcount.

How Do You Keep Quality High as You Grow?

This is a big one. When you’re small, you can personally ensure everything is perfect. But that just doesn’t scale. To maintain quality during rapid growth, you have to shift from being a hands-on manager to an architect of systems.

Here’s what that looks like in practice:

- Document everything with SOPs: Get those key processes out of your head and onto paper (or a tool like Notion or Slab). This is how new hires can execute tasks consistently from day one.

- Lean on automation: Use technology to take over repetitive tasks. This isn't just about efficiency; it's about eliminating the potential for human error where it's most likely to occur.

- Get obsessed with quality metrics: Define what "quality" actually means with clear KPIs. Track them relentlessly so you can catch small dips before they snowball into massive problems.

A founder’s role has to evolve. You go from being the primary "doer" to the architect of the systems that empower others to do their best work. Without scalable systems, quality is always the first thing to break under pressure.

At Spotlight on Startups, we deliver the insights and frameworks you need to navigate every stage of your entrepreneurial journey. From securing funding for early-stage companies to building resilient teams, our content in categories like Best Practices and Funding provides a blueprint for sustainable success. Explore our resources to move forward with confidence at https://spotlightonstartups.com/.