The “Gold Rush” era of artificial intelligence is over. In its place, a more disciplined, high-stakes market has emerged. While 2023 and 2024 were defined by massive private funding rounds and speculative hype, 2025 has become the year of the “Show Me the Money” IPO. Investors no longer care about how many parameters your model has; they care about your EBITDA, your compute efficiency, and your proprietary data moat.

For founders looking at the tech ecosystem in Orange County and beyond, the public debuts of 2025 provided a masterclass in building a public-ready powerhouse. As we pivot to our Top AI IPOs 2026 Outlook, the blueprint for success is moving from “General AI” to “Vertical Sovereignty.”

Analyzing the Best AI IPOs of 2025: The Foundation of 2026

Before we look at the 2026 forecast, we must understand the titans that successfully cleared the 2025 hurdle. These companies didn’t just survive the market volatility; they defined the valuation multiples we will see in the coming year.

1. CoreWeave (NASDAQ: CRWV) – The Infrastructure King

The Story: Originally a crypto-mining operation, CoreWeave pivoted to AI infrastructure at exactly the right moment. By the time they went public in March 2025, they had become the world’s most significant “GPU-as-a-Service” provider.

- The Revenue Backlog: At the time of their Q3 2025 report, CoreWeave boasted a staggering $55.6 billion revenue backlog. This gave public investors something rare in AI: predictable, long-term contracted growth.

- The 2026 Outlook: CoreWeave’s success signals that 2026 will be dominated by Specialized Cloud providers. While the stock saw volatility in late 2025 due to massive CapEx requirements, its high utilization rates (near 100% across 41 data centers) prove that the appetite for compute is decoupling from general cloud growth.

2. Chime Financial (NASDAQ: CHYM) – The AI-Led Fintech Blueprint

The Story: Chime’s 2025 IPO was the most anticipated fintech debut in years. After surviving the “Fintech Winter,” Chime re-emerged not just as a neobank, but as a lean, AI-driven machine.

- AI Efficiency: Chime proved that AI could radically change banking margins. Their AI-driven fraud models cut losses by 29%, and AI chatbots reduced support costs by 60% while maintaining customer satisfaction.

- The 2026 Outlook: Chime’s success at a reset valuation (roughly half of its $25B private peak) provides a “reality check” for 2026 candidates. The message is clear: public markets reward sustainable unit economics over vanity valuations.

Top AI IPOs 2026 Outlook: The Contenders and the Strategies

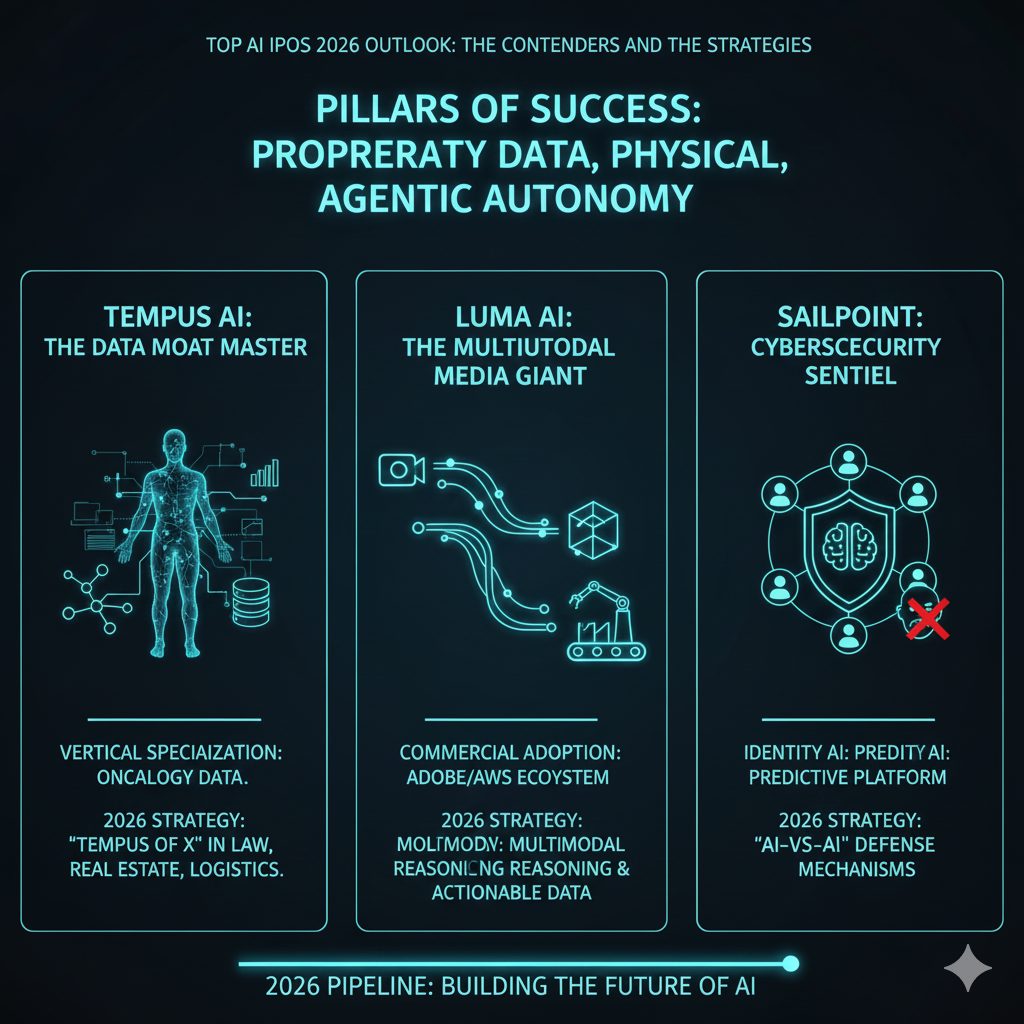

Looking ahead, the 2026 pipeline is being built on three pillars: Proprietary Data, Physical AI, and Agentic Autonomy.

3. Tempus AI (NASDAQ: TEM) – The Data Moat Master

Tempus AI entered the public markets to prove that the most valuable AI companies are those that own proprietary, non-public data.

- Vertical Specialization: They avoided the “General AI” trap by dominating a single, high-value vertical: Oncology. By licensing de-identified clinical data to big pharma, they created a high-margin second engine alongside their diagnostic testing.

- The 2026 Strategy: In 2026, the market will look for the “Tempus of X”—companies that own the specific data in Law, Real Estate, and Logistics. If you don’t own the data, you are just a skin on someone else’s model.

4.Luma AI (NASDAQ: LUMA) – The Multimodal Media Giant

While many expected OpenAI to lead the video generation charge, Luma AI successfully commercialized first.

- Commercial Adoption: Luma didn’t just chase viral clips; they embedded their technology into major ecosystems like Adobe and AWS.

- The 2026 Strategy:Multimodal Reasoning is the theme of 2026. Companies that can turn video into 3D environments or actionable data (watching a manufacturing line and diagnosing a mechanical failure in real-time) will be the ones filing S-1s next year.

5. SailPoint (NASDAQ: SAIL) – The Cybersecurity Sentinel

SailPoint’s return to the public markets in 2025 as a transformed AI-first identity security company was a “boring but essential” winner.

- Identity AI: In a world of AI-generated deepfakes, SailPoint’s “Predictive Identity” platform became an essential utility.

- The 2026 Strategy: Cybersecurity will be the largest sector of the Top AI IPOs 2026 Outlook. We expect a surge in “AI-vs-AI” defense startups—those that use machine learning to hunt for malicious autonomous agents.

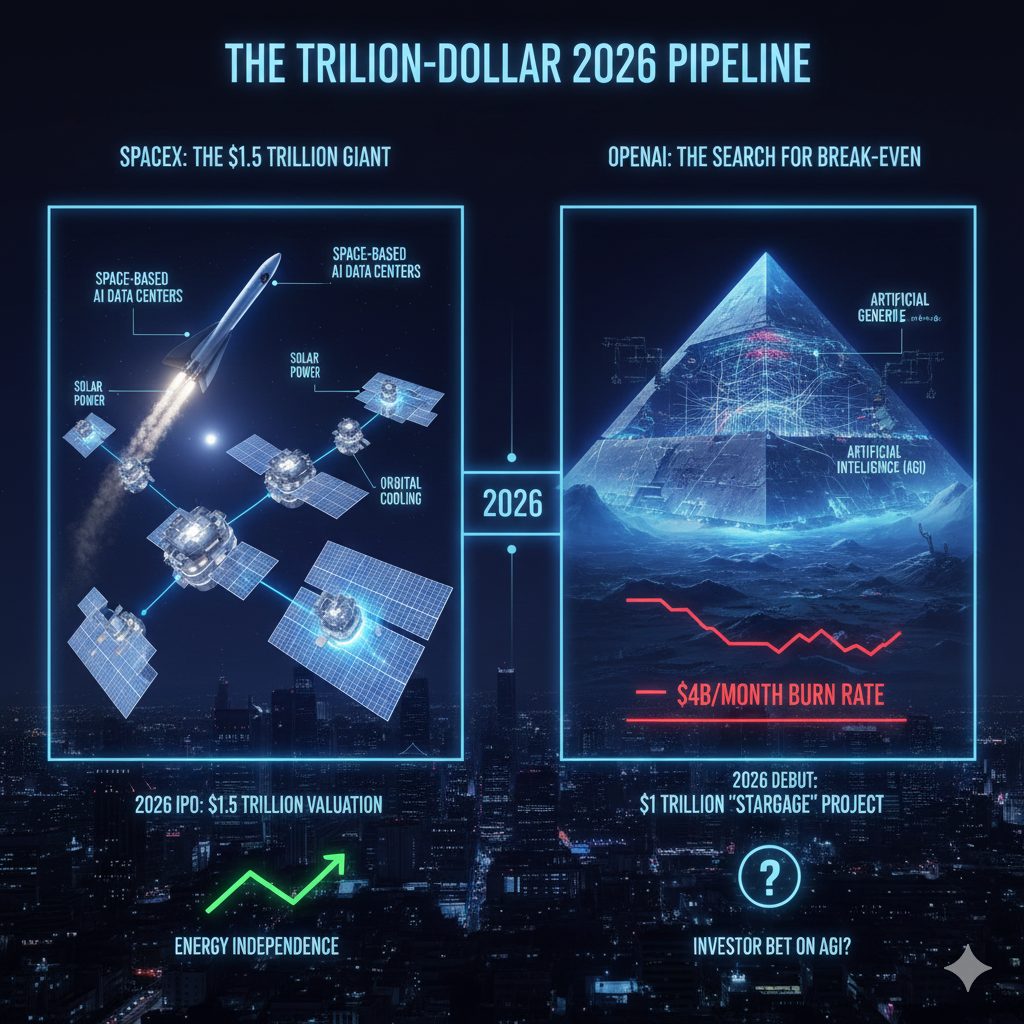

The Trillion-Dollar 2026 Pipeline: SpaceX and OpenAI

The biggest story of our Top AI IPOs 2026 Outlook involves two of the most valuable private companies in history.

- SpaceX (The $1.5 Trillion Giant): Analysts project that SpaceX could pursue a 2026 IPO with valuations reaching $1.5 trillion. Beyond rockets, the narrative for 2026 includes Space-Based AI Data Centers, utilizing solar power and orbital cooling to offset the massive energy costs of Earth-bound compute.

- OpenAI (The Search for Break-Even): Despite a burn rate estimated at $4B per month, OpenAI is preparing for a 2026 debut. The 2026 market will test whether investors are willing to fund the $1 trillion “StarGate” supercluster project in exchange for the potential of Artificial General Intelligence (AGI).

How These AI Trends Change the Game for Founders

For founders reading Spotlight on Startups, the lessons from the 2025/2026 shift are clear:

Verticalize or Die

General assistants are a commodity. Winners in 2026 will solve specific, high-stakes problems. Whether it’s AI for irrigation in agriculture or AI for compliance in heavily regulated finance, “Vertical Sovereignty” is the only way to protect your margins.

Infrastructure is the Safe Bet

CoreWeave’s success proves that investors still value the “picks and shovels” over the “apps.” If your startup provides the energy, the cooling, or the specialized hardware that makes AI possible, your path to an IPO is much wider.

Efficiency is the New Growth

Using AI to lower your Customer Acquisition Cost (CAC) and overhead is more impressive to 2026 investors than raw user numbers. Public markets are moving away from “subsidized growth” and toward companies that can generate $1M in revenue per employee.

How Profitable 2025 AI IPOs Set the Stage for 2026The Bottom Line

The Best AI IPOs of 2025 weren’t the ones with the most “hype”—they were the ones that used AI to build a more efficient, more profitable, and more defensible business. As we move into 2026, the window is open for companies that can demonstrate sustained profitability and proprietary technological advantages.

Orange County’s tech ecosystem is uniquely positioned for this shift. With our deep roots in medical devices (the precursor to Tempus AI) and aerospace (the foundation of the next SpaceX), the “Silicon Beach” talent pool is ready to lead the 2026 IPO class.

Looking for more insights into the Orange County tech ecosystem and the founders shaping the future of AI? Stay tuned to Spotlight on Startups for our upcoming interview series with the next generation of public-ready leaders.