Series A investors are typically the first institutional venture capitalists to fund a startup's growth. They provide significant capital not for an idea, but for a business that has demonstrated product-market fit and is ready to scale aggressively. This round marks a critical transition from proving a concept to building a dominant market presence.

From Proven Engine to Winning the Race

Think of your startup's journey in stages. The seed stage was about building an engine and proving it runs. The Series A round is about securing the fuel, the professional pit crew, and a prime position on the racetrack to win. This is the shift from survival to strategic, rapid expansion.

Series A investors are more than just a source of capital; they are strategic partners expecting a clear, data-backed path to substantial returns. Their evaluation is rigorous and evidence-based. They need proof that you have moved beyond a promising concept to a predictable, repeatable model for acquiring customers and generating revenue. This requires a deep understanding of your unit economics, an efficient customer acquisition strategy, and a leadership team with both resilience and a compelling vision. For a deeper look, our guide on what venture capitalists look for beyond the pitch deck offers crucial insights.

Core Investor Priorities

While every venture capital firm has its unique thesis, the core criteria for Series A funding are remarkably consistent. Investors are searching for tangible proof points that de-risk their investment and signal high-growth potential.

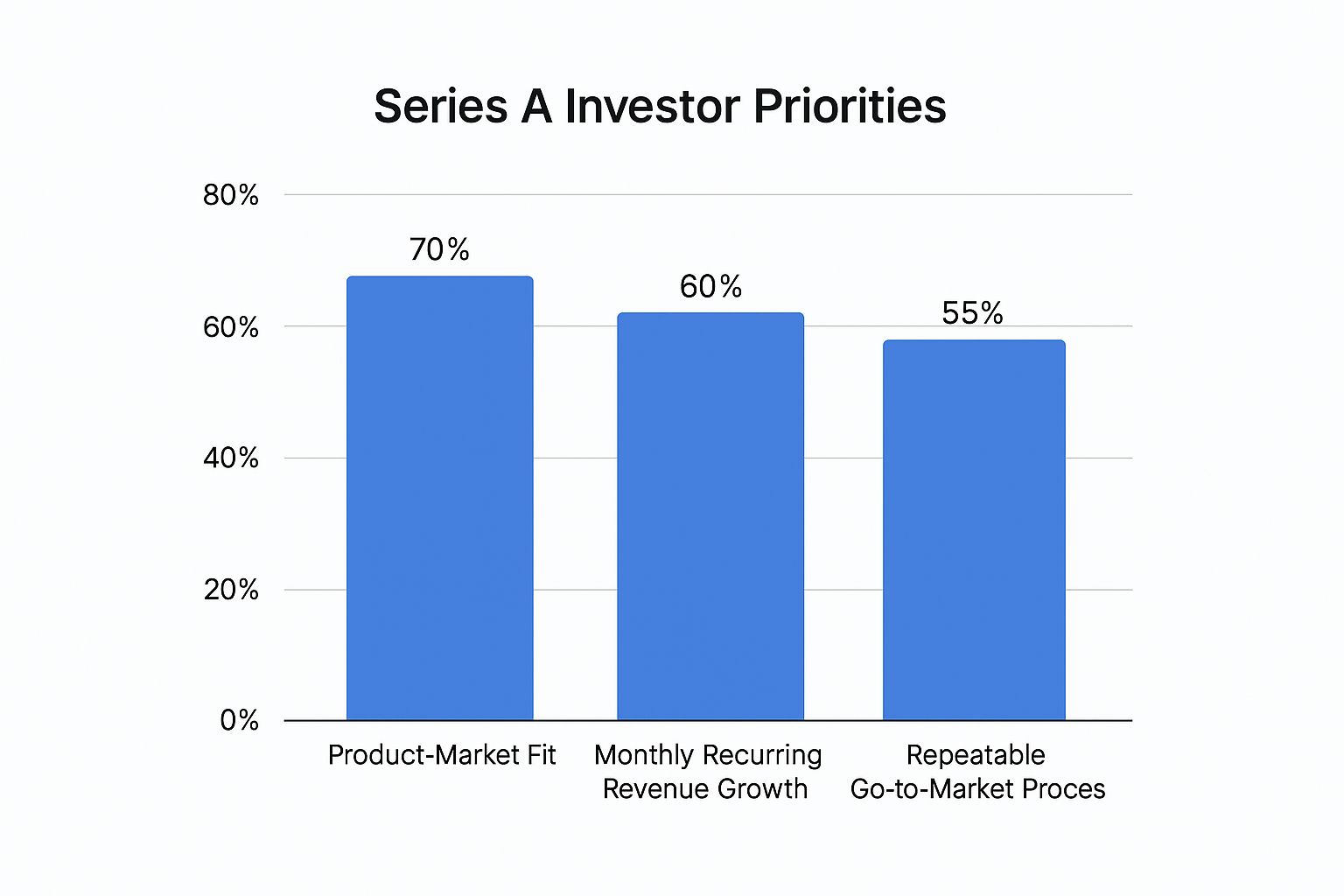

The infographic below outlines the top priorities for most VCs evaluating a Series A opportunity.

As the data illustrates, strong product-market fit is the non-negotiable foundation. However, it must be accompanied by demonstrable revenue growth and a scalable go-to-market strategy. This combination signals to an investor that you have not just a great product, but a viable business ready for significant investment.

The financial stakes at this stage are high. According to Investopedia, the median Series A funding round for U.S. startups typically ranges from $15 to $20 million, underscoring the heightened expectations for companies prepared to accelerate their growth.

The Metrics That Matter Most to Series A Investors

In a Series A meeting, the conversation elevates from vision to validation. While the passion that secured seed funding remains important, the spotlight shifts decisively to performance metrics. VCs are no longer just investing in potential; they are investing in a proven, predictable growth engine. To secure their commitment, you must present the data that proves your startup is a machine ready to scale.

These metrics function as the vital signs of your company. Just as a high fever alerts a doctor to an underlying issue, weak unit economics or slowing revenue growth will trigger immediate alarms for an investor, signaling potential flaws in the business model. Your pitch must be built on a foundation of undeniable evidence.

Demonstrable and Growing Traction

Traction is the clearest signal of product-market fit. This isn’t about vanity metrics like user sign-ups; it's about a growing base of paying customers who validate your solution.

- Monthly Recurring Revenue (MRR): For SaaS and subscription businesses, this is the heartbeat of the company. Investors look for consistent MRR growth, often in the range of 15-20% month-over-month, leading up to the fundraise.

- Customer Acquisition Cost (CAC): This metric quantifies the cost to acquire a new customer. A low and stable CAC demonstrates an efficient, repeatable method for expanding your customer base without excessive cash burn.

- Lifetime Value (LTV): LTV represents the total revenue you can expect from a single customer over their entire relationship with your company. VCs typically look for an LTV that is at least 3x your CAC, proving that your customer acquisition strategy is not just effective but profitable.

A common founder mistake is focusing solely on top-line revenue. Series A investors dissect this number. They analyze the quality of that revenue: is it recurring? Is it profitable? Does it come from a healthy mix of new business and existing customer expansion?

A Massive and Defensible Market

Venture capitalists are in the business of funding outliers—companies with the potential to become market leaders. This requires a business that can operate in a massive market, not just a niche segment.

Simply presenting a large Total Addressable Market (TAM) figure is insufficient. You must articulate a credible strategy for capturing a significant share of that market. Your narrative is strengthened by demonstrating that the market itself is expanding. Crucially, you must also define your "moat"—a unique, defensible advantage that protects you from competition. This could be proprietary technology, a strong brand, or powerful network effects that strengthen with each new user.

A Scalable and Predictable Business Model

A scalable business model is one where revenues can grow exponentially without a corresponding increase in costs. This is where your unit economics must be flawless.

Investors will scrutinize your gross margins to understand the core profitability of your product or service. They will also analyze your sales and marketing funnel to verify that your growth is repeatable. Can you prove, with data, that every $1 invested in customer acquisition reliably generates $3 or more in lifetime value? If you can answer that question with confidence, backed by a detailed financial model, you are speaking the language of a Series A investor. You are presenting a financial plan for a high-performance engine ready for its next growth phase.

Key Evaluation Metrics for Series A Investors

| Category | Key Metrics & Indicators | What It Signals to Investors |

|---|---|---|

| Product-Market Fit | Monthly Recurring Revenue (MRR) Growth, Net Revenue Retention (NRR), Customer Churn Rate | Proof that a real market need is being met and that customers find ongoing value in the solution. |

| Go-to-Market Efficiency | Customer Acquisition Cost (CAC), LTV:CAC Ratio, Sales Cycle Length | A repeatable and profitable process for acquiring new customers, indicating the business model is ready for scaling. |

| Financial Health | Gross Margins, Burn Rate, Cash Runway | The fundamental profitability of the core business and the operational efficiency of the company. |

| Market Opportunity | Total Addressable Market (TAM), Market Growth Rate, Competitive Landscape | The potential size of the prize and the startup's ability to carve out a significant, defensible position within it. |

| Team & Execution | Founder Experience, Key Hires, Ability to Hit Milestones | The team's capability to execute on the vision and navigate the challenges of rapid growth. |

Mastering these metrics does more than prepare you for a pitch; it compels you to build a fundamentally stronger, more disciplined business.

How to Prepare Your Startup for Fundraising

Successfully closing a Series A round is the result of a disciplined, methodical fundraising campaign. Series A investors expect every claim to be substantiated by meticulous documentation. This rigorous preparation separates interesting startups from investable ones. The process begins with a comprehensive data room.

Building Your Data Room

A data room is not merely a folder of documents; it is a strategic tool that preempts the due diligence process. A well-organized data room anticipates investor questions and provides clear, concise answers, signaling operational excellence.

It must be a fortress of clarity, impeccably organized to communicate that you run a detail-oriented operation. Key contents include:

- Financials: At least three years of financial projections, detailed profit and loss (P&L) statements, a clean capitalization (cap) table, and cohort analyses demonstrating customer retention.

- Legal Documents: Corporate incorporation documents, intellectual property (IP) filings, key employee and customer contracts.

- Team Information: Detailed biographies for the founding team and key executives, highlighting experience relevant to executing the company's vision.

- Product & Market: The product roadmap, a comprehensive competitive analysis, and market research validating the size of the opportunity.

Fundraising is storytelling with evidence. Your pitch deck tells the story, but your data room provides the irrefutable proof. A weak data room can kill a strong narrative.

Crafting a Compelling Narrative

While the data room is your vault of evidence, your pitch deck is the narrative vehicle. It must tell a compelling story about a significant market problem, your unique solution, and the exceptional team poised to execute.

A powerful deck articulates a vision so clearly that an investor can see the path to a billion-dollar valuation. This story should be interwoven with the key metrics you've been tracking, transforming data into a narrative of inevitable growth. Showcasing a deep, obsessive understanding of your market is critical. A great pitch guides the investor logically from the problem to the prize. For more guidance, our article offers key frameworks on how to write a winning startup business plan investors actually read.

The Art of the Relationship

Many founders overlook the importance of relationship building. The ideal time to connect with a VC is six to twelve months before you need their capital. This transforms your first pitch from a cold ask into a warm follow-up conversation.

Use this lead time to build genuine connections. Seek advice and provide periodic, concise progress updates. This strategy allows investors to track your execution over time, building trust and credibility long before you ask for a check. Always leverage your network for warm introductions, as they dramatically increase the probability of securing a meeting. In venture capital, a trusted referral is invaluable.

Navigating Today's Investment Landscape

The venture capital ecosystem is dynamic, influenced by economic cycles, technological innovation, and global events. To secure funding, founders must understand the current landscape. What Series A investors prioritized two years ago may not be their focus today. Pitching with an outdated playbook is a surefire way to fail.

The "growth at all costs" era has subsided, replaced by a sharp focus on capital efficiency and a clear path to profitability. Investors are now scrutinizing burn rates and unit economics, seeking founders who can demonstrate sustainable growth, not just rapid expansion fueled by excessive spending.

The Profitability Paradigm Shift

While revenue growth remains important, the quality of that revenue is now under the microscope. VCs want to see that you can scale the company without a commensurate explosion in expenses. A high burn rate is no longer a badge of honor; it is a red flag signaling potential operational inefficiencies.

Today’s Series A investors are backing businesses, not just exciting projects. They need to see a founder who is as obsessed with gross margins and operational discipline as they are with product innovation and market disruption. This focus on fundamentals is a key indicator of a startup's long-term viability.

This emphasis on financial health should inform your pitch deck and financial models. Founders who can clearly articulate a credible plan to achieve profitability will have a significant advantage. For a deeper look into these dynamics, explore the top investor trends driving startup valuations in 2025.

Hot Sectors Capturing Investor Attention

While strong fundamentals are essential across the board, certain sectors are currently attracting significant investor interest. If your startup operates in one of these high-growth areas and your metrics are solid, you are more likely to secure investor meetings.

Key areas of focus include:

- Artificial Intelligence: VCs are particularly interested in AI applications that solve specific, high-value problems in industries like healthcare, finance, and logistics.

- Climate Tech: With the global focus on sustainability, innovations in renewable energy, carbon capture, and sustainable materials are attracting major investment.

- Cybersecurity: As digital threats become more sophisticated, companies providing advanced protection for data and critical infrastructure remain a top priority for VCs.

Despite a market tightening after 2022, confidence is returning. A recent S&P Global Market Intelligence report on H1 2025 venture capital funding showed global venture funding reached $189.93 billion in the first half of 2025, a 25% increase over the same period in 2024. This indicates that early-stage funding is rebounding. The takeaway is clear: the bar is higher, but capital is available for exceptional companies.

Common Mistakes That Will Derail Your Pitch

Understanding common pitfalls is as crucial as mastering best practices. When pursuing Series A investors, success often hinges on avoiding unforced errors. These mistakes can signal a lack of preparation or strategic thinking, undermining your credibility before the conversation truly begins.

Pitching Without Proof of Traction

The most frequent mistake is pitching prematurely. Series A is not the stage for speculative projections; it is about presenting hard evidence of a growth story that is already unfolding. A pitch without this proof is not an investment opportunity; it is a premature conversation.

Consider a SaaS founder with an innovative product but only a handful of trial users and inconsistent revenue. A Series A investor will view this as a seed-stage company and provide direct feedback: "Return when you have more traction."

The fundamental difference between Seed and Series A is the transition from proving your product works to proving your business model works. Pitching without clear evidence of the latter is a recipe for rejection.

To avoid this trap, be ruthlessly honest about your startup's stage. Do not begin your fundraising roadshow until you have several consecutive months of strong, predictable growth in key metrics like MRR, user engagement, and a healthy LTV:CAC ratio. Your goal is to present an undeniable case that you have built a well-oiled machine, not just a promising prototype.

Presenting a Vague Use of Funds

Another critical error is ambiguity regarding how the investment will be deployed. Vague statements like "we'll use the capital for growth" or "investing in marketing" are major red flags. They indicate a lack of a detailed operational plan for scaling the business.

Series A investors provide capital to execute a specific, well-defined plan. You must present a clear, milestone-based strategy that shows exactly how their investment translates into tangible results.

A strong "use of funds" slide should include precise details:

- Hiring Plan: Specify key roles to be filled (e.g., "hire a VP of Sales and three enterprise account executives in Q3").

- Marketing & Sales Budget: Detail spend by channel (e.g., "$500k for performance marketing to scale our top three acquisition channels").

- Product Development: Outline specific features or initiatives on your roadmap that this funding will unlock.

This level of detail demonstrates that you are a disciplined operator who thinks strategically about capital allocation, significantly boosting investor confidence.

Answering Your Top Fundraising Questions

As you move from strategy to execution, practical questions will arise. Having clear answers will enable you to navigate conversations with investors and negotiate from a position of strength. Here are some of the most common questions founders face during a Series A raise.

How Much Equity Should I Expect to Give Up in a Series A Round?

Founders should typically expect to sell between 20% and 30% of their company in a Series A round. This range strikes a crucial balance: it is sufficient to raise the capital needed for an 18 to 24-month growth plan while ensuring that founders and the early team retain a meaningful stake.

This percentage is negotiable and influenced by several factors:

- Company Valuation: A higher valuation allows you to raise the required capital for a smaller equity stake.

- Amount Raised: Larger funding amounts naturally correspond to larger equity percentages.

- Market Conditions: In a founder-friendly "hot" market, valuations are higher and dilution may be lower. In a more conservative market, investors have more leverage.

What Is the Typical Timeline for a Series A Fundraising Process?

Raising a Series A round is a marathon, not a sprint. Founders should allocate three to six months for the entire process. This endeavor typically becomes the CEO's primary focus.

A typical timeline can be broken down as follows:

- Preparation (1–2 Months): Finalize the pitch deck, build a comprehensive data room, and validate financial models.

- Investor Outreach & Meetings (1–2 Months): Secure warm introductions, conduct initial meetings, and manage follow-up conversations.

- Term Sheet & Due Diligence (1–2 Months): After receiving a term sheet, undergo an intensive legal and financial review before the final closing.

What Are the Key Differences Between Seed and Series A Investors?

The primary distinction lies in the basis of their investment decision. Seed investors primarily bet on the founding team and the promise of an idea, often before significant traction exists. Their capital is intended to help the startup achieve product-market fit.

Series A investors, in contrast, bet on a proven business model and its potential to scale rapidly. They require evidence that product-market fit has already been achieved and that a repeatable engine for customer acquisition and revenue growth is in place.

This fundamental difference leads to a much more rigorous due diligence process at the Series A stage. While a seed investor may be swayed by vision and early signals, a Series A investor needs that vision to be validated by robust metrics and a predictable growth trajectory. They are investing in a scaling machine, not a science experiment.

At Spotlight on Startups, we provide the clarity and actionable knowledge founders need to navigate every stage of their journey, from validating an idea to closing a critical funding round. Learn more about how we equip entrepreneurs for success.