A solid pricing strategy is so much more than picking a number. For startup founders, it’s a direct reflection of your company’s mission and where you stand in the market. The price you set sends an immediate, powerful signal about your product’s value, its quality, and the specific problem you’re solving for customers. Before we dive into models and metrics, you must anchor your price to what you’re trying to achieve as a business.

Aligning Your Price with Your Business Vision

Before you even think about numbers, your pricing has to be tied directly to your core business goals. For founders, the price you set is a critical communication tool. It tells investors, competitors, and especially your customers exactly where you see your product fitting into the market.

This first step has nothing to do with profit margins or cost calculations. It’s all about clarity of purpose. What’s the main objective for your startup right now? Are you trying to steal market share from established players as fast as possible? Is the goal to maximize early-stage profitability to fund future growth? Or are you aiming to build a premium brand from day one, signaling top-tier quality and innovation?

Defining Your Core Pricing Objective

Every startup’s journey is different, which means every founder has different strategic priorities. Your pricing has to support whatever is most important to your business at this moment.

- Market Share Domination: If your goal is to get as many users as you can, as quickly as you can, you’ll need an aggressive price. We see this all the time in SaaS and consumer tech. The focus is on scaling a startup through user growth over immediate revenue, hoping to build a moat of customers that competitors can’t cross.

- Profitability and Sustainability: For bootstrapped startups or companies in a niche market, making a profit from the get-go is often a matter of survival. This means setting a price that ensures a healthy margin on every single sale, funding your own growth.

- Premium Brand Positioning: If your product has unique features, superior quality, or solves a problem in a completely new way, a premium price reinforces that value. This strategy is all about targeting customers who care more about getting the best possible outcome and are less sensitive to price.

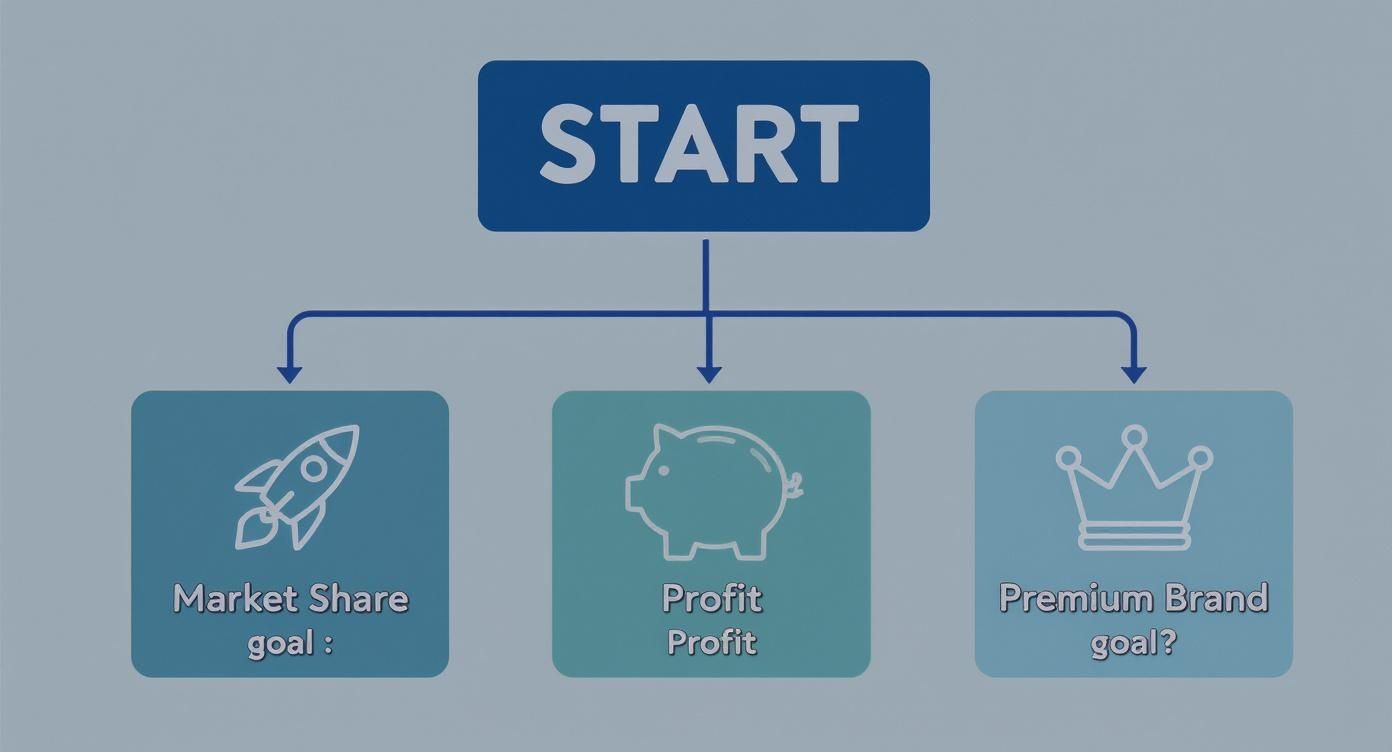

This decision tree helps visualize how your main business goal points your pricing strategy in a specific direction, whether that’s aggressive market capture or premium positioning.

As the flowchart shows, without a clear objective—be it growth, profit, or brand prestige—any pricing model you choose is just a shot in the dark. It won’t have any real strategic purpose.

Connecting Price to Your Unique Value Proposition

Once you know your primary business goal, you need to connect it to your Unique Value Proposition (UVP). Your UVP is the promise you make to your customers. It’s that clear, simple statement explaining the real benefit they get, how you solve their problem, and what makes you different from everyone else.

Your price has to tell the same story as your UVP. If you claim to offer a game-changing, time-saving tool for enterprise teams but slap a bargain-bin price on it, you create a disconnect. Potential customers will start to question if your claims are even true.

Think about it this way: a cybersecurity startup with a patented threat detection algorithm can’t price its service like a generic antivirus software. The price has to reflect the unique, high-stakes value it provides.

By getting these foundational pieces right from the start, you create a strategic filter for every pricing decision you make down the line. This ensures your price isn’t just some arbitrary number, but a core part of your growth story that’s perfectly aligned with your mission and the value you deliver.

Choosing the Right Pricing Model for Your Launch

Alright, you’ve locked in your business goals. Now comes the moment of truth: putting a price on your product. This isn’t just about picking a number; it’s one of the most strategic decisions a founder will make. Your pricing model sends a powerful signal to the market, shapes how customers see your brand, and ultimately determines whether your startup gets off the ground or stalls on the runway.

Picking the right model can feel like rocket fuel for your growth. The wrong one? It’s like trying to drive with the emergency brake on. Let’s dig into the four core models every founder needs to have in their toolkit, not just in theory, but with a look at how they play out in the real world.

Value-Based Pricing

At its core, value-based pricing is about anchoring your price to what your product is worth to the customer, not what it costs you to make. It’s the ultimate “it’s not about you, it’s about them” strategy. To pull this off, you absolutely have to know your customer’s world inside and out—their biggest headaches and the tangible ROI you deliver.

Let’s consider a B2B SaaS tool for sales teams. You could price it based on the average revenue lift it creates or the sheer number of hours it saves per employee. If your software saves a company $20,000 a month by automating manual reporting, charging them $2,000 a month feels like an absolute steal.

My biggest piece of advice for founders considering this model: get out and talk to your customers. Constantly. You can’t just guess what they value; you have to get them to tell you, then validate it.

This model is a home run for startups with a truly unique product that delivers clear, measurable results. The catch? It demands a ton of upfront market research to nail down that value and even better messaging to communicate it.

Cost-Plus Pricing

This is pricing in its most straightforward form. You simply calculate all your costs—materials, labor, overhead, you name it—and add a fixed percentage on top for profit. It’s simple, it’s predictable, and it ensures you’re never losing money on a sale.

You see this a lot with e-commerce brands. If an artisan’s materials, labor, and shipping for a handmade bag add up to $50, and they want a 40% margin, the price tag becomes $70. Easy.

The problem? It’s entirely inward-looking. It pays zero attention to what the market will bear, what competitors are charging, or, most critically, what a customer is actually willing to pay. You risk leaving money on the table for a high-value product or pricing yourself out of the market entirely.

Penetration Pricing

With penetration pricing, you launch with a deliberately low, almost irresistible price. The goal isn’t immediate profit; it’s to grab as much market share as you can, as quickly as possible. Once you have a solid user base, the plan is to gradually increase prices or upsell customers to more profitable tiers.

This is a classic move for new apps or services trying to break into a crowded space. A new music streaming service might launch with a $2.99/month offer to peel users away from the established giants.

But be warned, this strategy has two major tripwires. First, you risk attracting bargain-hunters who will churn the second your price goes up. Second, you can accidentally anchor your product’s perceived value at a very low point, making it a tough uphill battle to justify a higher price tag later.

Price Skimming

The polar opposite of penetration, price skimming involves launching with a premium price to cash in on the excitement of early adopters. These are the customers who are willing to pay more to be the first to have something new and innovative. As that initial hype cools and competitors start to show up, you gradually lower the price to appeal to a broader, more price-sensitive audience.

Consumer electronics is the textbook example. A company launching a groundbreaking drone might set the initial price at $1,500 for the tech enthusiasts. Six months later, it drops to $1,200 to pull in the mainstream crowd. Research from Harvard Business Review shows that, when done right, this approach can boost profitability by as much as 25% over a single-price strategy.

Comparison of Core Pricing Models

To help you decide, here’s a quick-glance table breaking down these four models. Think about your product, your market, and your long-term goals to see which one feels like the right fit.

| Model | Best For | Primary Pro | Primary Con |

|---|---|---|---|

| Value-Based | Innovative B2B SaaS, products with clear ROI | Maximizes revenue by capturing customer value | Requires deep customer research and strong messaging |

| Cost-Plus | Physical goods, traditional manufacturing | Simple to calculate and ensures profitability | Ignores market conditions and customer perception |

| Penetration | New entrants in competitive, mass markets | Quickly acquires market share and user base | Attracts low-LTV customers; can devalue the product |

| Price Skimming | Highly innovative products, strong brand cachet | Maximizes revenue from early adopters | May alienate price-sensitive customers early on |

Each of these models offers a distinct path forward. The key is aligning your choice with your product’s unique strengths and your vision for the company. For more perspectives, you can find other great articles on building a winning pricing strategy.

Putting Your Price to the Test with Market Research

Let’s be blunt: a pricing strategy without data is just a shot in the dark. You can have the most elegant pricing model on a spreadsheet, but until you test it against the real world, it’s pure guesswork. This is the moment you move from theory to a number that can actually make or break your launch.

It’s all about gathering hard evidence on what your customers will actually pay, not just what you think your product is worth. The goal isn’t just to land on a number but to truly grasp the why behind it—how your audience perceives value and how sensitive they are to different price points.

Uncovering What Customers Are Willing to Pay

So, how do you find a price range backed by actual data? You have to get out there and talk to your target market. Even for scrappy, early-stage startups, a couple of proven methods can give you surprisingly accurate insights: the Van Westendorp Price Sensitivity Meter and conjoint analysis.

They might sound intimidating, but they’re founder-friendly at their core.

- Van Westendorp Price Sensitivity Meter: This is a fancy name for a simple four-question survey. Instead of asking “What would you pay?”, you ask customers to identify prices that feel:

- “Too cheap” (making them question the quality)

- A “bargain”

- “Starting to get expensive”

- “Too expensive” (an immediate ‘no’)

Where the answers to these questions intersect on a graph, you’ll find a surprisingly clear optimal price point and an acceptable range.

- Conjoint Analysis: This is your go-to if your product has multiple features or tiers. You present potential customers with different bundles (e.g., Feature A + B for $20/mo vs. Feature A + C for $25/mo) and ask them to pick one. Their choices quickly reveal which features they truly value and how much extra they’re willing to pay for them. It’s perfect for designing and pricing your different plans.

The big takeaway here is to stop asking, “What would you pay for this?” That question almost always gets you a lowball answer. Instead, frame your research around understanding perceived value and the trade-offs your customers are willing to make.

Sizing Up the Competition

Knowing what your competitors charge is critical, but not so you can just copy them. The real goal is to map out the value benchmarks in your industry and then strategically position your product. Don’t just look at direct competitors; check out indirect ones, too, to see how the market prices any solution to the problem you’re solving.

This analysis should help you answer a few key questions:

- Where does our product fit in? Are we offering more features, a better experience, or a highly specialized solution?

- How are competitors structuring their tiers? What are the key differentiators that justify their higher-priced plans?

- Is there a gap in the market? Could we serve a segment that would happily pay more for a premium offering or less for a stripped-down version?

Digging into consumer behavior shows that companies that segment their markets can price new products much more effectively. In fact, nearly 60% of businesses running structured pricing experiments with specific customer groups see major improvements in both conversion and retention. That’s a massive edge, especially since over 80% of consumers now actively shop around and compare prices. You can find some great insights on this from Coursera’s pricing strategy resources.

Ultimately, you can’t skip this research. It gives you the data-backed confidence to set a price that reflects customer value, fuels your business goals, and sets your startup up for success. For more specific guidance on this process, check out our other resources on market research for startups.

Testing Your Pricing Strategy in the Real World

Your market research gets you into the ballpark, but running real-world experiments is how you find home plate. After all the data analysis and model selection, it’s time to stop theorizing in spreadsheets and start observing actual customer behavior. This is where you design and run low-risk pricing tests to see if your assumptions hold up before you go all-in on a full launch.

Launching with an untested price is one of the biggest gambles a startup can make. The feedback you get from a small, controlled experiment is worth its weight in gold, allowing you to make data-driven tweaks that can make or break your success. It’s about moving from “I think” to “I know.”

Designing Your Low-Risk Pricing Experiments

The goal here isn’t to nail the “perfect” price right out of the gate. It’s to gather hard data on how real people react to what you’re asking them to pay. For early-stage companies, a few practical methods work exceptionally well for testing the waters without taking a huge risk.

A/B Testing on Landing Pages

This is a classic for a reason—it’s a straightforward and powerful way to test different price points. You simply create two or more versions of your pricing page, each with a different price or tier structure, and then split your website traffic between them. The version that gets more sign-ups or “Buy Now” clicks is your winner.

For example, a new SaaS startup could test a $29/month plan against a $39/month plan to see which one converts better. You can even do this before the product is fully built, which gives you incredible pre-launch data for forecasting revenue.

Paid Pilot Programs

Instead of a big, splashy launch, why not offer your product to a small, hand-picked group of early adopters as a paid pilot? This accomplishes two crucial things at once: it confirms that people are actually willing to open their wallets for your solution, and it creates a direct feedback loop with highly engaged users.

A local health-tech company, for instance, might offer its new platform to a few clinics at a discounted beta price. The feedback they’ll get on features, perceived value, and the price itself is exactly what they need to fine-tune the public offering.

The ‘Land-and-Expand’ Model

For B2B startups, the land-and-expand approach is a fantastic way to test pricing within a larger organization. You start small, selling a limited version of your product to a single department or team at a lower, more accessible price. Once you’ve proven its value and created internal champions, you have a much stronger case for expanding the contract across the entire company at a higher price.

This tactic de-risks the purchase for your client while giving you priceless insight into the ROI your product delivers—insight you can use to justify your pricing to every future customer.

Key Metrics to Track for Data-Driven Decisions

Running tests is only half the job. You have to measure the right things to make any sense of the results. By focusing on a few core metrics, you’ll get a clear, unbiased picture of how your pricing is performing.

- Conversion Rate: This is your most direct signal. What percentage of visitors who see your price actually sign up or purchase? A low conversion rate is often a clear sign that your price is too high or the value isn’t being communicated effectively.

- Customer Acquisition Cost (CAC): How much does it cost you to get each new paying customer? A lower price point might convert better, but if it sends your CAC skyrocketing, you’ve got an unsustainable business model on your hands.

- Lifetime Value (LTV): This metric forecasts the total revenue you can expect from a single customer over their entire relationship with your company. A solid pricing strategy ensures your LTV is substantially higher than your CAC—a healthy LTV:CAC ratio is generally considered to be 3:1 or better.

Tracking these metrics transforms pricing from a one-time decision into an ongoing optimization process. Your first price is never your last price; it’s just the starting point for a continuous cycle of testing, learning, and iterating.

By running these real-world experiments, you build a foundation of confidence that your pricing is grounded in reality, not just wishful thinking. You’ll have the data to back up your decisions, whether you’re talking to your team, your board, or investors. This hands-on testing is the final, and most critical, step before you officially go to market.

Rolling Out Your Price and Telling the Value Story

You’ve nailed down the model and tested it in the wild. Now for the moment of truth: telling the world what your product costs. How you introduce your price is every bit as important as the number itself. A smart, confident launch builds immediate trust and gets the market buzzing. A clumsy one, on the other hand, creates confusion and friction that can kill your momentum before you even get started.

The trick is to connect the dots for your customers. You need to translate your product’s features into real, tangible benefits and then tie those benefits directly to the price tag. Your website, sales scripts, and investor deck all have to sing the same tune—a clear, compelling story about value. Don’t just list what your product does; show how it solves a massive headache or unlocks a huge opportunity for your customer. That’s what makes the price feel like a no-brainer.

Building a Value Narrative That Clicks

Your pricing page is where the rubber meets the road. It’s often the first place a potential buyer seriously considers if your product is worth their money. It needs to be a masterclass in clarity, guiding them to the right option without causing a migraine.

Cut the jargon. Focus on outcomes. Instead of boasting about “AI-powered analytics,” show them the money: “Uncover insights that slash your marketing spend by 20%.”

This is also your chance to speak directly to different types of customers. Well-designed pricing tiers should feel like a natural journey, with each step offering an obvious increase in value.

- Name your tiers wisely. Use descriptive names that resonate with the user, like “Solo,” “Team,” or “Business.” It helps them self-identify.

- Guide their choice. A simple “Most Popular” or “Best Value” tag can do wonders for decision-making. It’s a gentle nudge in the right direction.

- Frame it as an investment. For B2B products, always bring the conversation back to ROI. Are you saving them time? Making them more money? Reducing their risk? That’s the real value.

A classic founder mistake is getting too clever with pricing tiers. If they’re too complicated or the differences are too subtle, people just give up. When in doubt, keep it simple. Simplicity sells.

Thinking through these details is a huge part of a successful rollout. For a deeper dive, check out our guides on building a powerful go-to-market strategy.

Taking Your Story from the Web to the Pitch Deck

This value story can’t just live on your website. Your sales team needs to be armed with simple, powerful messaging for their calls and demos. Give them clear battle cards showing how your value and pricing obliterate the competition. This empowers them to handle objections with confidence, always bringing the conversation back to the value delivered, not just the price.

This narrative is also absolutely critical when you’re preparing for fundraising. Investors aren’t just looking at a price; they’re analyzing a strategy for profitability and scale. Your pitch deck needs to lay out the math behind your model, including your Customer Acquisition Cost (CAC) and Lifetime Value (LTV) projections. This proves you’ve done the hard work and have a data-backed plan to win.

In fact, companies that use pricing analytics—drawing on historical sales data, promotional results, and competitor pricing—report revenue bumps between 5% and 15%. With over 80% of shoppers comparing prices online, having data on your side isn’t just an advantage; it’s essential. You can learn more about leveraging historical data from DataWeave.

A Soft Landing for Early Adopters

Finally, don’t forget your first believers—the beta testers and pilot customers who got in on the ground floor, likely at a steep discount. A successful launch means managing their transition carefully.

Be upfront and transparent about when and how their pricing will change. A great move is to offer them a special “early bird” rate for a limited time. It shows you appreciate their early support and helps move them to a standard plan without making them feel penalized for their loyalty. A smooth launch isn’t just about new customers; it’s about setting the stage for lasting relationships and sustainable growth.

Answering the Tough Questions on New Product Pricing

No matter how solid your pricing framework is, you’re going to run into some tough, real-world questions. Founders, especially those in competitive markets, often face the same handful of challenges that can make or break a launch. Let’s tackle the most common ones with some straight, actionable advice to help you move forward with confidence.

How Should I Handle Discounts for Early Customers?

Tempting, isn’t it? Slashing prices to get those first few users in the door feels like a quick win. And it can be, but it’s also a classic trap. Offering discounts without a clear strategy can permanently anchor your product’s value in the bargain bin, making it incredibly difficult to charge your intended price later.

If you’re going to offer a discount, you need to frame it strategically. It’s not a sale; it’s a specific, time-bound offer with a purpose.

- Create urgency and scarcity: Call it a “Founder’s Rate” or “Early Adopter” price. Limit it to the first 100 customers or a specific timeframe, like the first 30 days post-launch. This gets people to act now without devaluing the product forever.

- Make it a trade: Position the discount as a two-way street. You’re giving them a special price, and in return, you’re asking for something valuable: detailed feedback, a testimonial, or participation in a future case study.

Never give a discount just to close a deal. It should always be a tool to achieve a specific goal, whether that’s getting crucial early feedback, landing a logo for your website, or generating buzz.

This approach turns your first customers into genuine partners. They feel valued for taking a chance on you, and you get the social proof and insights needed to grow, all while protecting your long-term pricing power.

When Is the Right Time to Raise My Prices?

The thought of raising prices makes most founders sweat. You start worrying about angry emails from loyal customers or seeing prospects flock to a cheaper competitor. But here’s the thing: if you never increase your price, you’re telling the market your product isn’t getting any better. You’re also leaving a ton of money on the table.

The right time to raise prices is when you can confidently point to a jump in the value you deliver.

Keep an eye out for these clear signals:

- You’ve Shipped Major Value: Have you rolled out game-changing features, significantly boosted performance, or added integrations your customers were begging for? When your product does more, it’s worth more. Simple as that.

- You Can Prove the ROI: Your customers are winning because of you, and they’re telling you about it. Once you have a collection of case studies and testimonials that prove your product’s financial impact, you have all the justification you need.

- Your Market Position Has Changed: Maybe you priced low initially just to get a foot in the door. Now, your brand has a solid reputation, and you’re seen as a serious player. Your price needs to catch up to your new status.

When you pull the trigger, communication is everything. Consider grandfathering existing customers at their current rate for a while—it’s a great way to reward their loyalty. For new customers, give them a heads-up. And always, always frame the conversation around the new, incredible value they’re getting, not just the new price.

What if My Competitors Are Much Cheaper?

Seeing a competitor slash their prices can send you into a panic. The gut reaction is to jump into the fray and start a price war. Don’t do it. That’s a race to the bottom, and unless you’re sitting on a mountain of cash, you won’t win.

Instead of matching their price, make the price irrelevant.

This is where your Unique Value Proposition (UVP) isn’t just marketing fluff—it’s your best defense. You need to shift the conversation from price to value.

Double down on what makes you the obvious choice for the right customer:

- A Superior Solution: Is your product more powerful, more reliable, or just flat-out better at solving the core problem? Show it.

- World-Class Support: Can customers get a real, knowledgeable human on the phone when they need help? That’s a huge differentiator.

- A Stronger Brand and Community: Have you built a reputation for trust and expertise? Customers will pay a premium to align with a brand they believe in.

Refuse to compete on their terms. By confidently articulating why you’re worth more, you’ll attract customers who see the bigger picture and are looking for the best solution, not just the cheapest one. This is the cornerstone of a pricing strategy for new products built to last.

At Spotlight on Startups, we provide the frameworks and insights you need to build a resilient and scalable business. Explore our platform for more deep dives into founder excellence, funding strategies, and best business practices.

Find out more at https://spotlightonstartups.com/.